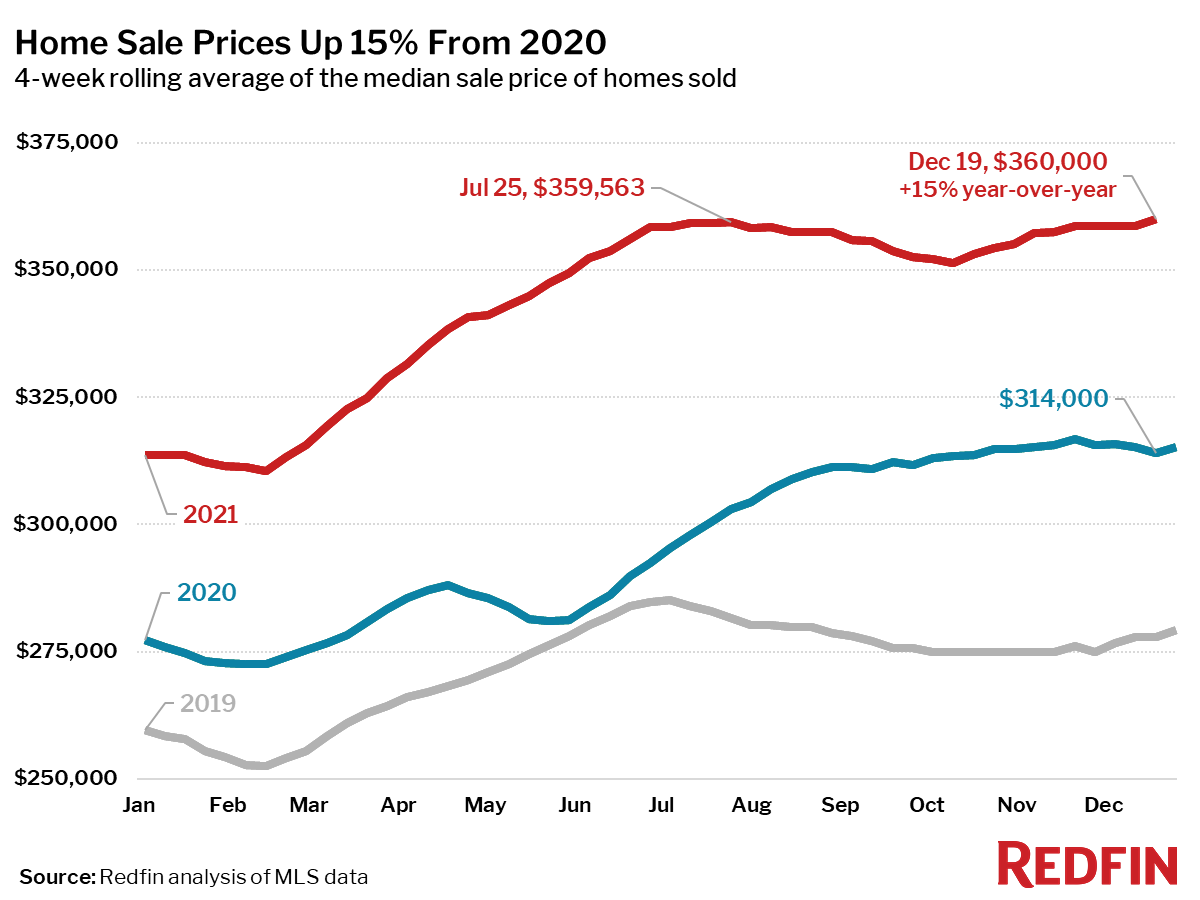

The median home sale price rose 15% year over year to an all-time high of $360,500 during the four-week period ending December 19, according to a new report from Redfin, the technology-powered real estate brokerage.

