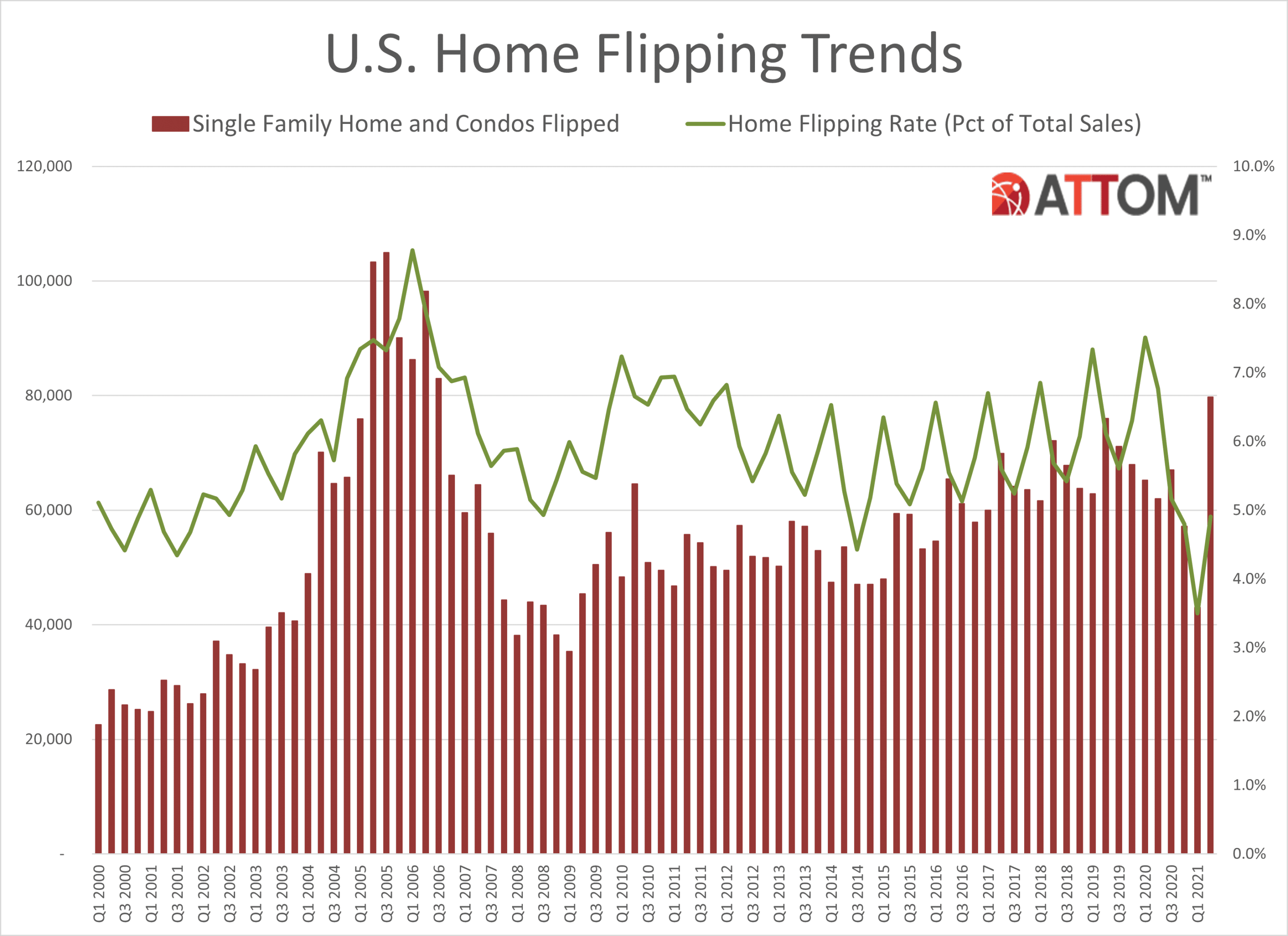

ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Home Flipping Report showing that 79,733 single-family homes and condominiums in the United States were flipped in the second quarter. Those transactions represented 4.9 percent of all home sales in the second quarter of 2021, or one in 20 transactions – the first increase in more than a year.

