Now, more than ever, it has become evident that market share strategy is entering a new age. In this age, advertising, creativity, and expansion are no longer the cornerstone of market share growth.

There used to be an old saying that goes, “here today, gone tomorrow,” in regards to today’s brands, the phrase is more like “here today, gone the next minute.” Inez Blackburn, a professor at the University of Toronto, found that new grocery store products fail 70 to 80 percent of the time.

Inez Blackburn’s finding shows that today’s brands don’t have the luxury of “figuring it out” in the marketplace’s rapid succession of new brands. There are too many brands, too much social media, too many brand voices, and too much noise.

To capture more market share and succeed in our excessively-communicated society, a brand must create and employ a “Unique Mind Premise” in the prospect’s mind.

A premise that holds a strong foundation to position the brand in the prospect’s mind.

A premise that is exclusive to only that brand’s position and can’t be attributed to the competition. Market share growth is entering a new age where a “Unique Mind Premise” is obligatory to succeed.

History remains present

If you were to ask most marketing strategists what took place in the year of 1961 and 1972, chances are they would look at you puzzled. You should know that these two dates paved the way for the marketing landscape we navigate today.

In 1961, Rosser Reeves published the book ‘Reality in Advertising’. This book featured for the first time; the groundbreaking “Unique Selling Proposition,” or U.S.P for short. The concept caused an earthquake throughout the marketing world and is still shaking today’s landscape.

In the book, the eloquent Mr. Reeves detailed 3 points in creating a unique selling proposition.

“Each advertisement must make a proposition to the customer.” Mr. Reeves then went on to say, ” The proposition must be one that the competition either cannot, or does not offer.” And the third point is, “The proposition must be strong that it can move the mass millions, and pull over new customers to your product.”

Sound the trumpets; thus, the U.S.P was born.

Even today’s publications, such as Forbes and Entrepreneur, have run articles on the unique selling proposition with tips on creating one.

The next monumental date in marketing history was on April 24, 1972. On this day, the article titled “The Positioning Era Cometh,” authored by Al Ries and Jack Trout, appeared in Advertising Age magazine.

The article was the first of a 3-part series that detailed why companies must create a “position” in prospects’ minds to succeed in an overcommunicated society.

“Strategy is king” is a theme of the article, which still runs true in current times.

Positioning is still required to succeed. Although positioning is widely known throughout the marketing landscape, both Al Ries and Jack Trout would be disgusted with the lack of execution in today’s brands.

You can’t fight fire with fire

Despite the ever-changing KPIs in the marketing world, the one factor that matters the most is the prospect’s mind.

The prospect’s mind matters the most because it’s the target of all marketing messages. If you want to know where you stand in the prospect’s mind, consider your place in market share. The leading brand is the best brand (rather it’s true or not).

Market share is a direct reflection of what’s in the mind of customers. That’s why the battle for more market share starts in the prospect’s mind, not the marketplace.

Throughout life, there are two ways to do things – correctly and incorrectly. You could choose to drive correctly (straight, use blinkers, safe) or incorrectly (swerving, speeding, unsafe.) You could build a house correctly (strong foundation) or incorrectly (weak foundation).

The same bells ring true in market share.

You could expand market share correctly (get in the mind, differentiate, focus) or incorrectly (line-extend, expand the line, advertise). Unfortunately, it’s widely accepted by brands to broaden market share incorrectly.

When battling against a market leader, you have no hope of progressing head-on against the leader’s position established by its “Unique Mind Premise.”

Case in point: The Coca-Cola Company, the powerhouse beverage brand, has incorrectly tried to fight Red Bull’s “Unique Mind Premise” head-on.

In the mind of customers, Red Bull means energy drink and holds a 43% market share globally of energy drinks, according to T4, the data research company. Red Bull established this vital position in energy drinks; by creating a “Unique Mind Premise” of being the first energy drink in the customer’s mind.