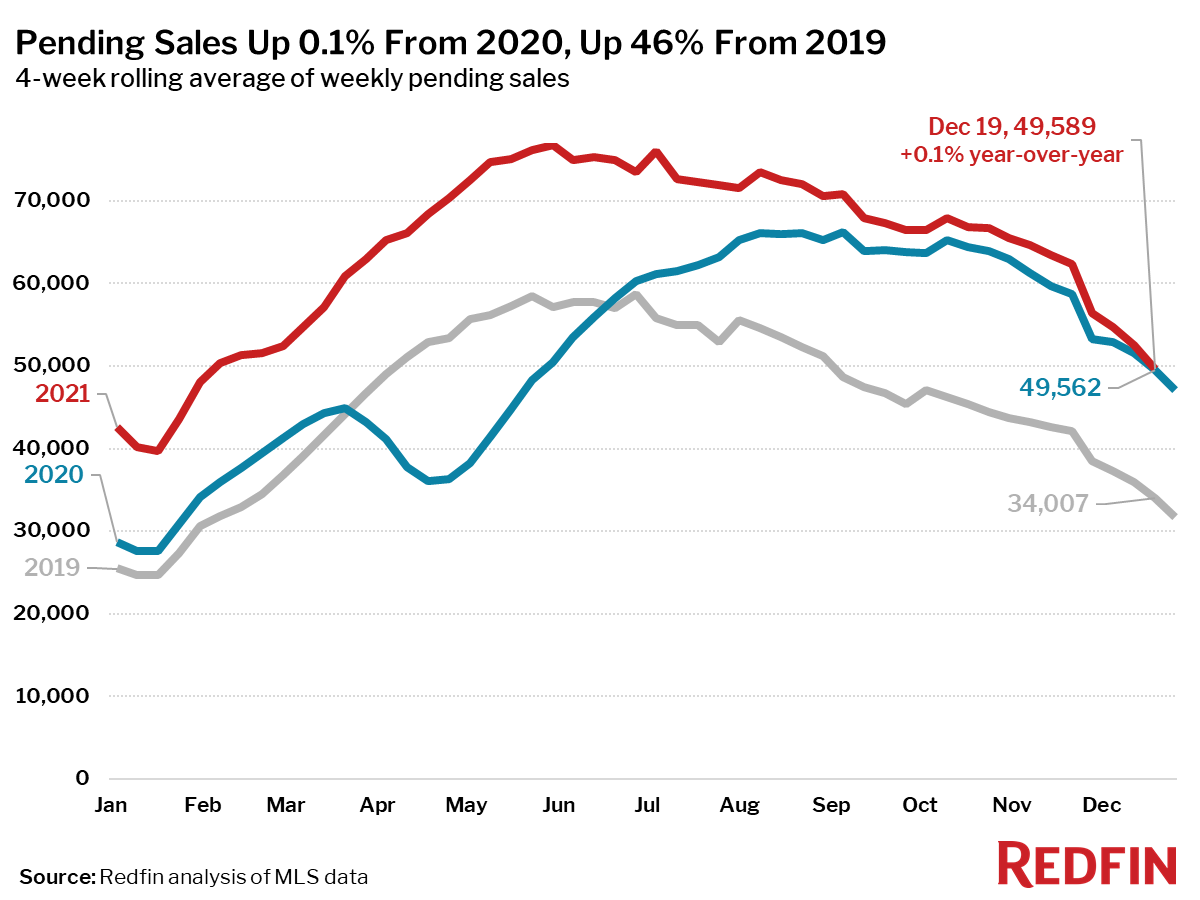

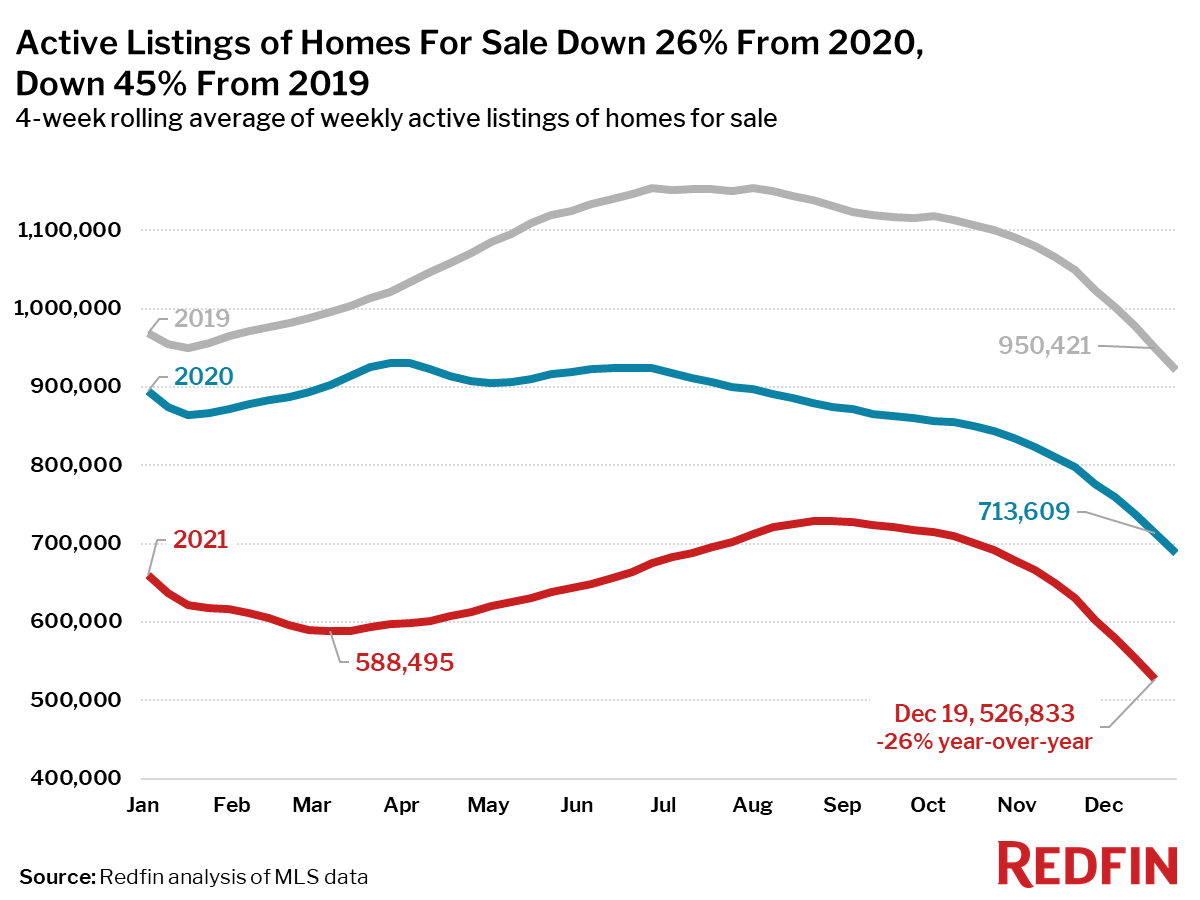

Pending sales rose 0.1%, the smallest year-over-year increase since June 2020. Sales activity is constricted by supply, not demand; the number of homes for sale fell 26% to an all-time low.

