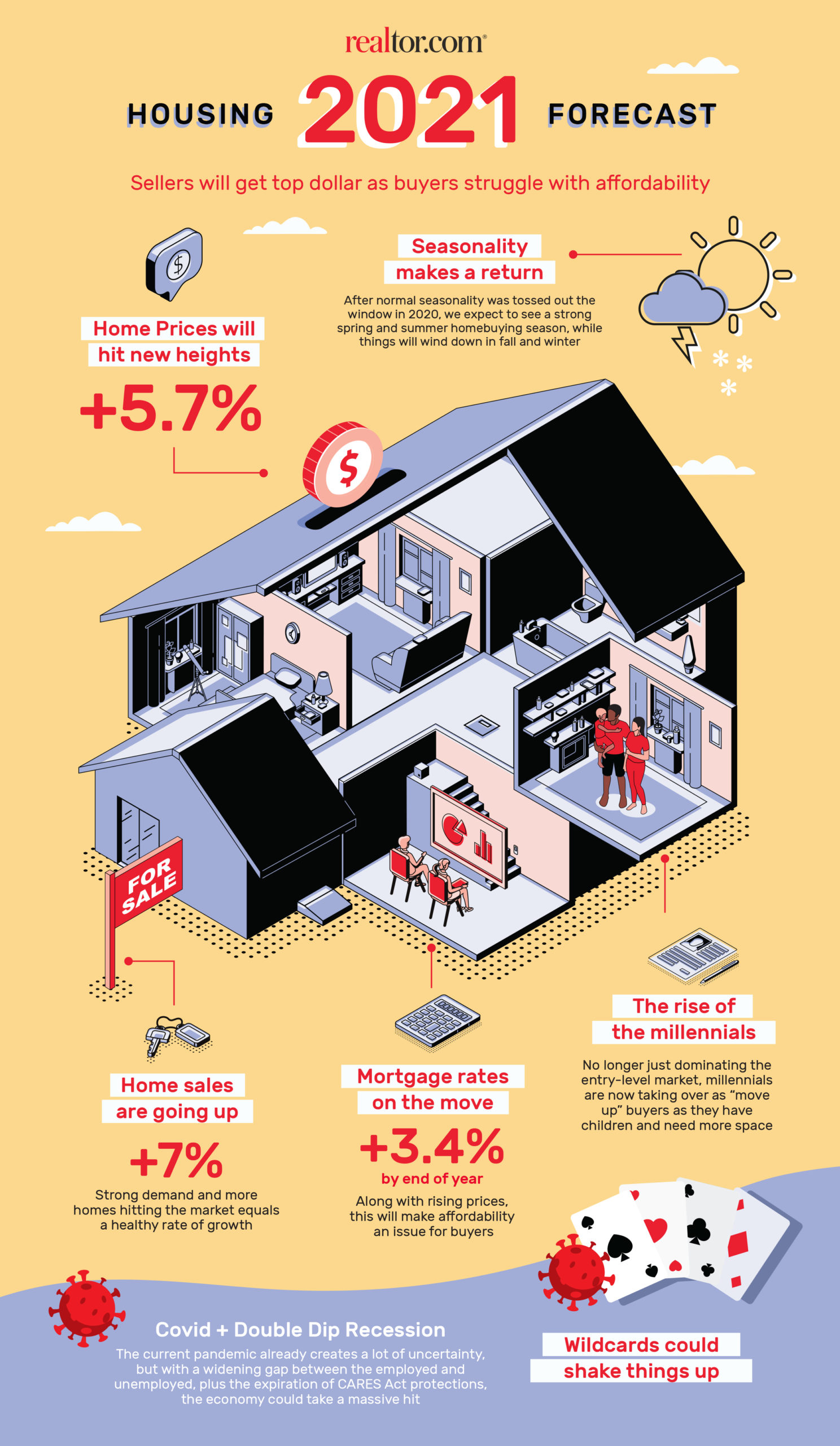

Amid COVID-19 uncertainty, 2021 will be a robust sellers market as home prices hit new highs (+5.7%) and buyer competition remains strong, according to the realtor.com® 2021 housing forecast released today. Inventory is expected to make a slow but steady comeback, which will give buyers some relief. However, increasing interest rates and prices will make affordability a challenge throughout the year.

“The 2021 housing market will be much more ‘normal’ than the wild swings we saw in 2020. Buyers may finally have a better selection of homes to choose from later in the year, but will face a renewed challenge of affordability as prices stay high and mortgage rates rise,” said realtor.com® Chief Economist, Danielle Hale. “With less cash and no home equity, millennial and Gen Z first-time buyers will be impacted the most by rising home prices and interest rates. While waiting until the fall or winter months of 2021 may mean more home options to choose from, buyers who can find a home to buy earlier in the year will likely see lower prices and mortgage rates.”