In January 2020, Coca-Cola tried to fight against Red Bull’s position by releasing an energy drink called Coca-Cola Energy. 17 months later, Coca-Cola Energy was pulled off the shelves because “the sales disappointed,” said the WSJ.

Coca-Cola Energy is a clear-cut example of what happens when you try to establish a brand without getting into the mind. Add it to the beverage graveyard.

IBM employed a “Unique Mind Premise” of being first in mainframe computers. Being first allowed IBM to hold a strong position in mainframe computers.

When IBM tried to expand its market share in the personal computer category incorrectly, the corporation reported losing $965 million between Jan 1, 2001, and Jun 30, 2004.

At the time of IBM’s incorrect move, Dell had the strongest position leading with 18 percent of the global PC market. IBM was more than half away at a disgruntling 7 percent. (Dell winded up losing its leading position to Lenovo, who bought IBM’s PC business – proof that you can’t fight fire with fire. You must use a different strategy.)

Of course, we run the risk of criticism from billion-dollar companies.

We can imagine them saying they can do as they please if they want to enter a new category. We agree you can and should enter new categories. Just don’t take your current name with you.

And to this criticism, we have more reasons why you shouldn’t. Let’s turn to the hard seltzer category.

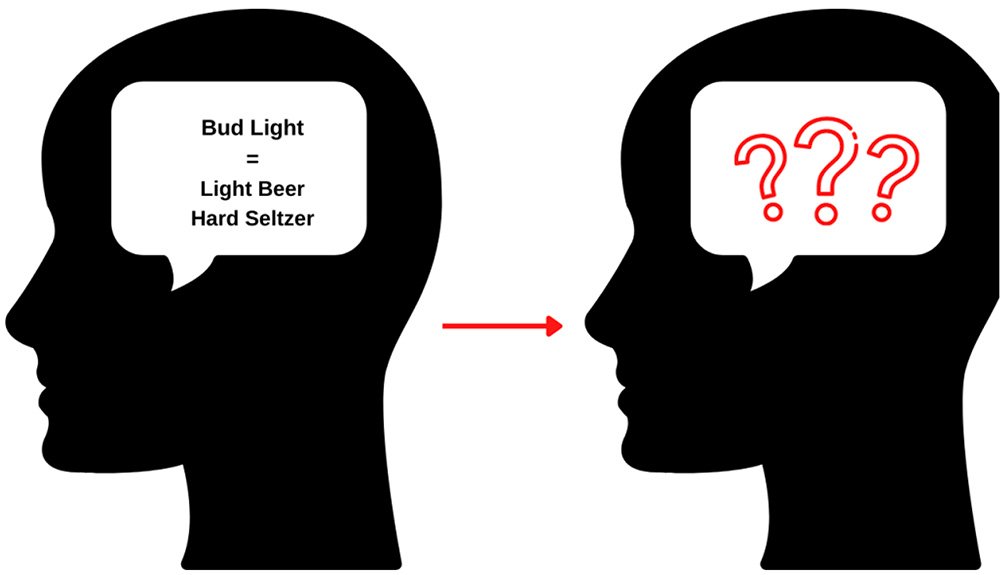

Anheuser-Busch, the parent company of Bud Light, has done exceptionally well in positioning Bud Light as the leader in light beer. USAToday reported that Bud Light leads all beers with a 13.24% market share. Unfortunately, this success hasn’t carried over to the hard seltzer category.

You must know that you can’t stand for two things in customers’ minds. In the minds of customers, White Claw stands for hard seltzer.

White Claw leads the hard seltzer category with a 43.2% market share, according to a Goldman Sachs analysis of Nielsen Data reported in the WSJ. Bud Light Hard Seltzer is at 9.8%.

Coors Light, another beer brand, also jumped on the hard seltzer wave. It drowned within a year.

Another response we can give is from Al Ries and Jack Trout, the creators of positioning themselves, “It’s possible to compete successfully with a market leader, the rules say it can’t be done head-on.”