“As the number of homes for sale drops to a new all-time low every week, homebuyers have a sense that the well is running dry,” said Redfin Chief Economist Daryl Fairweather. “Fewer homes are selling because of a lack of supply, while demand remains strong. That’s why home prices continue to climb higher and higher. But once mortgage rates increase in 2022, I expect the rate of price growth to slow down significantly.”

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, this data covers the four-week period ending December 19. Redfin’s housing market data goes back through 2012.

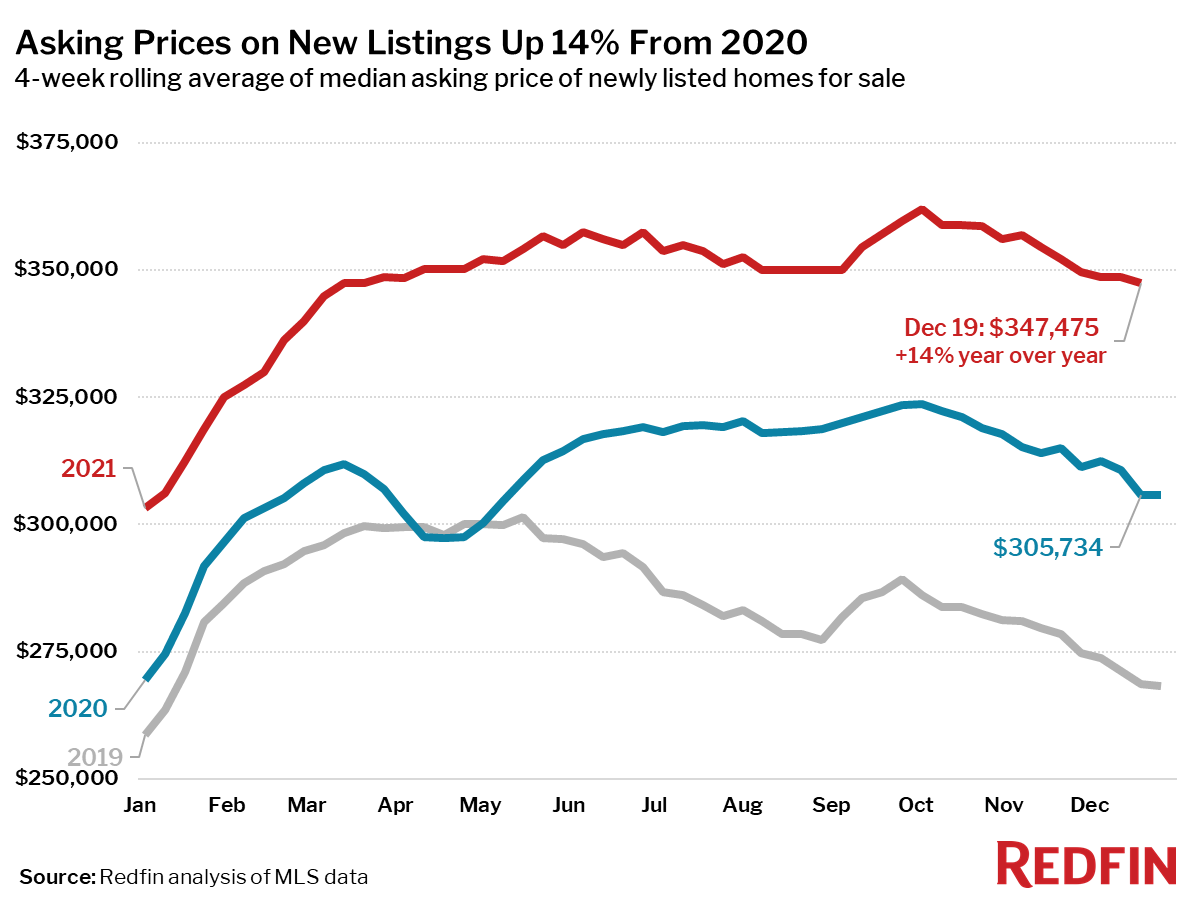

- The median asking price of newly listed homes increased 14% year over year to $347,475, up 29% from 2019.

- Pending home sales were up 0.1% year over year, and up 46% compared to the same period in 2019.