The second quarter home flipping rate was up from 3.5 percent, or one in every 29 home sales in the nation, during the first quarter of 2021. But it was still down from 6.8 percent, or one in 15 sales, in the second quarter of last year and remained below levels seen throughout most of the past decade.

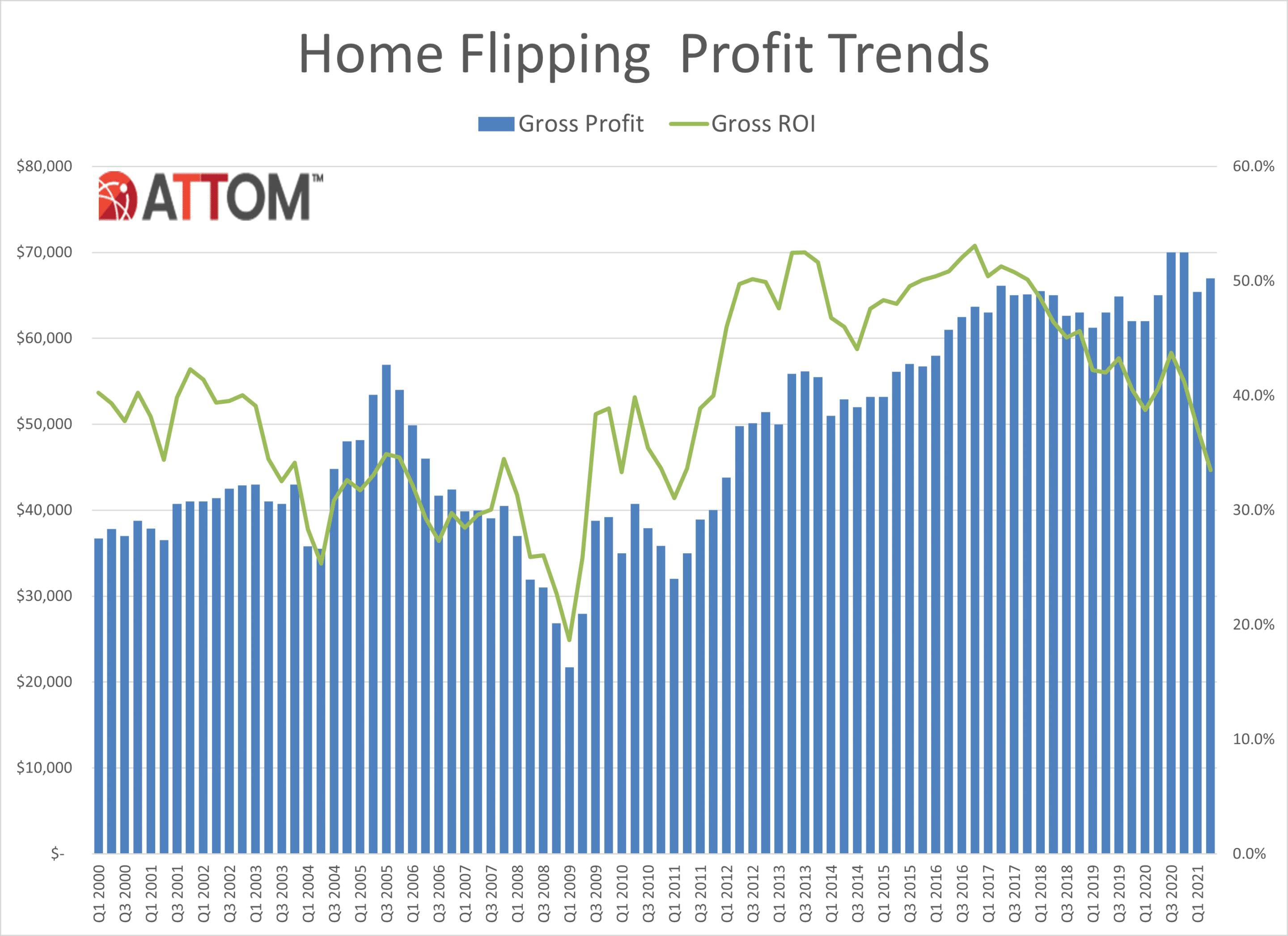

The report further shows that as the flipping rate rose, profit margins dipped to a 10-year low. The gross profit on the typical home flip nationwide (the difference between the median sales price and the median paid by investors) rose in the second quarter of 2021 to $67,000. That figure was up 2.4 percent from $65,400 in the first quarter of 2021, and 3.1 percent from $65,000 in the second quarter of last year.