You must stand out

As IBM, Anheuser-Busch, and Coca-Cola found out; you can’t just push a me-too product to market and hope for success.

A big problem brands are making is trying to gain success through advertising. And advertising isn’t the vehicle you want to drive to try and reach the prospect’s mind.

Forbes estimates that the average person sees between 6,000 and 10,000 ads a day. That’s thousands of messages trying to enter the mind of the prospect.

And while it’s pretty excessive, there’s just no extra room in the mind to take it all in. It’s like trying to walk through a door shoulder-to-shoulder with six other people. You’re not getting through.

To ignite the fire even more, Credos, a UK advertising think tank, found that in 2018, public favorability towards advertising reached a low of 25%. The noise level is just too high.

The new ball game isn’t to be won with advertising. In order to succeed in today’s excessively- communicated society, you must look to differentiate.

Differentiation is how BMW overtook Mercedes-Benz in luxury cars. Southwest saw 47 consecutive years of profitability (the pandemic stopped 48 but continued the streak). And Lenovo overtook Dell and HP to lead the PC market with a 24.1% market share.

To understand why some brands win or die in today’s fast-changing landscape, it’s best to turn to the foundations of differentiation.

The unique selling proposition was the foundation

Back in the 60s, the USP was the foundation for creating a product that would sell. The USP said, “buy this product, and you get this benefit.”

Unfortunately, the lines became blurred once more me-too products hit the marketplace.

Essentially it was almost indistinguishable to differentiate one product from another. It became harder and harder to stand out in the prospect’s mind. The USP lacked the missing link to the mind.

Positioning links

Where the USP lacked, positioning picked up the slack.

A positioning campaign doesn’t look at the product features, customer benefits, or company image. Positioning, created by Jack Trout and Al Ries, didn’t focus on the product itself but on the prospect’s mind.

A good example of positioning given by Al Ries and Jack Trout was about the once-popular 7-up brand.

Cola was the most popular soda category at the time, so 7-up took the “un-cola” position. Al Ries and Jack Trout said this position jolted sales up near 10% in the first year.

Chick-fil-A is another brand that positioned itself correctly.

Chick-fil-A’s chicken-not-beef position has led them to hold the top spot in online chicken sandwich orders in 2020, with an impressive 45% share, according to QSR magazine.

In addition, QSR reported that nationally Chick-fil-A was the brand awareness leader when asked to recall a chicken sandwich. It had a whopping 75% awareness score.

You must have a position to succeed.

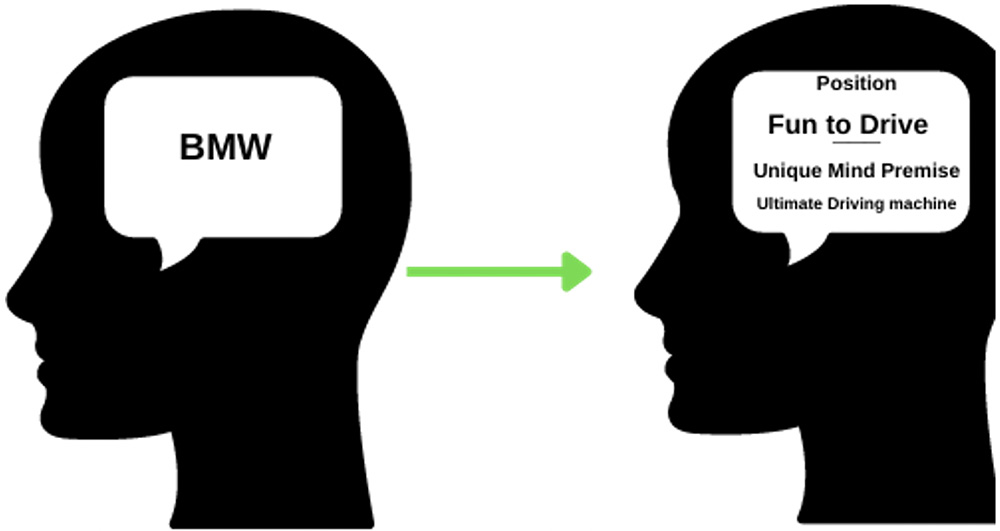

Look at BMW. “The Ultimate Driving Machine” positioned BMW as the fun car to drive. We can dig further into this example by turning to a book named “Visual Hammer” created by Laura Ries.