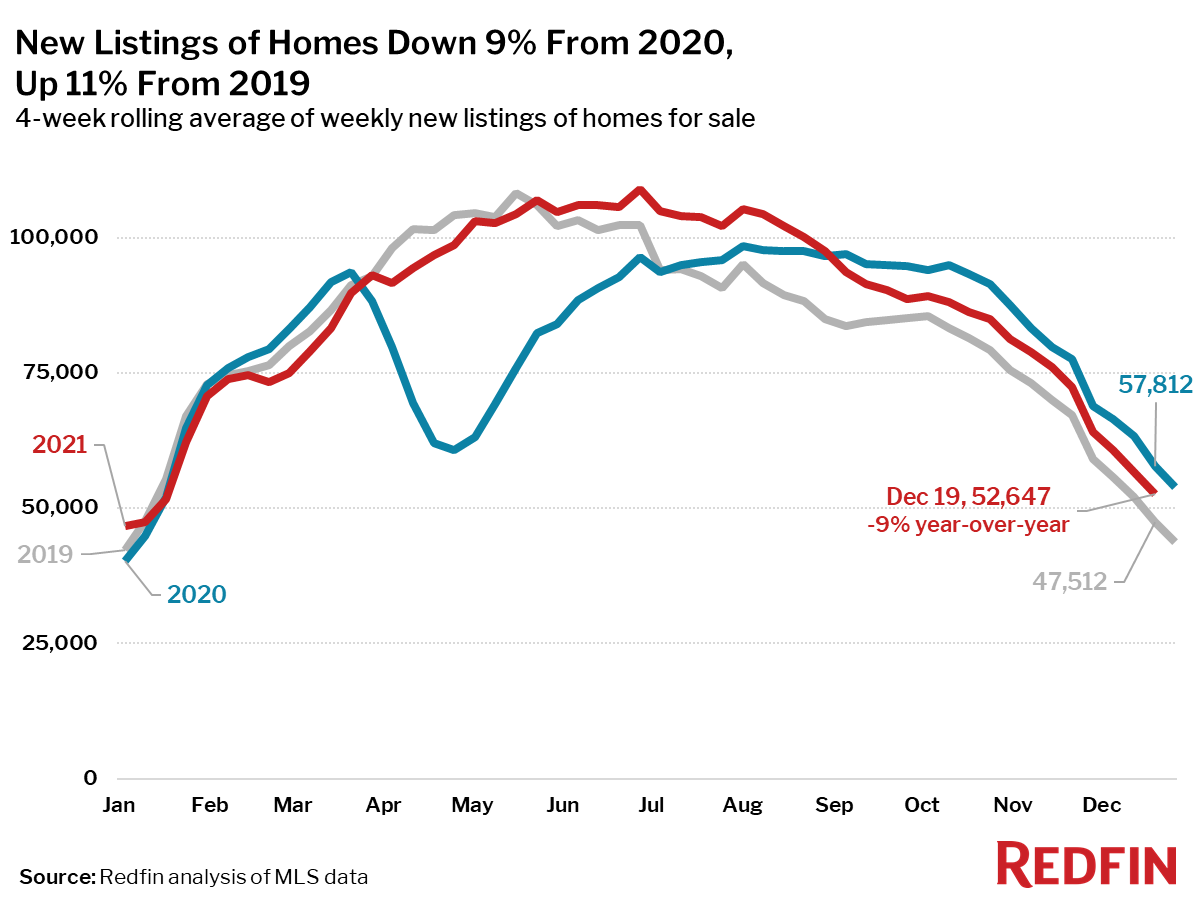

- New listings of homes for sale were down 9% from a year earlier, but up 11% from 2019, marking the largest two-year increase since September.

- Active listings (the number of homes listed for sale at any point during the period) fell 26% year over year to an all-time low, and were down 45% from 2019.