Q2 2021 U.S. Home Flipping Profit Trends Chart

But the more important measure of profit margins slid downward, with the typical gross-flipping profit of $67,000 in the second quarter of 2021 translating into just a 33.5 percent return on investment compared to the original acquisition price. The national gross-flipping ROI was down from 37.2 percent in the first quarter of 2021, and from 40.6 percent a year earlier, to its lowest point since the first quarter of 2011, when the housing market had yet to start recovering from a price slump brought on by the Great Recession in the late 2000s.

The decrease of 7.1 percentage points in the typical profit margins from the second quarter of last year to the same period this year, marked the largest annual drop since mid-2014. Profit margins declined in the second quarter as prices on flipped homes rose more slowly than they did when investors originally bought their properties.

Specifically, the median price of homes flipped in the second quarter of 2021 soared to an all-time high of $267,000. That was up 10.6 percent from $241,400 in the first quarter of 2021 and 18.7 percent from $225,000 a year earlier. The annual increase marked the biggest price spike for flipped properties since 2005, and the quarterly gain topped all improvements since at least 2000.

But those price run-ups still failed to surpass increases that investors were absorbing – 13.6 percent quarterly and 25 percent annually – when they bought the homes that they sold in the second quarter of this year. That gap – prices rising more on purchase than resale – led to profit margins dropping.

The price surges on both sides of flipping deals came amid an ongoing housing-market boom that continued during the second quarter of 2021 despite widespread financial damage done to the broader U.S. economy by the Coronavirus pandemic that hit early in 2020. Home prices continued surging amid a glut of buyers chasing an already-tight supply of homes stifled further by the pandemic. Those buyers were drawn into the market in large part by 30-year home-mortgage rates that dipped below 3 percent and a desire among many households to escape virus-prone areas and opt for space to accommodate work-at-home lifestyles.

