Wilmington Trust announced its 2020 Capital Markets Forecast, “Market Tug of War: The interplay of productivity, populism, and portfolios.” The report finds that while reported productivity growth has been slow, it is expected to move higher, a trend that is providing support to long-term economic growth. However, productivity gains do not come without risk. As corporations reap the benefits of previous technology investments, including robotics, artificial intelligence, and related technological advancements, a broader spectrum of jobs may become susceptible to automation and elimination of jobs, which will, in turn, continue to spur the resurgence in economic and political populism.

The firm recently increased risk in portfolios, returning to equity overweight versus its long-term benchmark. Citing a reduction in trade, policy, and recession risks, the firm chose to add to international developed equities, which should benefit from a reacceleration of growth and attractive valuations.

“The interplay of productivity and populism is creating a perfect storm of uncertainty in the market,” said Tony Roth, Chief Investment Officer at Wilmington Trust Investment Advisors, Inc. (“Wilmington Trust”). “The single best source of growth for an economy is productivity. Ironically, higher productivity has contributed to populism, which in turn can result in policies that are damaging to economic growth. However, we are now seeing upside risk to productivity over the next 12-18 months, which coupled with a near-term reduction of trade tensions is supportive of a modest overweight to equities.”

“The effects of productivity are absolutely critical for impending monetary policy by the Fed and other central banks. If we are right about productivity heading higher, then central banks globally will likely be looking at contained inflation pressures that provide leeway for more supportive monetary policy,” said Luke Tilley, Chief Economist at Wilmington Trust. “At this time, we believe that investors will benefit over the next 9-12 months from a slight overweight to risk in portfolios, but we also recommend including adequate exposure to fixed-income and hedge funds for protection should volatility increase.