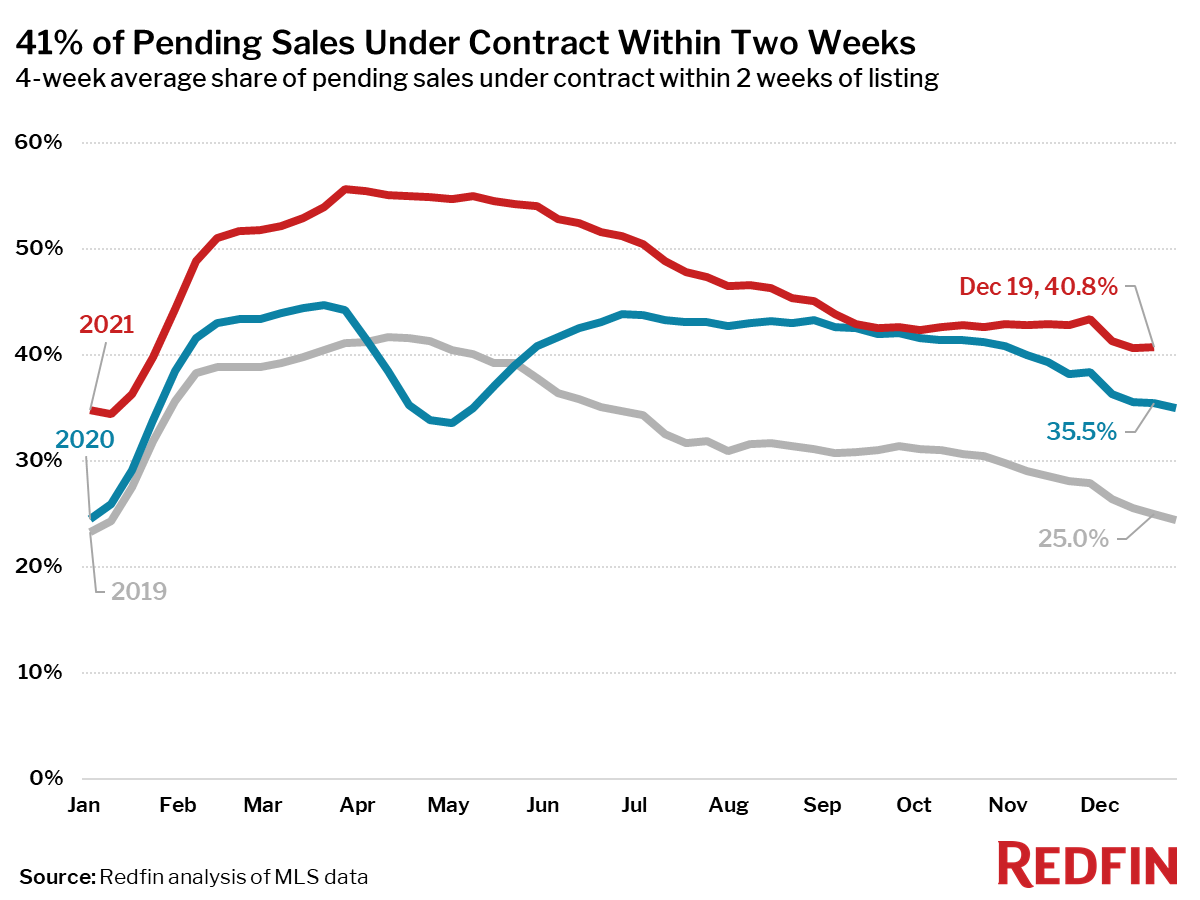

- The share of homes that went under contract that had an accepted offer within the first two weeks on the market was 42%, above the 36% rate of a year earlier and the 25% rate in 2019.

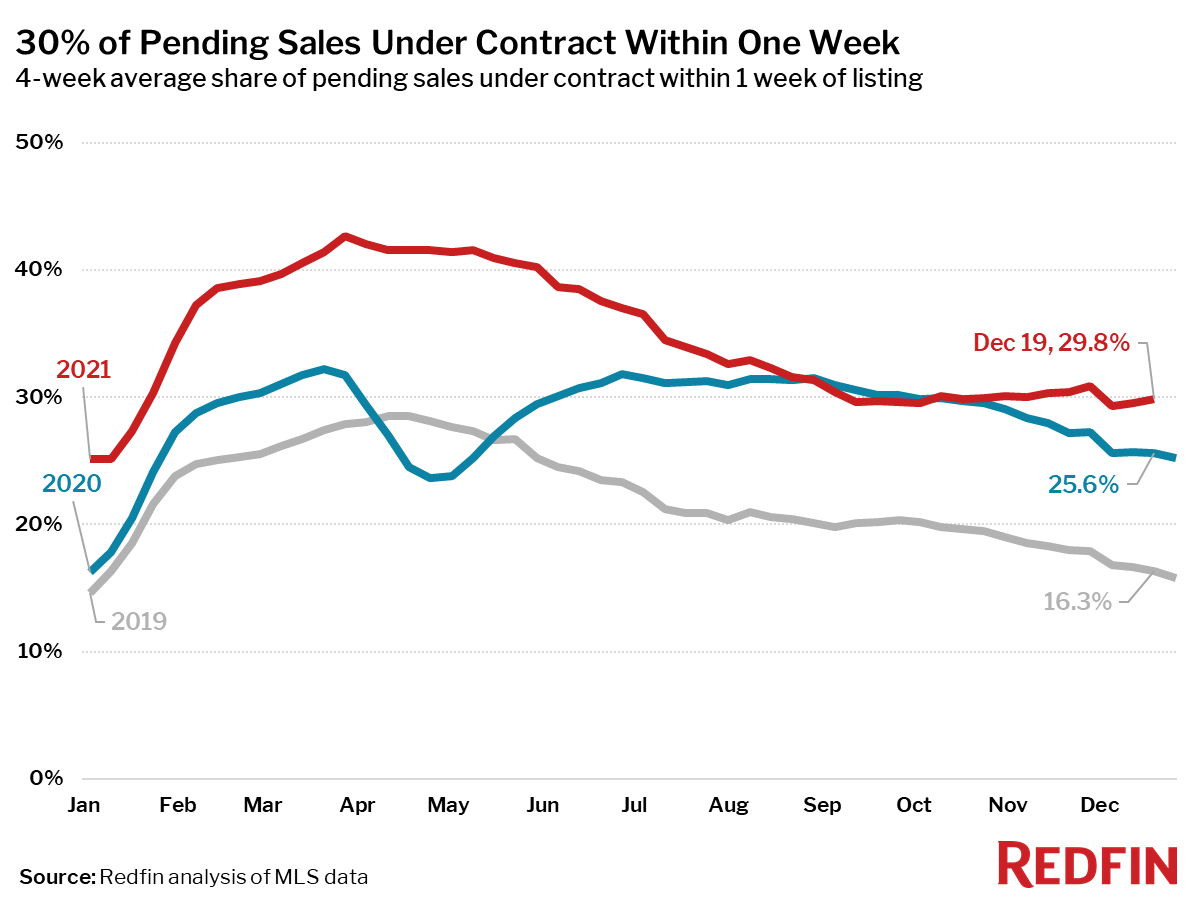

- 31% of homes that went under contract had an accepted offer within one week of hitting the market, up from 26% during the same period a year earlier and 16% in 2019.