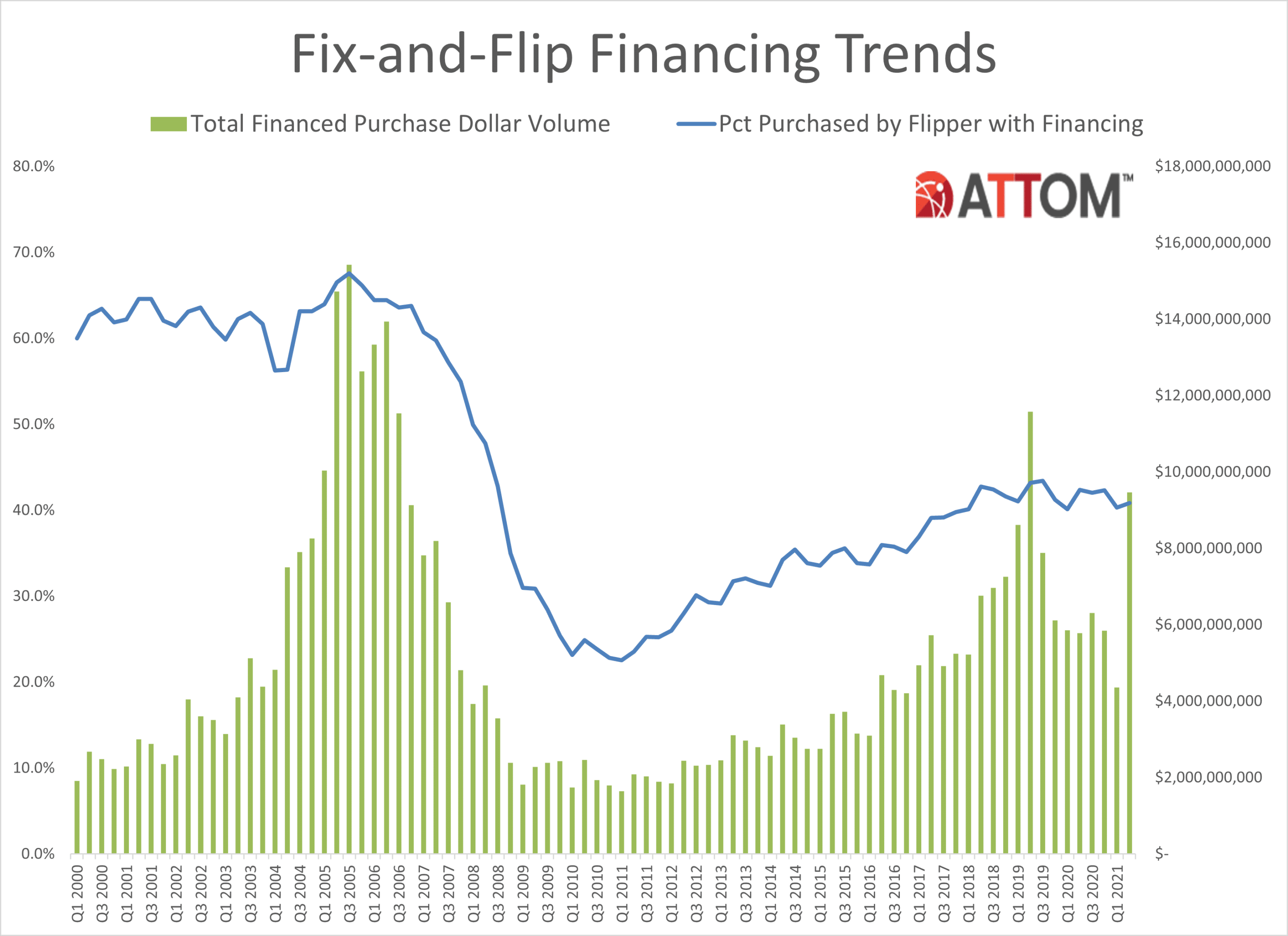

Q2 2021 Fix-and-Flip Financing Trends Chart

“Home flipping rebounded during the second quarter. But profits sure didn’t, as the typical home flip around the country netted the smallest return on investment in a decade,” said Todd Teta, chief product officer at ATTOM. “However, it’s not like home flipping has become a losing proposition. A 33 percent profit on a short-term investment remained pretty decent, even after renovation and holding expenses. But with a few more periods like the second quarter of this year, investors may need to reframe how they look at these deals.”

Home flipping rates up in almost 80 percent of local markets

Home flips as a portion of all home sales increased from the first quarter of 2021 to the second quarter of 2021 in 144 of the 182 metropolitan statistical areas analyzed in the report (79 percent). While the national rate remained below where it was throughout most of the past decade, it commonly rose up to 3 percentage points around the U.S. (Metro areas were included if they had a population of 200,000 or more and at least 50 home flips in the second quarter of 2021.)

Q2 2021 U.S. Home Flipping Trends Chart

Among those metro areas, the largest flipping rates during the second quarter of 2021 were in Savannah, GA (flips comprised 9.5 percent of all home sales); Fort Wayne, IN (9.3 percent); Canton, OH (9 percent); Ogden, UT (8.9 percent) and Indianapolis, IN (8.9).

Aside from Indianapolis, the largest flipping rates during the second quarter of 2021 in 53 metro areas with a population of 1 million or more, were in Memphis, TN (8.7 percent); Phoenix, AZ (8.1 percent); Nashville, TN (7.7 percent) and Tucson, AZ (7.6 percent).

The smallest home-flipping rates in the second quarter were in San Jose, CA (1.8 percent); Rochester, NY (1.9 percent); Albany, NY (2.1 percent); Bakersfield, CA (2.1 percent) and Wilmington, NC (2.2 percent).

Typical home flipping returns drop in almost two-thirds of markets

The median $267,000 resale price of homes flipped nationwide in the second quarter of 2021 generated a gross flipping profit of $67,000 above the median investor purchase price of $200,000. That resulted in a 33.5 percent profit margin or return on investment.

Profit margins dipped from the first quarter of 2021 to the second quarter of 2021 in 112 of the 182 metro areas with enough data to analyze (62 percent).