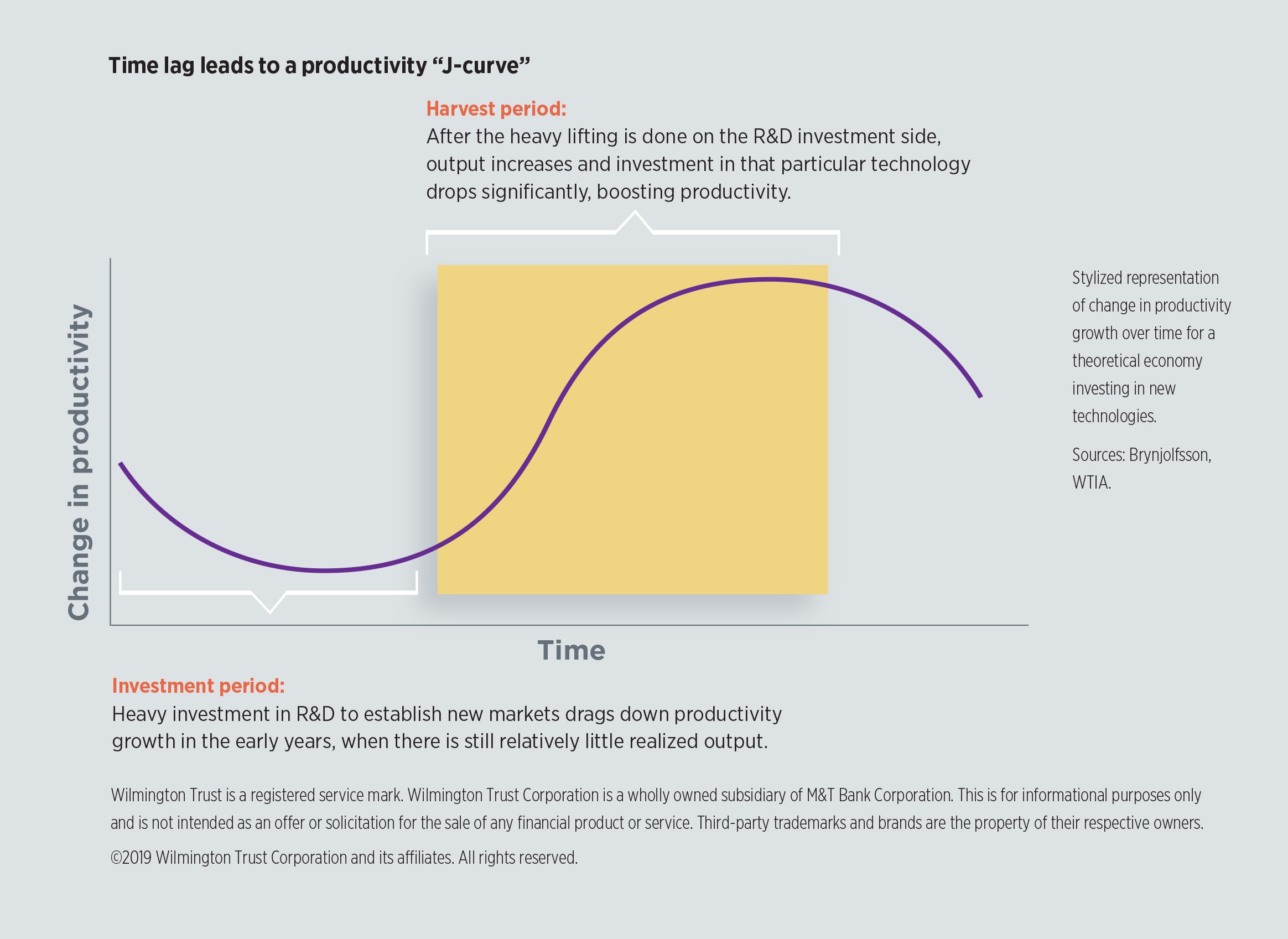

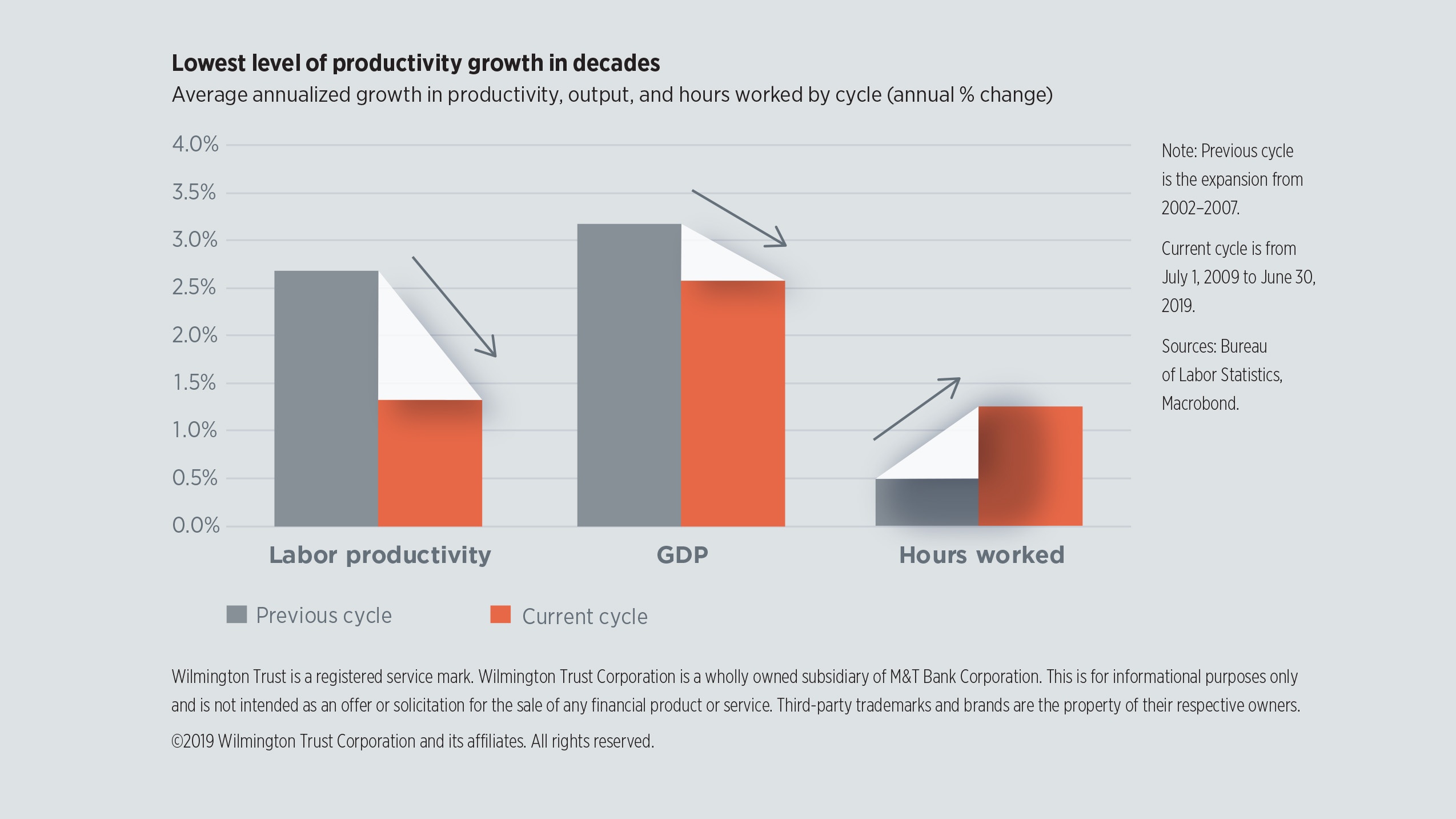

Measured productivity growth in the U.S. has been at its lowest level of any post-World War II expansion. U.S. productivity growth has declined from 2.6% during 2002-2007 to 1.4% in the current cycle beginning in 2009, according to the Bureau of Labor Statistics. In a hyper-connected world with social media platforms, video conferencing and streaming services, this lack of productivity appear to be paradoxical.

However, Wilmington Trust sees productivity as both understated and moving higher. Evidence of increased economic output from investments in new technology has taken longer to materialize, but we should soon start to see technology-driven productivity gains, which will support future growth. For example, the firm believes that within 10 years, autonomous driving will start to have a material impact, leading to sharp increases in output and a boost in productivity.

“The productivity story lends significant structural support to technology stocks, which is why we have been specifically focused on companies benefiting from cloud computing and 5G technologies. We recently returned to an overweight position in the tech sector,” said Meghan Shue, Senior Investment Strategist, Wilmington Trust. “A bottoming of global economic activity and receding trade tensions improves the outlook for the most cyclical stocks within the tech sector, including semiconductors.”

Additionally, several developing and emerging market countries are showing that they are ahead of the game in terms of automation in the manufacturing sector, making international equities more attractive than they have been in the prior decade. More downside than upside risk to the U.S. dollar in the coming years also supports this view.