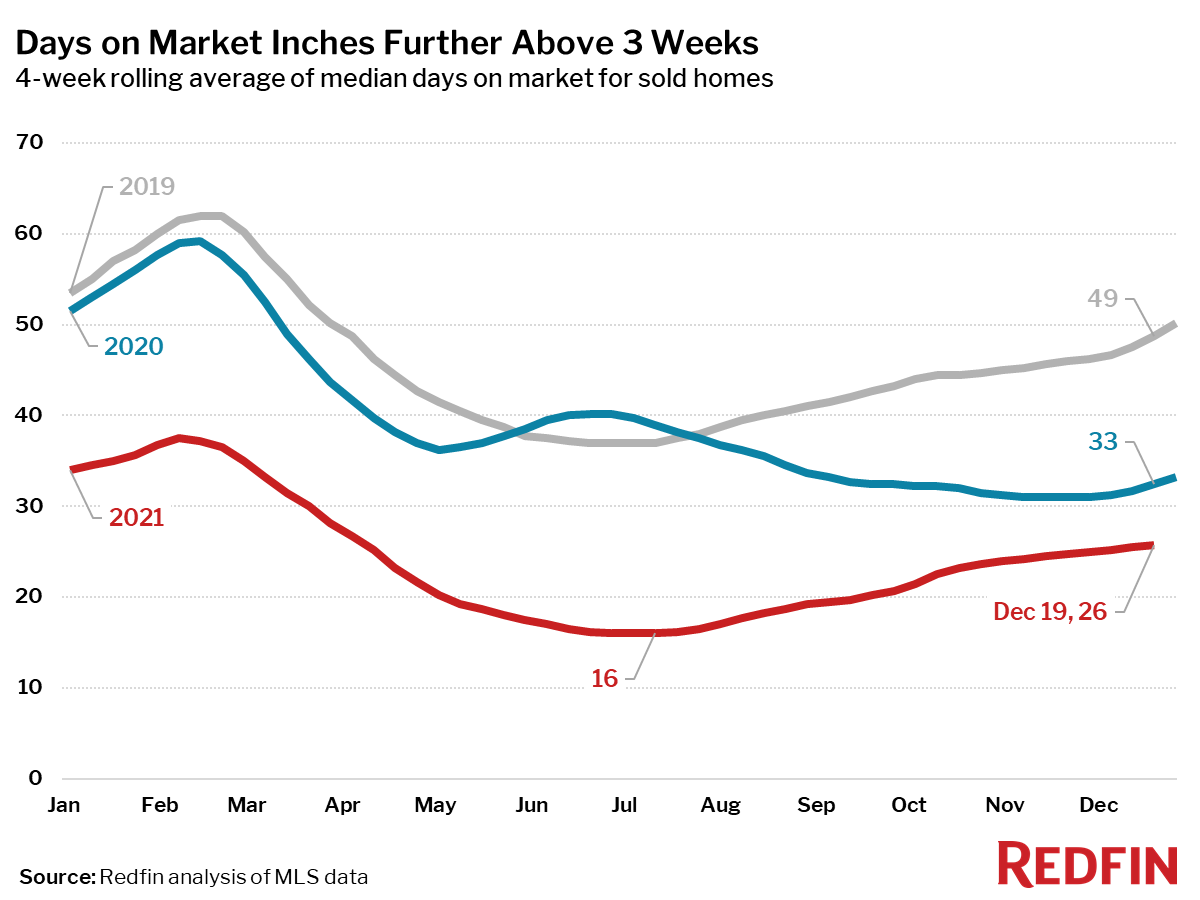

- Homes that sold were on the market for a median of 26 days, down from 32 days a year earlier and 48 days in 2019.