Metro areas with the largest returns on investment during the second quarter on typical home flips were Oklahoma City, OK (ROI of 196.4 percent); Fargo, ND (185.7 percent); Pittsburgh, PA (154.2 percent); Omaha, NE (135 percent) and York, PA (115.1 percent).

Aside from Oklahoma City and Pittsburgh, the largest investment returns in the second quarter among metro areas with a population of at least 1 million were in Philadelphia, PA (100 percent); Buffalo, NY (93.3 percent) and Baltimore, MD (90.5 percent).

Metro areas with the smallest profit margins on typical home flips in the second quarter of 2021 were Gulfport, MS (7.8 percent loss); Corpus Christi, TX (0.7 percent return); College Station, TX (1.2 percent return); Longview, TX (7.1 percent return) and Daphne-Fairhope, AL (8.5 percent return).

Raw profits still highest in the West, Northeast and South; lowest in the Midwest and South

The highest raw profits on median-priced home flips in the second quarter of 2021, measured in dollars, were again concentrated in the West, Northeast and South. Among metro areas with enough data to analyze, 22 of the top 25 were in those regions, led by San Jose, CA (typical gross profit of $242,500); Fargo, ND ($200,336); San Francisco, CA ($182,000); Salisbury, MD ($159,500) and Barnstable, MA ($155,500).

The 25 smallest raw profits on typical deals were spread across southern and midwestern metro areas, with the lowest in Gulfport, MS ($12,938 loss); Corpus Christi, TX ($1,800 profit); College Station, TX ($2,779 profit); Longview, TX ($14,291 profit) and Amarillo, TX ($16,514 profit).

Home flips purchased with cash virtually unchanged

Nationally, the portion of flipped homes in the second quarter of 2021 that had been purchased with cash by investors dipped slightly to 59.2 percent, down from 59.7 percent in the first quarter of 2021, although still up from 57.6 percent in the second quarter of 2020. Meanwhile, 40.8 percent of homes flipped in the second quarter of 2021 had been bought with financing. That was up slightly from 40.3 percent in the prior quarter, but still down from 42.4 percent a year earlier.

Among metropolitan statistical areas with a population of 1 million or more and sufficient data to analyze, those with the highest percentage of flips in the second quarter of 2021 that had been purchased with cash by investors were in Buffalo, NY (83.6 percent); Pittsburgh, PA (81.3 percent); Detroit, MI (80.5 percent); Cincinnati, OH (80.3 percent) and Cleveland, OH (80.3 percent)