In the book, Laura Ries states that in 1974, the year before the “Ultimate Driving Machine” campaign was created, only 15,007 BMWs were sold in the US at the time, the Beemer was in 11th place for European imported vehicles in the US market. This position led BMW to become the leading seller globally of luxury cars decades later.

Once BMWs position was changed in 2010 from “The Ultimate Driving Machine” to “Joy,” BMW lost its leadership in America to Mercedes after nine consecutive years. Recently, BMW regained its luxury leadership as “The Ultimate Driving Machine.”

One and the same

If you’re familiar with boxing, then you know the most important punch is the jab, and an extension of this significant move is the double jab. Although they have the same name, they can serve different functions.

A jab is used to generate space between you and the opponent. Contrarily, a function of the double jab is maneuvering to another position, as you would never double jab in a stationary position like a regular jab.

Even though they may have different functions, they can still serve the same purpose. The purpose of the jab and double jab is to score points with judges and set up the opponent for a more favorable attack like a straight, power-punch, short hook, uppercut, long hook, or even an overhand.

Positioning and the “Unique Mind Premise” are similar to the jab and double jab.

The Unique Mind Premise, like the jab, generates space between you and the competition with a premise exclusive to your brand.

Like the double jab, positioning is used to maneuver throughout the market to stand out in the prospect’s mind.

Comparatively, they’re both used to get into the prospect’s mind and capture more market share. Fundamentally, they go hand and hand.

The Unique Mind Premise is the why behind a strong position. It’s the premise for a position to stand on.

For example, what made Coca-Cola’s position so strong in cola? It had a Unique Mind Premise of being the first cola. That’s why when you try to say “Coca-Cola Energy,” the mind rejects it. It’s a juxtaposition.

The same with Coors Light. Before Coors Light’s drought in the hard seltzer category, Coors created non-alcoholic bottled water called Coors Rocky Mountain Spring Water.

A beer brand creating water?

The water saw terrible sales and was promptly discontinued. Coors is a light beer in the customer’s mind. So when they fought against their own position, they shouldn’t expect a positive outcome. So that you know, Coors wasn’t the only one to try this.

Let’s take a look at the cola market.

Cola has a distinct brownish-red color, which has been the standard color since its invention in 1886 by Coca-Cola. So what happens when you break this association between the brownish color and cola? The mind of the drinker rejects it. Ask Pepsi.

In 1992, Pepsi created Crystal Pepsi, a clear cola drink. “You’ve never seen a taste like this” was the slogan across the campaign.

As bubbly as that sounds, things weren’t filled with bubbles and sunshine.

You can’t ignore what’s in the customer’s mind. Crystal Pepsi didn’t last 24 months.

Old concept gets new meaning

Like most new concepts, the Unique Mind Premise isn’t new. Well, not in its most common use.

In one use, it’s an extension of Al Ries and Jack Trout’s positioning. In another service, it could overlap with the USP.

A good example would be BMW’s “The Ultimate Driving Machine” this is a USP because there can only be one Ultimate Driving Machine, which also doubles as a Unique Mind Premise to position the brand as a fun car to drive in the customer’s mind.

What’s new regarding the Unique Mind Premise is its purpose is to provide a strategic premise for a strong position.

One premise is to be the first in the category. Another premise is to narrow the focus. Domino’s focused on home delivery and overtook Pizza Hut. Google narrowed the focus to search only and overtook Yahoo and Altavista. Another is to differentiate.