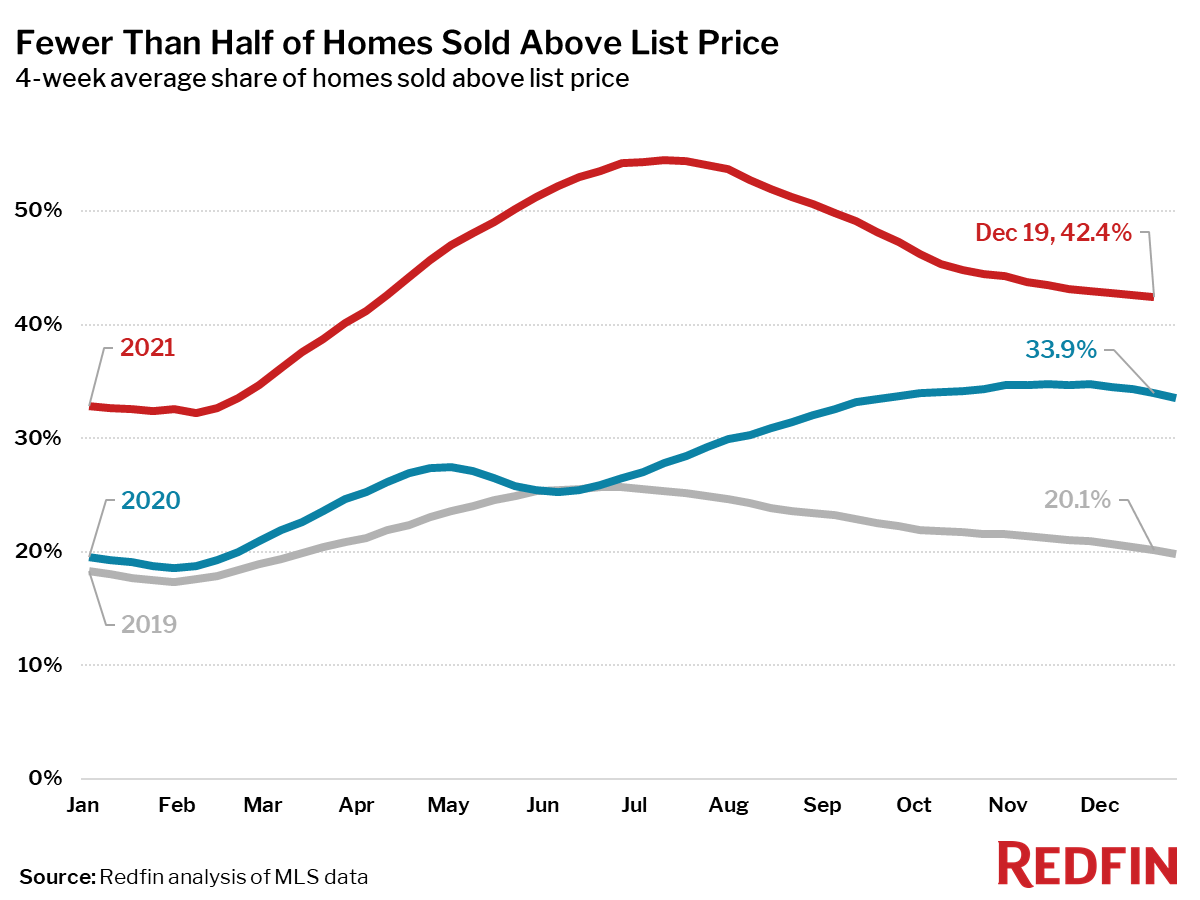

- 43% of homes sold above list price, up from 34% a year earlier and 20% in 2019.