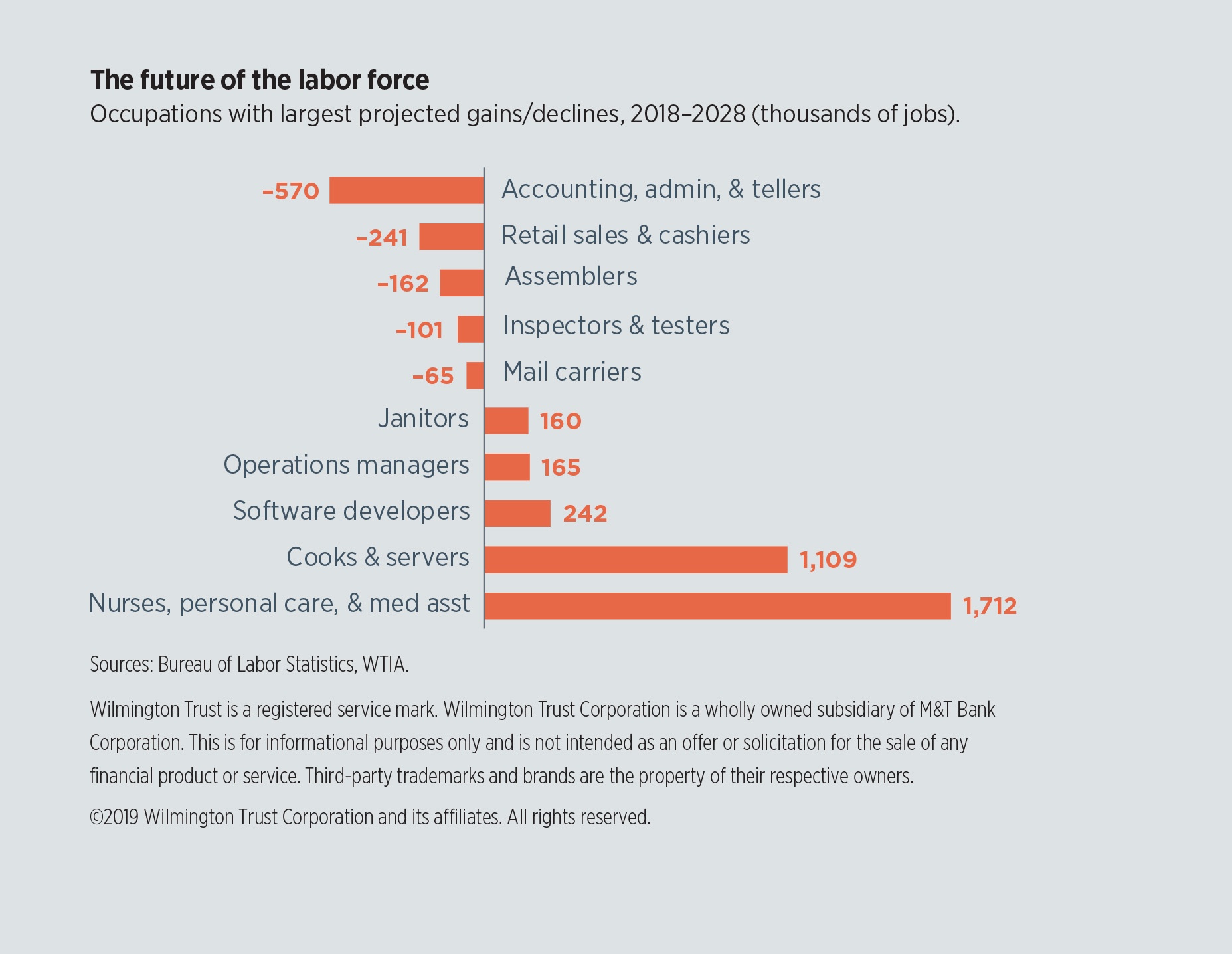

While technological advancements are driving the bottom line for businesses, and Wilmington Trust anticipates this to increase as productivity rises, the general workforce is not seeing the benefits of this growth. In many cases, technology is eliminating jobs that are susceptible to automation, which is leading to increased support for populist policies.

“While productivity growth invariably leads to ‘growing the pie’ of revenue and margins, it’s becoming clearer that it’s the businesses, not the workers, who are benefiting the most from this,” said Shue. “Wilmington Trust’s view is that this rise in populism is in part an outgrowth of the unintended consequences of productivity, which includes more gains for owners than workers and the secular disruption of the labor force.”

For example, labor’s share of income – the compensation paid by U.S. firms to employees as a share of GDP – remains low. This figure dropped from 56.5% at the turn of the 20th century to 50.9% in 2014, according to the Bureau of Labor Statistics. Wilmington Trust is confident that even if all outsourcing ceased (which it will not), the persistent growth of tech and automation will continue to eliminate certain types of jobs, forging discontent with some pockets of the population and leading to increased populist sentiment.