At its core, the Unique Mind Premise is a differentiating idea. For example, it’ll be challenging to establish a USP for these leading brands in market share:

- State Farm; Auto Insurance – 98% (NAIC)

- Gatorade; Sports Drink – 67.7% (Beverage daily)

- Oreo; Cookie Sandwich – 69% (Statista)

What’s the USP of these brands? There’s no distinguishing a USP from them and the competition. The only thing that makes these brands stand out is their position and the way their position got into the mind (Unique Mind Premise.)

Each brand named established a strong position by employing a Unique Mind Premise of being first in the prospect’s mind in the category – thus creating the category.

Note: the keywords here are “in the mind.” Being first in the marketplace doesn’t do much for you if you’re not first in the prospect’s mind.

Traveler’s Auto Insurance was the first auto insurance. But, State Farm got into the mind by focusing only on farmers’ auto insurance. Then the PR from the farmers allowed them to start issuing auto-insurance policies to non-farmers.

Lucozade was the first sports drink. But Gatorade got into the mind first after the Florida Gators won the Orange Bowl in 1967. When Robert Cade, the opposing coach, was asked why his team lost, he replied, “We didn’t have Gatorade.”

Oreo’s first got into the mind after taking Hydrox’s idea of the sandwich cookie and creating the “twist” campaign.

A strong position is built on the foundation of a Unique Mind Premise. In these cases, the Unique Mind Premise is being first in the prospect’s mind.

Watchout for the backfire

To better grasp what brands are up against, it’ll be beneficial to take an in-depth look into the most important receiver of all branding messages – the human mind.

Brands seem to think that they exist in a vacuum. They send out creative advertising that completely ignores their competition and their own position.

In short, brands do a lot of swinging and not enough hitting. Havas, the global media agency, states that 60% of branded content is cluttered and fails to deliver.

Havas’ finding isn’t surprising because the mind rejects conflicting information against its belief, which is a confirmation bias, also known as the backfire effect.

The Macmillan Dictionary defines the backfire effect as “The finding that given evidence against their beliefs, people can reject the evidence and believe even more strongly.”

Unknowingly, brands are triggering the effect and helping their competitors.

For example, whenever someone sees a Bud Light Hard Seltzer commercial, their mind rejects it. In the customer’s mind, Bud Light is a beer; White Claw is a hard seltzer. Ironically, Bud Light is reinforcing White Claw’s position.

To add more fuel to the backfire, Bud Light Hard Seltzer has run commercials with former NY Jets Center Nick Mangold to block out Bud Light on the can with his fingers because, as the commercial says, “Our Bud Light logo makes people think our seltzer is a beer.”

You don’t say.

Imagine spending millions to tell people your beer is now a hard seltzer. Another brand suffering from the backfire effect is Marcus by Goldman Sachs.

Marcus is a consumer bank created by Goldman Sachs. At its core, Goldman Sachs is an investment bank that deals with IPOs and high-end finance.

Globally, Goldman Sachs owns a 7.8% market share in investment banks, according to Statista – which puts Goldman Sachs at number 2 in market share but only .2% behind the number 1 spot.

So what’s the backfire effect?

The prospect’s mind rejects it when you try to hang a high-end name on a low-end product.

Marcus targets the everyday consumer, so when a typical consumer sees “Goldman Sachs,” they assume you need to be a tycoon.

Here’s what a September 19, 2019 article by Liz Hoffman and Peter Rudejeair of the WSJ said about Marcus’ products, “It pitches loans to cash-strapped consumers who need money to fund home renovations or pay off debt.”

Hanging the Goldman Sachs name on the Marcus brand has cost them greatly. From 2016 to 2019, the WSJ reported that the brand Marcus had lost $1.3 billion. On June 28, 2022, an article by Lydia Moynihan of the New York Post noted that the bank would lose more than $1.2 billion in 2022.

Attaching a high-end name to a low-end product is a sure way to trigger the backfire effect. The same is true vice-versa.

When Volkswagen, a brand known for inexpensive small cars, tried introducing a $100,000 big vehicle named the Phaeton, the outcome shouldn’t be surprising. Introduced in 2003 and rolled away in 2007, the Phaeton sold less than 3,400 vehicles in that span.