Realtor.com® forecasts mortgage rates will continue to hover near 3% then slowly rise to 3.4% by the end of the year. Home sales are expected to increase 7% and new construction will increase 9% over the previous year. However, the strength of the 2021 housing market is highly dependent on the containment of COVID-19 pandemic and staving off a double dip recession.

What 2021 will be like for buyers?

Buyers will find some relief in 2021 as more homes hit the market, but many will struggle with affordability as home prices continue to rise. Mortgage rates will slowly rise toward 3.4% and will no longer help offset the record breaking prices. Additionally, the time it takes to sell a home will slow from late 2020’s frenzy, but fast sales will remain in many parts of the country, which will be particularly difficult for first-time buyers learning the ins and outs of homebuying.

What will 2021 be like for sellers?

Sellers will continue to hold the upper hand throughout 2021 as the number of buyers in the market outweighs the number of homes for sale. Home prices won’t grow as fast as they did in 2020, but steady increases will continue to push home prices to new highs. Additionally, sellers can expect their home to sell relatively quickly in 2021, so having their next home lined up will be key. Many sellers are also buyers themselves, so they will struggle with the same issues when it comes to purchasing their next home.

Forecast key 2021 housing trends

Millennials continue to drive the market while Gen-Z become market players – The largest generation in history, millennials, will continue to shape the housing market as they outnumber Gen-X and Baby Boomers. Older millennials will likely be trade-up buyers while the larger, younger segment of the generation age into their key home buying years. Meanwhile, Gen-Z will begin to make their presence known in 2021 as they compete with younger millennials for entry-level homes. The oldest members of Gen-Z will turn 24 in 2021 and their impact on the market will only continue to grow from here.

Affordability becomes a growing obstacle – Buyers in 2020 received a huge boost in affordability as mortgage rates pushed to new lows throughout the year, however, a lack of inventory and strong demand drove prices up, erasing most of the boost. As mortgage rates are no longer able to counteract rising home prices, affordability will be tested for buyers across the board in 2021. Home price increases are expected to slow as affordability gets stretched throughout the year. Buyers will need to act with a sense of urgency if they want to lock in a low rate before home prices increase even more in 2021.

Inventory will begin the slow road toward recovery – A lack of homes for sale has plagued the U.S. housing market for the last five years. The problem only intensified in 2020, in large part due to an estimated shortfall of nearly 4 million newly constructed homes heading into the year, as well as sellers pulling back due to COVID-19. The number of homes for sale is expected to slowly rebound in 2021, but the road to recovery will be long because the market has to make up for multiple years of declines. Additional homes hitting the market will offer buyers some relief in 2021, but it won’t be enough to tip the scales in favor of buyers. As inventory slowly begins to replenish and buyer demand for homes remains steady, sellers will continue to be in the driver’s seat.

Suburbs will shine if remote work stays around – As COVID-19 lockdowns gripped many of the nation’s largest cities, buyers flocked to nearby suburbs in search of increased space. Now, more and more workers are finding the freedom to work remotely. This has sparked intense interest in suburban homes, further exaggerating a trend that had been slowly emerging over the last couple of years. The big question is what demand will look like once a coronavirus vaccine is widely available. If companies require workers to return to the office, demand may wane. Conversely, if companies commit long-term to remote work, demand for these homes could see an additional boost in 2021.

Wildcards that could shake things up in 2021

COVID-19 – The deck is stacked with wildcards for 2021. The most impactful will be the U.S.’s ability to control and contain the spread of COVID-19 as well as distribute a vaccine. Additional lockdowns and quarantines could put a dent in housing inventory and sales, slowing the market and putting increased pressure on buyers. Conversely, if a vaccine is rolled out quickly, it could lead to better than expected sales and a strong increase for home prices and inventory. Either way, COVID-19 will have a large impact on the U.S. housing market in 2021.

Double dip recession – The possibility of a double dip recession is still in play for 2021. As the U.S. continues in a K-shape recovery, a gap is widening between those with and without jobs as well as industries recovering well versus those seeing continued lack of business. In the short term, this could lead to less consumer spending which could more broadly impact businesses and economic growth. In the long term, this could impact the U.S. housing market as “would-be” buyers disappear from the market, cooling demand and driving down home prices. The current question is how long the K-shape can diverge before the impact begins to cascade into the broader economy and other previously less-affected sectors such as housing.

Realtor.com® 2021 Housing Market Forecast

|

Mortgage Rates |

Up to 3.4% by year end |

|

Existing Home Median Price Appreciation |

+5.7% |

|

Existing Home Sales |

+7.0% |

|

Single-Family Home Housing Starts |

Up 9% |

|

Homeownership Rate |

65.9% |