Vanguard today released its comprehensive outlook and analysis on the global economy and financial markets. With ongoing trade tensions, geopolitical uncertainty, and unpredictable policymaking becoming the new normal, Vanguard expects U.S. growth to decelerate below trend to around 1% in 2020, with the risk of recession still elevated.

“The current geopolitical environment is defining a new age of uncertainty, which we expect will weigh negatively on the financial markets for the coming year,” said Joseph Davis, Ph.D., Vanguard’s Global Chief Economist and head of Vanguard’s Investment Strategy Group. “Despite this outlook, we expect long-term investors to continue to benefit from the time-tested principles of portfolio construction. Factors within a long-term investor’s control—such as saving more, working longer, spending less, and controlling costs—far outweigh the less reliable benefits of ad-hoc return-seeking portfolio tilts, market timing, and forecasting future scenarios.”

Equity markets remain robust, fixed income slows

Although the confluence of slowing global growth and persistent geopolitical uncertainty creates a fragile backdrop for markets in 2020 and beyond, more favorable valuations have led to a modest upgrade in Vanguard’s global equity outlook over the next decade. Comparatively, fixed income returns are expected to be subdued at best, with Vanguard’s lower projections factoring in declining policy rates, sharply lower long-term bonds, and compressed credit spreads globally.

Based on projections from the Vanguard Capital Markets Model (VCMM), the firm’s long-term return outlook for equities remains guarded relative to previous decades. Upon factoring in lower expectations for global growth, inflation, and interest rates, the annualized return for the U.S. equity market over the next ten years is in the 3.5%-5.5% range. This is similar to last year’s outlook and significantly lower than the experience of the post-global financial crisis years.

Expected returns for the U.S. stock market remain lower than those for markets outside the U.S., underscoring the benefits of global equity strategies.

Global fixed income markets rallied in 2019, with most central banks revising down their assessment of long-run neutral policy rates. Against a backdrop of lower yields across the curve, the U.S. fixed income return outlook for the next decade has been revised downward from last year’s projections to 2%-3%. Importantly, while future returns for fixed income look low, there’s little reason to believe their fundamental role in a portfolio has changed, with high-quality bonds still expected to play a key role in risk reduction and stability.