Differentiation is key

Market share is determined by differentiation. If you want to become a leader, differentiation is the way to obtain this goal. Take a look at these online market leaders.

PayPal overtook Western Union in fund transfers by being different and focusing on sending funds online. According to Statista, PayPal dominates with a 50.32% market share of online payment processing.

Netflix took a similar approach against Blockbuster.

Netflix started as a different DVD service by mail. Then went into online streaming. You know the ending to this story. Netflix overtook Blockbuster. When Blockbuster tried to follow suit and get into online streaming – it failed.

In the year 2010, Blockbuster was forced to go into bankruptcy. This same year, Netflix saw a net income of $161 million on $2.16 billion in revenue. A healthy net profit margin of 7%.

In 2021, Netflix saw a net income of $5.16 billion on revenues of $29.69 billion. An astonishing 17% net profit margin. According to Parrot Analytics, Netflix leads the online streaming market with 45.2% globally.

Amazon had a similar approach against Barnes and Noble.

While Barnes and Noble competed with Borders, Amazon was different and sold books online at a discount. Amazon’s differentiation ignited a colossal war between Amazon and Barnes and Noble. Borders was a casualty of the war and closed its doors in 2011.

Amazon went on to dominate the online book market. T4 reported that in 2018 Amazon had 89% of e-book sales Barnes and Noble saw just 2%.

You don’t need to take your brand online to be different, especially today. Here are a few offline examples.

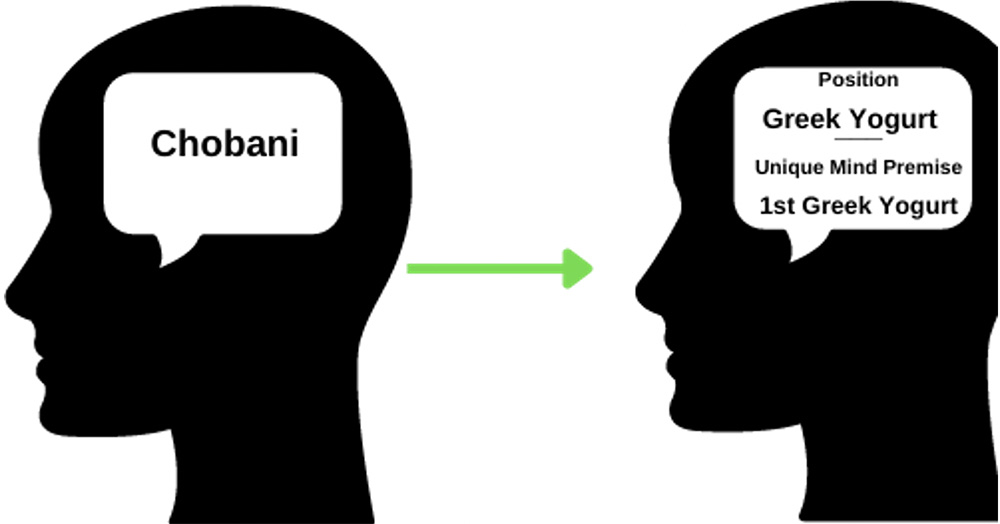

While Dannon and Yoplait competed with one another, they got overtaken by a different yogurt named Chobani.

Chobani was the first Greek yogurt in the customer’s mind. Quartz magazine reported that Chobani owns 44% of the US Greek yogurt market.

What Chobani did in yogurt, Cheerios did in cereal.

Kellogg’s Frosted Flakes constantly topped the cereal boxes until a different healthy, circular cereal named Cheerios took the top spot, according to Kiplinger, a media company.