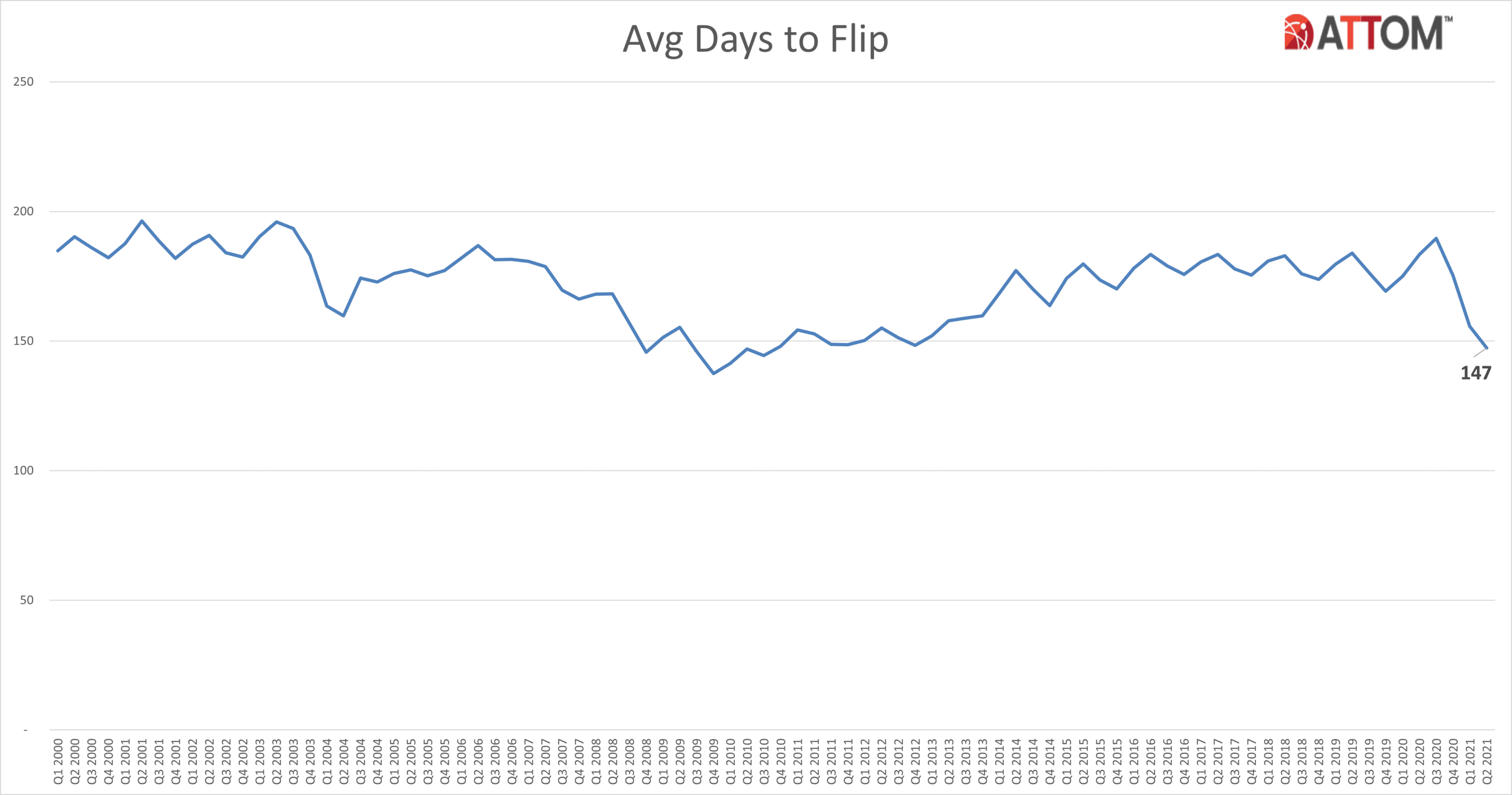

Average time to flip nationwide drops to smallest level since 2010

Home flippers who sold properties in the second quarter of 2021 took an average of 147 days to complete the transactions, the lowest level since the third quarter of 2010. The latest number was down from an average of 156 in the first quarter of 2021 and 183 in the second quarter of 2020.

Q2 2021 Historical Avg Days to Flip Chart

FHA buyers purchase smallest portion of flipped homes since 2007

Of the 79,733 U.S. homes flipped in the second quarter of 2021, only 7.8 percent were sold to buyers using loans backed by the Federal Housing Administration (FHA), down from 9.5 percent in the prior quarter and from 14.7 percent in the second quarter of 2020. That latest figure marked the lowest amount since the fourth quarter of 2007.

Among the 182 metro areas with a population of at least 200,000 and at least 50 home flips in the second quarter of 2021, those with the highest percentage of flipped properties sold to FHA buyers — typically first-time home buyers — were Yuma, AZ (24.7 percent); McAllen, TX (20.7 percent); Albany, NY (20 percent); Salem, OR (20 percent) and Merced, CA (19.7 percent).

Only 58 counties have home-flipping rate of at least 10 percent

Home flips accounted for more than 10 percent of all home sales in just 58 of the 1,071 counties around the U.S. with at least 10 home flips in the second quarter of 2021. They were led by Truesdale County, TN (outside Nashville) (22 percent); Lewis County (Hohenwald), TN (20 percent); Jefferson County, GA (outside Augusta) (18.2 percent); Chester County, TN (outside Jackson) (15.5 percent) and Morgan County, TN (outside Knoxville) (15.4 percent).

Report methodology

ATTOM analyzed sales deed data for this report. A single-family home or condo flip was any arms-length transaction that occurred in the quarter where a previous arms-length transaction on the same property had occurred within the last 12 months. The average gross flipping profit is the difference between the purchase price and the flipped price (not including rehab costs and other expenses incurred, which flipping veterans estimate typically run between 20 percent and 33 percent of the property’s after-repair value). Gross flipping return on investment was calculated by dividing the gross flipping profit by the first sale (purchase) price.