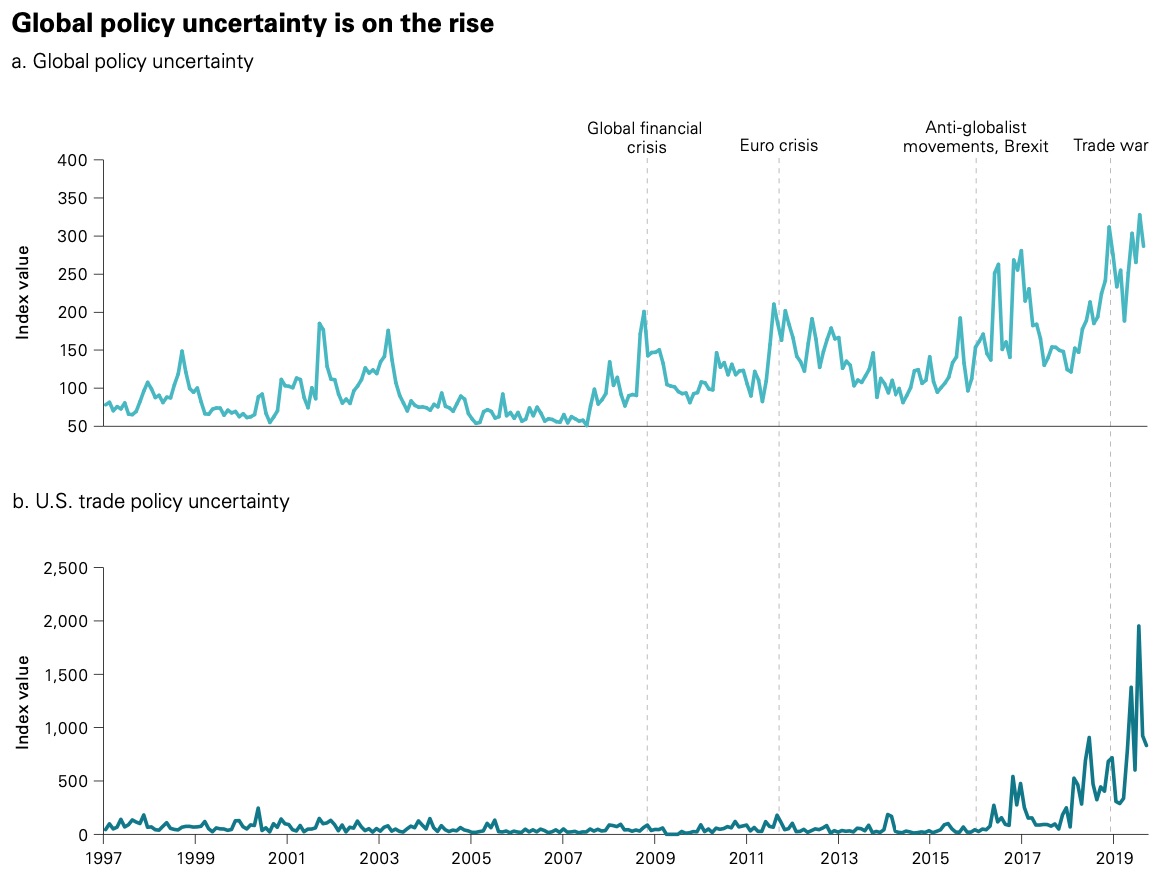

Increasing policy uncertainty impacts growth and inflation

One important consequence of the global slowdown in 2019 has been the marked pivot made by central banks around the world from gradual policy normalization to increased policy accommodation. There is increased skepticism, however, that monetary policy is still capable of playing the cyclical stabilization role being demanded of it. As a result, inflation expectations, both survey-based and derived from financial market instruments, remain relatively unresponsive to policy measures. Vanguard expects inflation to barely reach 2% in the U.S., with the Federal Reserve’s core inflation gauge staying below its 2% policy target.

In 2019, global central banks turned on their respective dimes, cents, and sixpences, reversing from actual and expected policy tightening to additional policy stimulus in the face of the deteriorating growth outlook and consistent inflation shortfalls. With the Fed having cut rates by 75 basis points so far in 2019, Vanguard expects it to further reduce the federal funds rate by 25-50 basis points before the end of 2020.

Waning support from the consumer, along with persistently elevated uncertainty in the U.S. and abroad for the foreseeable future, has led Vanguard to downgrade its U.S. growth forecast to 0.5%-1.5%, below target inflation in 2020, even in an environment of Fed policy easing.

Portfolio implications: A low return orbit

Investors have experienced spectacular returns over the last few decades, due to two of the strongest bull markets in U.S. history and a secular decline in interest rates from the highs of the 1980s. Elevated equity valuations and low rates have pulled the market’s efficient frontier of

expected returns into a lower orbit. The efficient frontier is also flatter (that is, it shows smaller increases in expected return for increases in equity risk) as seen from the return and volatility expectations of balanced portfolios.

Given Vanguard’s outlook for lower economic growth and subdued inflation expectations, risk-free rates, along with growth in corporate revenues and earnings, signifies that asset returns will also remain lower for longer compared with historical levels.

“Our analysis has shown that the current environment of persistently elevated policy uncertainty is holding back economic activity more than ever,” said Mr. Davis. “While we expect this political ambiguity to persist as a drag on global growth through 2020, we believe investors have the best chance for investment success by taking a portfolio-centric approach that leverages the benefits of diversification by simultaneously weighing risk, return, and correlation.”

Overall, Vanguard’s global market outlook suggests a somewhat more challenging environment ahead. Based on simulated ranges of portfolio returns and volatility, the diversification benefits of global fixed income and global equity remain compelling. Ultimately, investors with an appropriate level of discipline, diversification, and patience are likely to be rewarded over the long term. Adhering to investment principles such as long-term focus, disciplined asset allocation, and periodic portfolio rebalancing will be more crucial than ever.