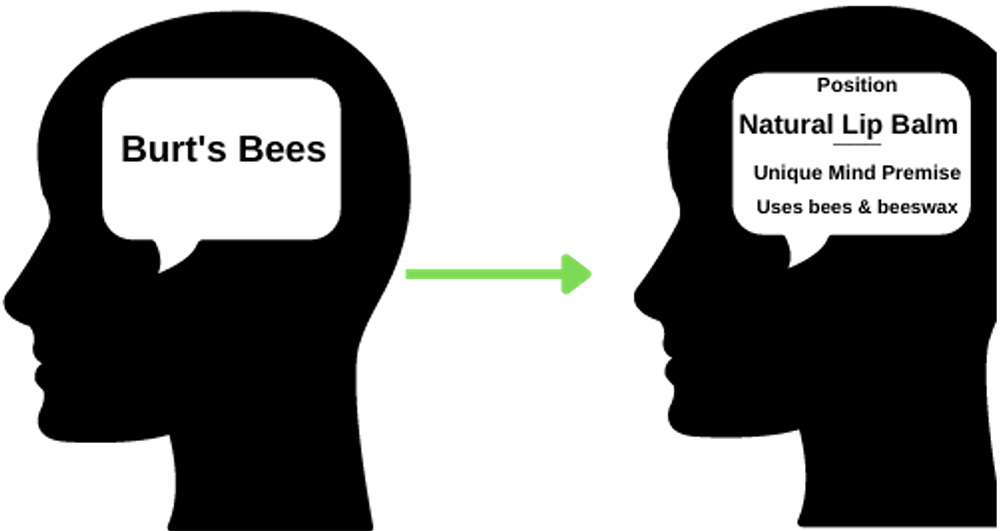

Another brand overtaken is the beloved Chapstick.

Chapstick’s core brand was overtaken in sales share by a different natural lip balm made of beeswax called Burt’s Bees.

Statista states Burt’s Bees’ has a 19.3% sales share to Chapstick’s 14.3% – this doesn’t include Chapstick Total Hydration (3.4%) and Chapstick Classic (2.2%).

Differentiation is the key to more market share. Differentiation is the key to establishing a Unique Mind Premise easily.

Netflix’s Unique Mind Premise of being the first online streaming platform allowed it to enforce and hold a streaming position in the customer’s mind.

Chobani’s Unique Mind Premise of being the first Greek yogurt allowed it to position itself in the customer’s mind as “healthy yogurt.”

Burt’s Bees’ Unique Mind Premise of using beeswax in lip balm allowed it to position itself as a “natural lip balm” in the customer’s mind.

Creativity will leave you invisible

When trying to capture more market share, as Al Ries and Jack Trout said, “strategy is king.”

Bud Light Hard Seltzer, Marcus by Goldman Sachs, and Coca-Cola Energy have all made the grave mistake of trying to attack the leaders head-on.

Strategy is what made BMW the leading luxury vehicle. Creativity with “Joy” made BMW lose its leadership. Then, strategy allowed BMW to regain its leadership.

Can you name the brands of these three creative slogans? “You Can money,” “Motivation That Moves,” and “Reimagine the Way You Home.”

Do these three slogans make sense? Well, if you’re lost, imagine the consumers of these messages.

Anyhow these brands are Marcus by Goldman Sachs, Peloton, and Zillow.

Besides creativity, these brands have another thing in common – they’re all losing money.

Marcus is expected to lose more than $1.2 billion this year, Peloton has lost $718 million since 2017, and Zillow has lost $1.2 billion since 2019.

On the contrary, strategy allowed CoStar, Zillow’s competitor, to make $835 million since 2019. Duracell, the leading battery, is another brand built off of strategy.

Instead of creating a zinc battery and competing head-on with the leader Eveready, Duracell was different and got into the prospect’s mind by being the first alkaline battery. Reuters reported that Duracell held a 45% market share of the household alkaline market in 2020.

DoSucceed, a market share consulting firm, provided the Mind Market Share Connection. DoSucceed, also known as “The Ultimate Market Share Expansionist,” focuses on expanding market share for brands with at least $25mm in revenue. For more market share tips, visit dosucceed.com.