Despite its disruptive impact on consumer behavior and retail spending throughout the year, COVID-19 is not cancelling the holiday shopping season, although it is changing how and where consumers will shop. For the past 35 years, Deloitte has been tracking the holiday shopping period, examining consumer behavior and what retailers can expect from shoppers as they tackle their holiday shopping. This year’s report, “2020 Holiday Survey: Reimagining Traditions,” surveyed 4,012 consumers nationwide. Conducted online Sept. 9-15, it provides key insights into how COVID-19 is impacting the holiday season.

Home for the holidays takes on new meaning as consumers shift spending

While the majority of consumers (71%) are in a similar or better financial situation than last year, nearly 1 in 3 (29%) say that their household’s financial situation is worse year over year. Given the financial uncertainty, 38% of consumers say they plan to spend less on the holidays, a level not seen since the Great Recession.

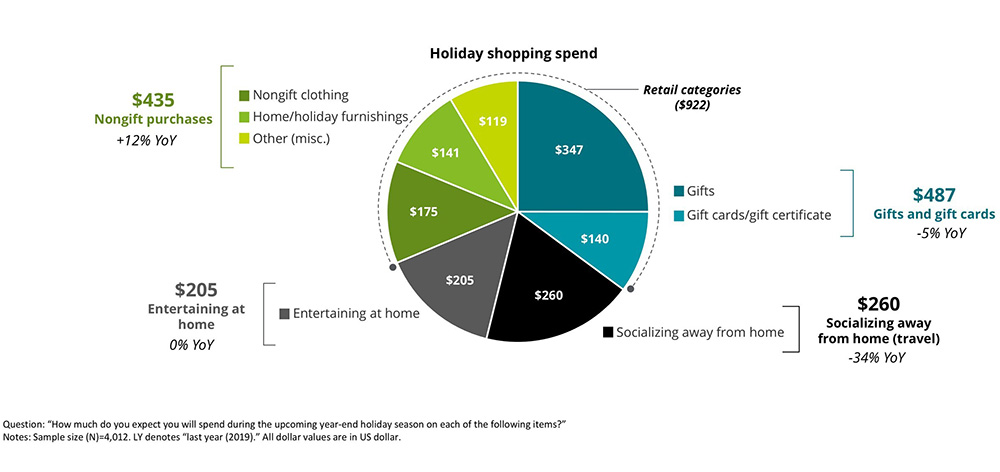

As consumers cut back on travel and other holiday experiences, they’re planning on celebrating the season with loved ones at home, and focusing their spending more on non-gift items like home, holiday furnishings and non-gift apparel.

- Consumers are expected to spend $435 per household on non-gift purchases this holiday season, accounting for nearly a third of household holiday spending and representing a 12% increase from last year.

- Travel and socializing away from home is expected to decline 34% year over year, to $260 per household.

- Spending on gifts and gift cards is forecast to be $487 per household, a decline of 5% since 2019.

