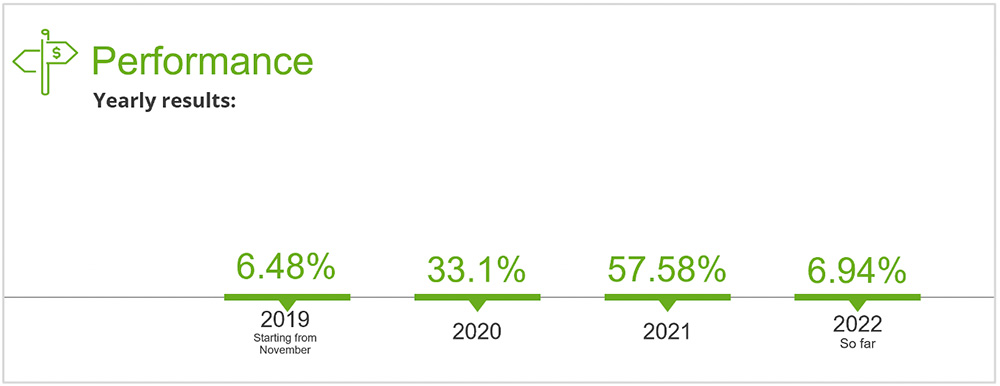

Can you achieve significant returns without the need for comprehensive research? By using social and copy trading on eToro, it is possible. I have been professionally trading for three years and have seen success every year, and even this year, when the S&P500 is down over 17% YTD, my eToro portfolio (Alphamale7 or Nikolaos Zervos) with over 200 followers is up over 6% (semi-annual performance).

For more details, including my monthly performance, please see my stats page on eToro, & my fact sheet.

Social and Copy Trading

eToro is the most well-known site for these investing strategies that involve the observation of other traders. These two methods do have similarities but are not the same. I’ll explain how using them investing has changed from an active to a passive endeavor and how by using them, non-professional traders can have the edge.

What is Social Trading

Social trading is a feature that was developed by eToro that combines investing with social media, allowing users to track the moves of other traders. They can see the performance of a trader, get notifications if that trader makes a move, and they can also communicate with different traders on the platform.

The idea is that eToro’s users are collaborating as a community. There are areas where users can post messages and talk about their strategies. Many eToro investors will discuss stocks and crypto.

Pros and Cons of Social Trading

Pros:

- Great for traders who learn by doing

- Access to lots of helpful data

- Focus on community success

Cons:

- Requires more time for research

- Strategy learning curve

- Can be slow, missing hot trades

- See trade but not understand it

What is Copy Trading?

Copy trading takes social trading to the next level, allowing users to “Copy” the trades of other platform investors. Social trading lets you see the trades that other investors make but Copy trading allows you to make the same trades that other users make. If they are buying, then your account automatically buys, and if they sell, you automatically sell.

Copy trading allows you to be more hands-off than social trading, following a professional trader that is ranked by eToro. You can see their risk score and the success of their historical trades. This is like having a top trader work for you without paying a management fee, leaving the heavy lifting of researching a good trade all to them.

Copy trading allows you to trade beyond your expertise, but you must find the right trader to copy because you take on the risk of their trades. If you choose this route for your investment, you should set loss limits and monitor your account regularly, even if you are not doing the trading yourself.

Pros and Cons of Copy Trading

Pros:

- More passive strategy

- Allows trading beyond current expertise

- Can set loss-limits

- Good for beginners

Cons:

- Relying on another trader so there can be high-risk

- Hands-on learners may not learn

Choosing Your Best Strategy

At its core, Social trading means you make the decisions and is ideal for anyone who wants control. The learning curve is steeper, but you can choose your risk level and are ultimately responsible for investing. You can learn from the community and learn by doing; if you want to develop trading skills or you already have them, and you want to share them with others, then this is the pathway to take.

Copy trading is great if you want a hands-off approach but still wish to get the heavy lifting done by another trader fee-free. Beginners and busy investors who don’t care about improving their trading skills and want to leave the decision-making up to someone else will find success choosing this route.

Nikolaos Zervos (Alphamale7)

The Success of Copy Trading

Copy trading can be very profitable, but copy trading has the same risks as all trading. There are no guarantees of future returns because no trader can predict the future, but successful traders with experience are more likely to make better decisions than inexperienced traders. This is where the commoditization of the market comes in. With copy trading, the novice trader can have access to experts that were once only possible by the wealthy buying into a hedge fund. And they can see their performance on an ongoing basis.

With copy trading, eToro incentivizes the success of the traders on the platform who perform well and gain more followers. The traders with the best track records will attract more followers, so they want to perform well.

With all types of trading, it is hard to beat the market. There are traders who can consistently outperform the market, but it is not easy to do, and there is always risk of loss. The more risk traders take on, the more they can gain but the more they can lose; copying a high-risk trader is more like gambling. Finding a risk-reward balance is the key to success; you may want to follow a trader with less exciting returns, but they also have a lower risk score so that you have a positive long-term experience.

Feel free to review my performance and see if I am the right trader for you to copy.

My monthly performance can be found on my eToro stats page and on my fact sheet.