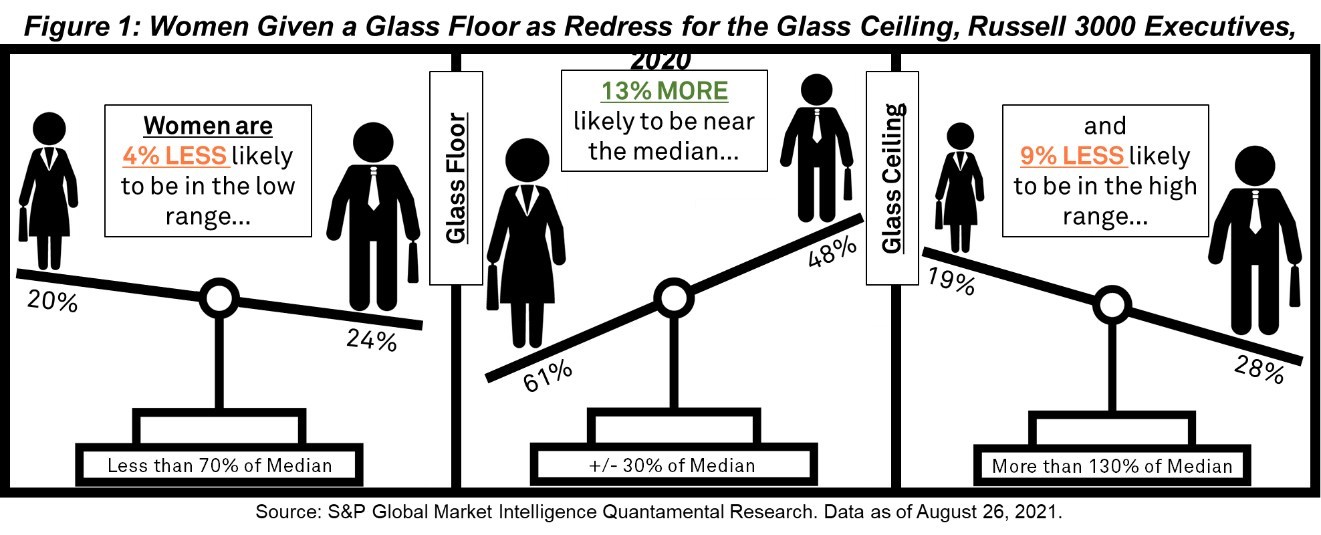

S&P Global (NYSE: SPGI) released a first-of-its-kind research report analyzing the gender wage gap and its evolution over the last 15 years. The new report, “Glass Floors and Ceilings: Why Closing the Median Wage Gap Isn’t Fair,” found that compared to men, women in executive roles are more likely to receive compensation in a compressed range around the median of their peer group (Figure 1). Firms have been focused on median compensation, but because the high end of the compensation range can be much farther from the median than the low end, the result has been a net disadvantage for women’s pay equity.

“In their push to address pay equity, companies have focused on one statistic – median pay – while losing sight of the larger picture. This suggests that companies are focused on the optics of the problem, rather than solving the problem,” said Daniel J. Sandberg, Senior Director of Quantamental Research at S&P Global Market Intelligence, who authored the report. “We hope this research sheds light on a worrisome trend and helps firms reevaluate their approach to closing the gender pay gap.”

Other key findings of the report include:

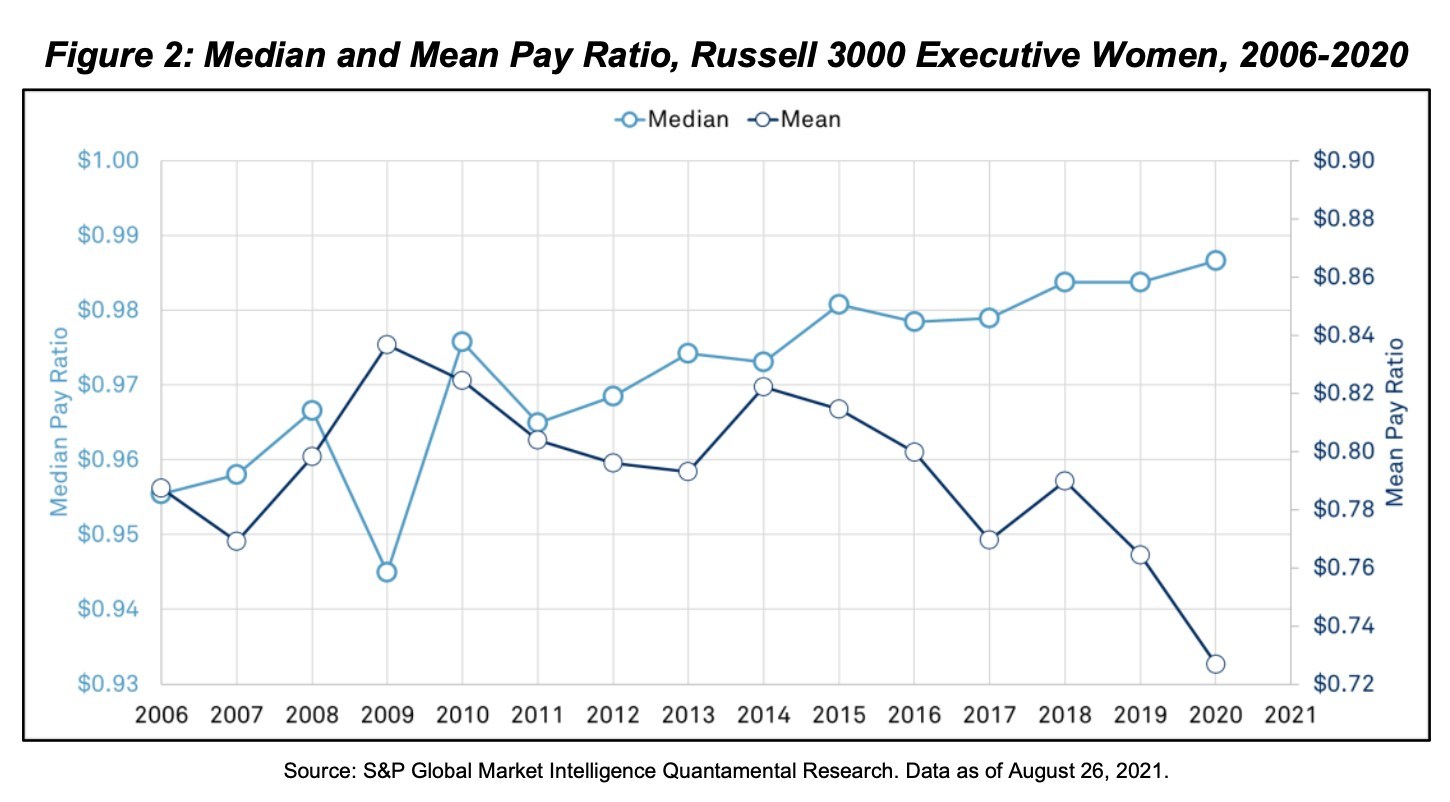

- Although women’s median pay ratio has been steadily increasing over the 15-year study period, the mean pay ratio has been declining over most of the study period. This suggests that measures of central tendency, used in many other studies, may be producing misleading conclusions by oversimplifying the gender wage gap problem to a single data point (Figure 2).

- Firms that have been defendants in federal court cases involving compensation disputes, discrimination, fraud, or other governance-related affairs exhibit more pronounced Gender-Based Compensation Management (GBCM). The practice of GBCM artificially addresses the gender pay gap by increasing the median woman’s compensation without providing women equal access to the full range of compensation. The findings suggest GBCM is associated with poor governance.

- The percentage of women holding positions across the C-suite, board of directors, and executive positions grew from 15.4% to 19.2% from 2018 to 2020. While this progress is statistically meaningful, at this rate women have at least one to two more decades before they reach parity in their representation across senior roles. In positions where women’s progress has been slower, such as CEO, parity will likely take even longer.

“This report, along with our previous research around the benefits of greater women’s workforce participation, is more than just data on a page – it has the power to create real change,” said Dimitra Manis, Chief Purpose Officer at S&P Global. “I’m proud that we are not only advancing the conversation around the gender pay gap through new insights, but also committed to transparency around our own rewards structure to ensure equitable pay among our people.”

This research was conducted by the S&P Global Market Intelligence Quantamental Research Team and includes analyses of more than 80,000 executives who held positions at Russell 3000 firms during the years 2006-2020.

These findings build off the team’s previous research around the performance of companies with women in CEO and CFO positions, which found that appointments of women leaders drove positive performance, including higher profitability and superior stock prices. Both reports are part of S&P Global’s #ChangePays initiative, which illuminates the positive impact of women in the workforce across companies, organizations, economies, and global communities.