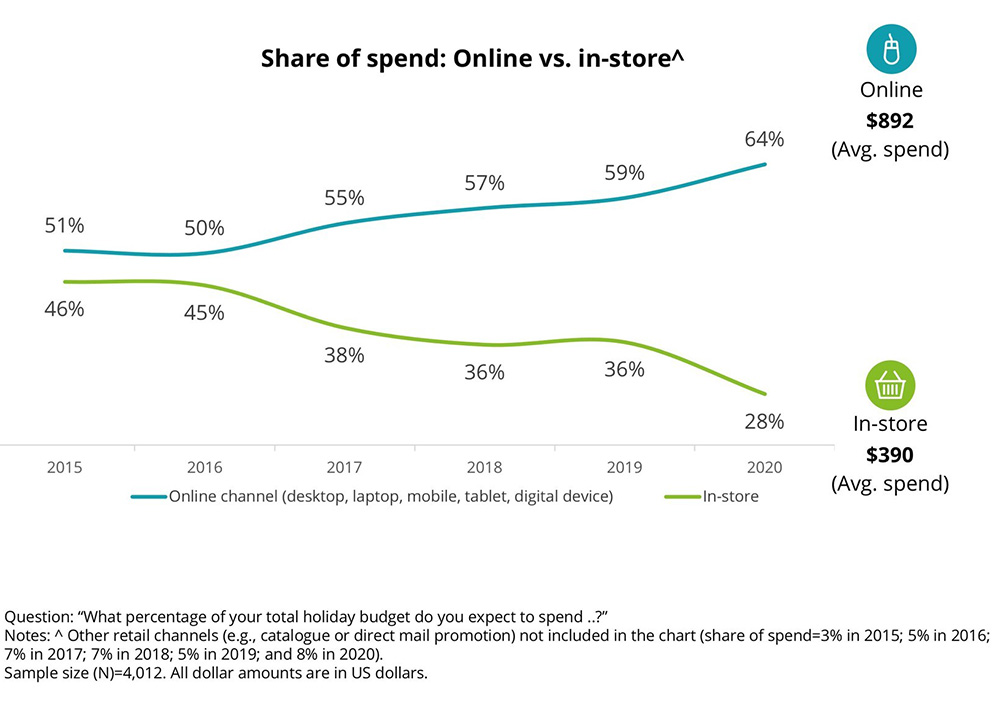

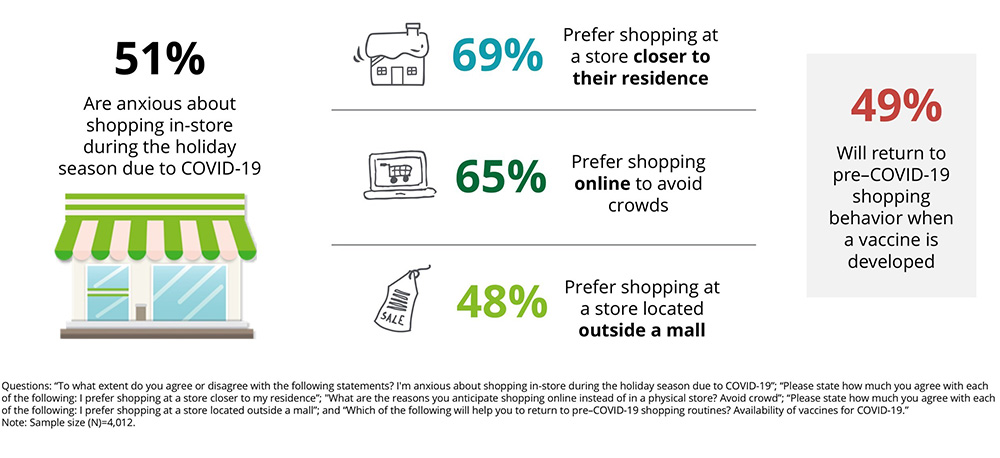

Ongoing anxiety spurred by COVID-19 continues to compound consumers’ shift from in-store shopping to contactless options. More than half of consumers (51%) are anxious about shopping in-store during the holiday season due to COVID-19, and furthermore, 49% won’t return to pre-COVID shopping behavior until a vaccine is developed.

- Among those who plan to shop predominantly online, nearly two-thirds of consumers will shop online to avoid crowds (65%), because they prefer the convenience of shopping at home (64%), and want to take advantage of free shipping or delivery options (60%).

- More than two-thirds (69%) of consumers noted that they prefer shopping at a store closer to their home, and 64% of shopping budget will be spent online during the holidays.

- As consumers seek out safe and convenient options, 35% of shoppers indicated preference for buy online and pick-up in store (BOPIS), and the use of curbside pick-up (27%), which is expected to more than double from last year.

- Free return shipping is expected to be in high demand, as 70% of consumers will prefer a retailer that offers this option to make product returns most convenient.

- While safety and convenience are important, a “great deal” continues to win the day, with 61% of consumers noting its relevance in selecting a retailer.

“In this season of uncertainty, price, value and convenience continue to be top considerations for consumers, as is the desire to get creative with how they celebrate the season with family, friends and pets, no matter the circumstances. As travel spend declines, retailers will likely benefit, and should receive a higher percentage of total holiday spend. The key for retailers is to stay flexible and offer options that appeal to consumers’ changing behaviors and address their evolving needs. Those that do will likely be better positioned for a bright holiday season.” – Rod Sides, vice chairman, Deloitte LLP, and U.S. retail, wholesale and distribution leader.

Consumers plan to shop fewer days this holiday season

Consumers plan to complete their holiday shopping in about 5.9 weeks, which is 1.5 weeks shorter than prior years, as they plan to avoid crowds, shop closer to home, shift purchases online and maintain flexibility in their personal budgets.

- Sixty-one percent of consumers plan to begin shopping before Thanksgiving, with an expected average spend of $1,537 per household.

- Thirty-nine percent of consumers plan to begin shopping on Thanksgiving or later, with an expected average spend of $1,149 per household.

- Moreover, consumers who plan to shop on major event days plan to spend more than the average shopper. And, consumers of all age groups are likely to rely more on Cyber Monday (29%) than Black Friday (24%).

- Consumers hang an extra stocking for a pet — and themselves

While gift cards (48%) and clothing (43%) are among the top gift items this holiday season, more than 30% of holiday budget will be on non-gift items.

- As consumers look for items to purchase for themselves, 45% will wait for holiday sales to buy big-ticket items for the household.

- Consumers plan to stay close to home and indulge on beverages (33%) and food items (30%).

- As COVID-19 has motivated families to add a pet to the household, half of the consumers (50%) plan to spend an average of $90 on pet food and supplies this holiday season.

- Pet stores (49%) are the most preferred retailer for pet purchases, followed by online merchants (17%) and mass merchants (15%).

“More than ever, shoppers are looking for safe and convenient ways to keep the season fun and festive. As a result, more shoppers are turning to contactless shopping options like home delivery and curbside pickup for safety and convenience. This holiday season is going to test even the best supply chains and logistics. Retailers who successfully address last mile requirements this season will like what they find in their own holiday stocking.” – Stephen Rogers, executive director, Deloitte Insights Consumer Industry Center, Deloitte LLP.

Join some of Deloitte’s top leaders as they celebrate and discuss the past few decades of #holidayshopping trends. Listen to the podcast now: “The History of Holiday Retail Trends.“