Redfin, the technology-powered real estate brokerage, is now publishing flood risk information for nearly every home on its website in regions where this data is available. Visitors to Redfin.com who want to understand the potential flood risk of any individual property can now see a Flood Factor® score from 1 to 10 associated with each home, representing its cumulative risk of flooding over a 30-year period. First Street Foundation, a science and technology nonprofit organization whose mission is to quantify and communicate America’s growing flood risk, provides Flood Factor® data to Redfin. Currently, this data is available everywhere in the contiguous U.S.

“Buying a home is the biggest purchase most people will make in their lifetime,” said Redfin Chief Product Officer Christian Taubman. “By publishing the Flood Factor score, we’re making it easier to understand the risk each home faces of being damaged by flooding, meaning everyone can make better-informed decisions about buying and selling. Most home buyers and sellers say that the frequency or intensity of natural disasters factors into their decision about where and whether to buy or sell a home, so this is information they can really use.”

Homebuyers and homeowners can find flood risk data—including a property’s Flood Factor score and estimated Federal Emergency Management Agency (FEMA) zone—on individual listing and off-market pages on Redfin.com. While there, consumers can learn more about Flood Factor, FEMA, and flood insurance, and they can visit FloodFactor.com for additional insights on a property’s flood risk, how to protect against flooding, and more. Redfin and First Street Foundation also encourage home buyers to visit floodsmart.gov to learn more about how FEMA assesses flood risk and maps a property into or out of a FEMA-designated Special Flood Hazard Area.

“Our goal has always been to help current and future homeowners understand the extent of the flood risk facing a property, its severity, and how it’s changing over time with changes to the environment,” said Matthew Eby, Founder and Executive Director of First Street Foundation. “Integrating with Redfin significantly expands our ability to enable home shoppers and owners alike to understand otherwise complex, difficult to find information about flooding and the sources that contribute to and exacerbate it. By providing them with this data when preparing to buy or sell a home, Redfin is an invaluable partner in contributing to the public’s understanding of flood risk.”

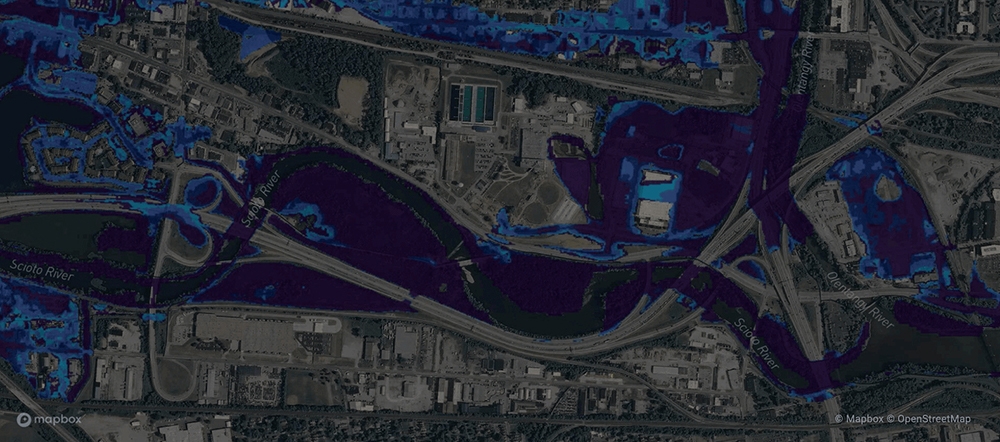

Produced in partnership with more than 80 of the world’s leading hydrologists, researchers and data scientists, and reviewed by some of the world’s leading research institutions, First Street Foundation’s flood model is the most comprehensive in the industry. It provides a climate-adjusted, property parcel-level assessment of risk today and over the course of the standard 30-year mortgage. The model accounts for flood risk from four primary flood events, including heavy rainfall, storm surge, tidal and riverine sources, and it accounts for the ways in which a changing climate has and will continue to impact these risk sources. Crucially, First Street Foundation models areas not currently mapped by FEMA, the official public source for flood hazard information produced in support of the National Flood Insurance Program.