In the investment and earning market, there is a type of earning product that is more popular and flexible, and which is more commonly known as, flexible savings with both high security and fantastic liquidity. This financial product will not only protect against any potential financial harm in principle, it can also be bought and sold at any time on autopilot, allowing it to be both flexible and convenient. The main focus of this type of financial product is currency funds. However, apart from this, there is actually another type of flexible savings that is even more advantageous than currency funds.

Better flexible savings than currency funds

The biggest advantage of currency funds is their high security and fantastic liquidity because there is basically no possibility of loss when buying currency funds, furthermore, they can be bought and sold at any time and on autopilot. Some currency redemption funds can basically be credited on the same day, which is similar or on certain occasions even more efficient to bank demand deposits. However, the rate of return of cash funds is several times the interest rate of bank demand deposits, thus the massive difference.

Having said that, among the flexible savings that are similar to the bank’s flexible savings deposit, the currency fund is not the only one, and even better than the currency funds, it is a financial product of digital currencies. A financial product, like a currency fund, also has high security and great liquidity. Compared with currency funds, the main advantage of a digital currency financial product is that it offers higher yields.

According to the data, there are many flexible savings issued by banks, and the annual rate of return can reach approximately 1% to 3%, but among digital currency earning products, the minimum rate of return can reach 5%, and there is no upper maximum limit, ultimately resulting in it being many times the bank’s flexible savings deposit.

Secondly, when investors buy flexible savings products, they usually consider three factors, most notably being Safety, Yield and Liquidity. The safety of various flexible savings products is not very different, the probability of principal loss is extremely low, and most of the liquidity rules are very similar if not identical. With the assessment point being mainly reflected in the rate of return.

In terms of rate of return, one is to look at the level of the rate of return, which is very intuitive, the other is to look at the fluctuation of the rate of return, with certain flexible savings products having a large income fluctuation. In this case, the single-day income is not of great reference significance, and it is best to compare Long-term rate of return. The third is to look at the income rules, most of the flexible savings products have a fixed daily rate of return, while a small number of products are based on tranches.

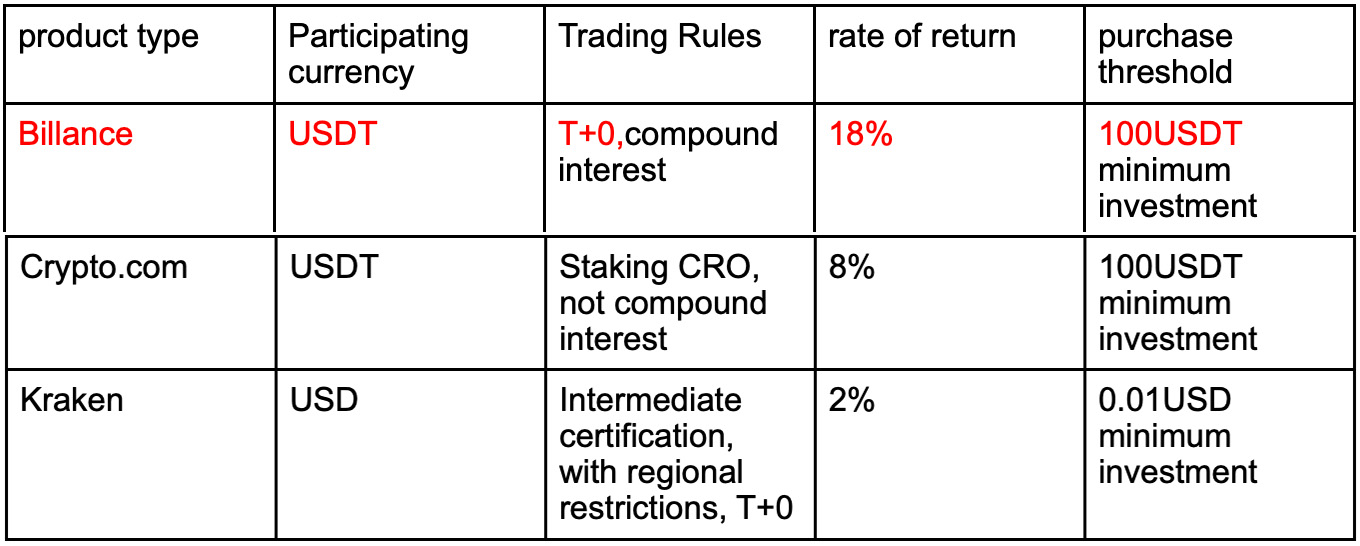

We have selected well-known digital currency exchanges with flexible savings products in the industry, and made a comparison according to the yield from high to low. The yields given here do not include novice interest rate hikes.

Comparison of 3 types of flexible savings products are as follows:

Billance, Crypto.com, Kraken, their flexible savings products differ in terms of transaction rules, yields, purchase thresholds and so on. The details are as follows:

1. Trading Rules for Buying and Redemption

These exchange products are all T+1 earning products. During trading hours, the interest is paid on the same day and the redemption funds are credited to the account in real time. There is no confusion, especially in relation to the liquidity aspect.

2. Yield

The overall income of Billance Earn is relatively high and the rate of return is fixed, it can regularly reach 100% and the flexible savings demand is 18%, with the income gap between different products not being too large. Billance Earn Flexible savings supports the financial management of two stable coins, USDT and USDC. With Crypto.com deposits, interest rates are relatively high, but there are rules for pledging platform coins, the pledge ratio will affect the yield, and the yield gap between different products is large; Kraken’s yield is the lowest among various flexible savings products, and the flexible savings average yield is only about 3% .

In summary, among the various features of flexible savings products, investors often care about the yield of the product the most. Therefore, compared with products from other exchanges, Billance Earn not only allows its users to obtain higher returns, but also has flexible deposits, as well, withdrawals, which can be redeemed at any time of the users choosing.

Furthermore, it’s being cashed out and credited on the same day. With the advantages of high yield and anytime deposit and withdrawal, offered on autopilot. Billance Earn may become one of the most “sought-after” financial products on the market today. Good things are shared with everyone without reservation, and everyone is welcome to join the ‘Billance Family’, so they can experience and reap the rewards fully.

Start Trading at billance.com.