This has changed the political landscape, as both U.S. major political parties are looking to enact their own populist policies. Wilmington Trust’s 2020 Capital Markets Forecast highlights several of these major proposals and what it believes are the effects they will have if they are enacted. For example, a wealth tax is being proposed in one form or another by several Democratic presidential candidates. However, the firm anticipates that a Democratic win in the 2020 U.S. presidential election will more likely result in a capital gains tax increase and very possibly a rollback of corporate tax relief as opposed to the establishment of a full-scale wealth tax, which could hurt small caps. With the outcome still both binary and uncertain, Wilmington Trust is not currently positioning around this risk.

Another example of a policy risk is within the health care sector. While Wilmington Trust sees a relatively small chance of enactment of a “Medicare for All” policy and the subsequent disruption to the industry, the firm favors medical devices over pharmaceuticals or managed care. Medical devices have higher valuations but benefit from a large amount of innovation and remain fairly insulated from the political fray.

Increased productivity brings lower inflation, which permits easier monetary policy from central banks and a longer economic cycle. With global central banks collectively pushing the easiest monetary policy since 2012, through cutting rates or restarting quantitative easing, Wilmington Trust does not see a reversal of this easier policy in the cards for 2020.

“The supportive central banks and receding trade tensions make global equities more appealing, warranting a return to an overweight position,” said Shue. “We find that the sensitivity to global growth, valuations and currency risks are pointing to favoring international developed equities over the U.S. Although we continue to see a steepening yield curve and rising yields, which are helpful for banks, we do not foresee yields, particularly on the short end of the curve, moving dramatically higher in the near term.”

While the firm sees trade policy, including the ongoing and unpredictable trade wars between the U.S. and China, as the greatest near-term risk to the economic cycle, it also believes the U.S. will put aside trade principles in favor of self-preservation by reducing trade tariffs with China, thus giving the economy a boost.

Despite warning signs from global factors such as Brexit and the ongoing trade wars, Wilmington Trust is not seeing signs of excess among the usual suspects. With healthy consumer balance sheets, moderately rising home prices and low-interest rates, the firm anticipates that if there is a recession in the next two years it will be relatively shallow. As a result, economic contraction and market disruption could be mild and short-lived. One asset class which while not yet in bubble territory the firm is watching closely is leveraged finance, where loan quality has fallen precipitously in recent years. Defaults remain contained but the firm believes this space is likely to be one of the first to signal trouble when it arrives.

Wilmington Trust is a registered service mark. Wilmington Trust Corporation is a wholly-owned subsidiary of M&T Bank Corporation. Wilmington Trust Company, operating in Delaware only, Wilmington Trust, N.A., M&T Bank, and certain other affiliates, provide various fiduciary and non-fiduciary services, including trustee, custodial, agency, investment management, and other services. International corporate and institutional services are offered through Wilmington Trust Corporation’s international affiliates. Loans, credit cards, retail, and business deposits, and other business and personal banking services and products are offered by M&T Bank, member FDIC.

Wilmington Trust Investment Advisors, Inc., a subsidiary of M&T Bank, is an SEC-registered investment adviser providing investment management services to Wilmington Trust and M&T Bank’s affiliates and clients. Registration with the SEC does not imply any level of skill or training. Additional Information about WTIA is also available on the SEC’s website at adviserinfo.sec.gov.

Investing involves risk and you may incur a profit or a loss. There is no assurance that any investment strategy will be successful.

Wilmington Trust’s Capital Markets Forecast is provided for information purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or as a recommendation or determination by Wilmington Trust that any investment strategy is suitable for a specific investor. The forecasts presented herein constitute the informed judgments and opinions of Wilmington Trust about likely future capital market performance. Actual events or results may differ from underlying estimates or assumptions, which are subject to various risks and uncertainties.

No assurance can be given as to actual future market results or the results of Wilmington Trust’s investment products and strategies. The estimates contained herein constitute Wilmington Trust’s judgment as of the date of these materials and are subject to change without notice.