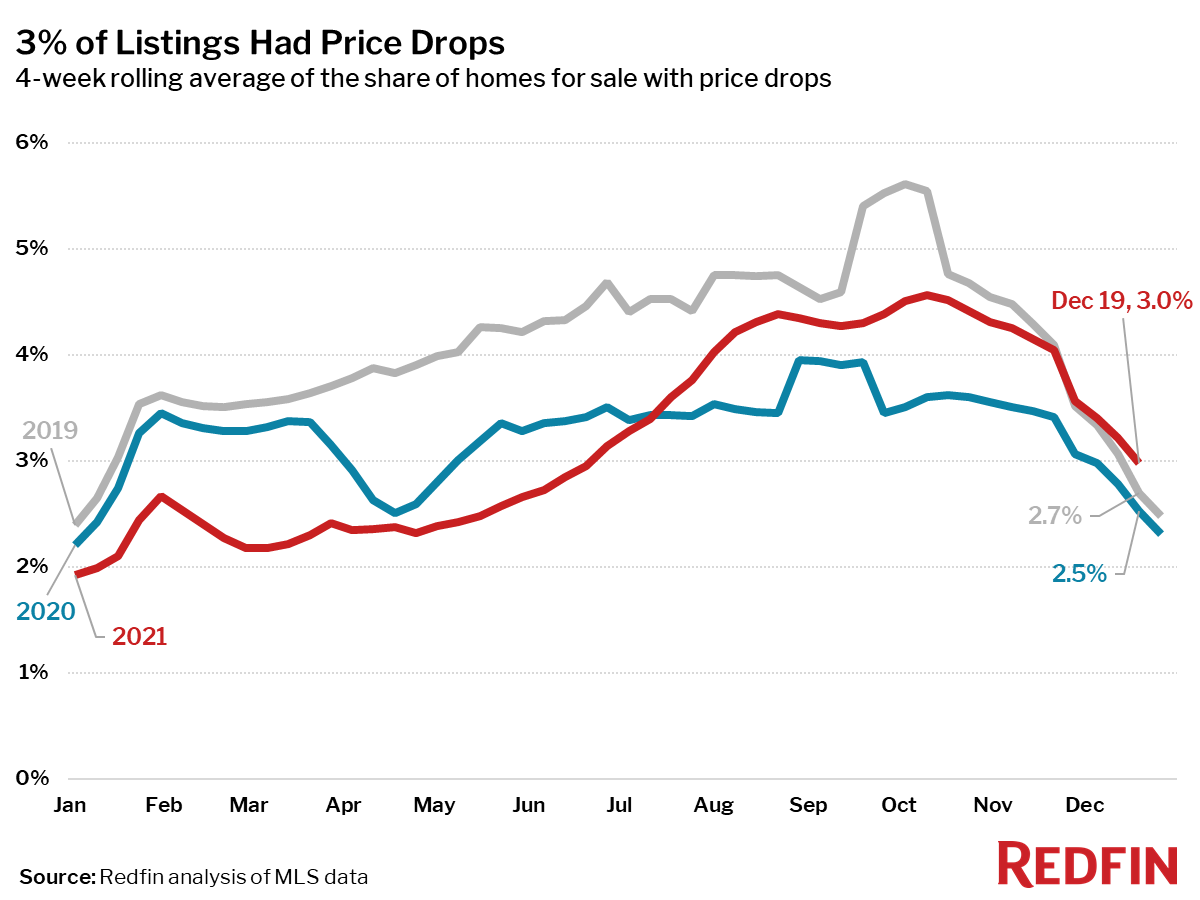

- On average, 3% of homes for sale each week had a price drop, up 0.5 percentage points from the same time in 2020 and up 0.3 points from this time in 2019.

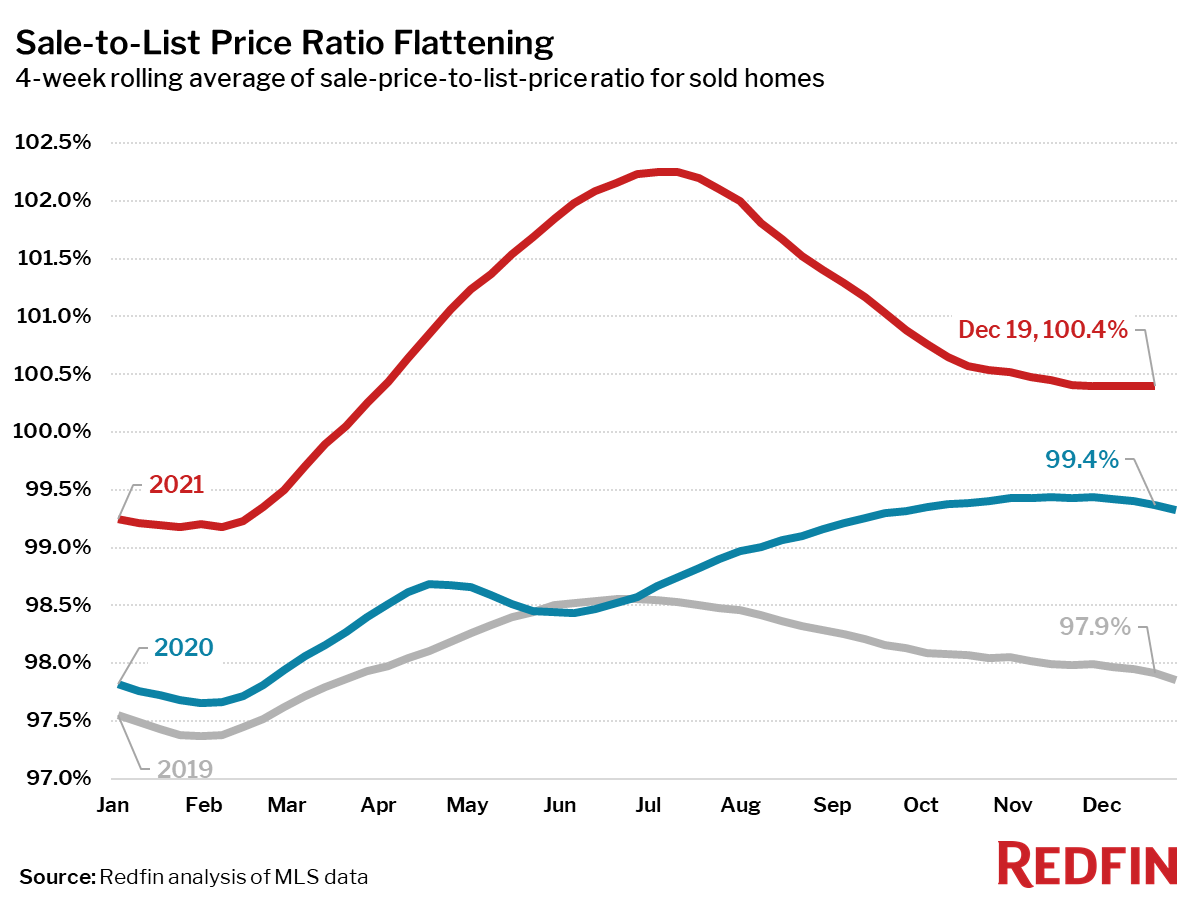

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, was 100.4%. In other words, the average home sold for 0.4% above its asking price.

Other leading indicators of homebuying activity:

- Mortgage purchase applications decreased 3% week over week (seasonally adjusted) during the week ending December 17. For the week ending December 16, 30-year mortgage rates inched up to 3.12%.

- Touring activity through December 19 was 2 percentage points behind 2019 and 9 points behind 2020 relative to the first week of January according to home tour technology company ShowingTime.

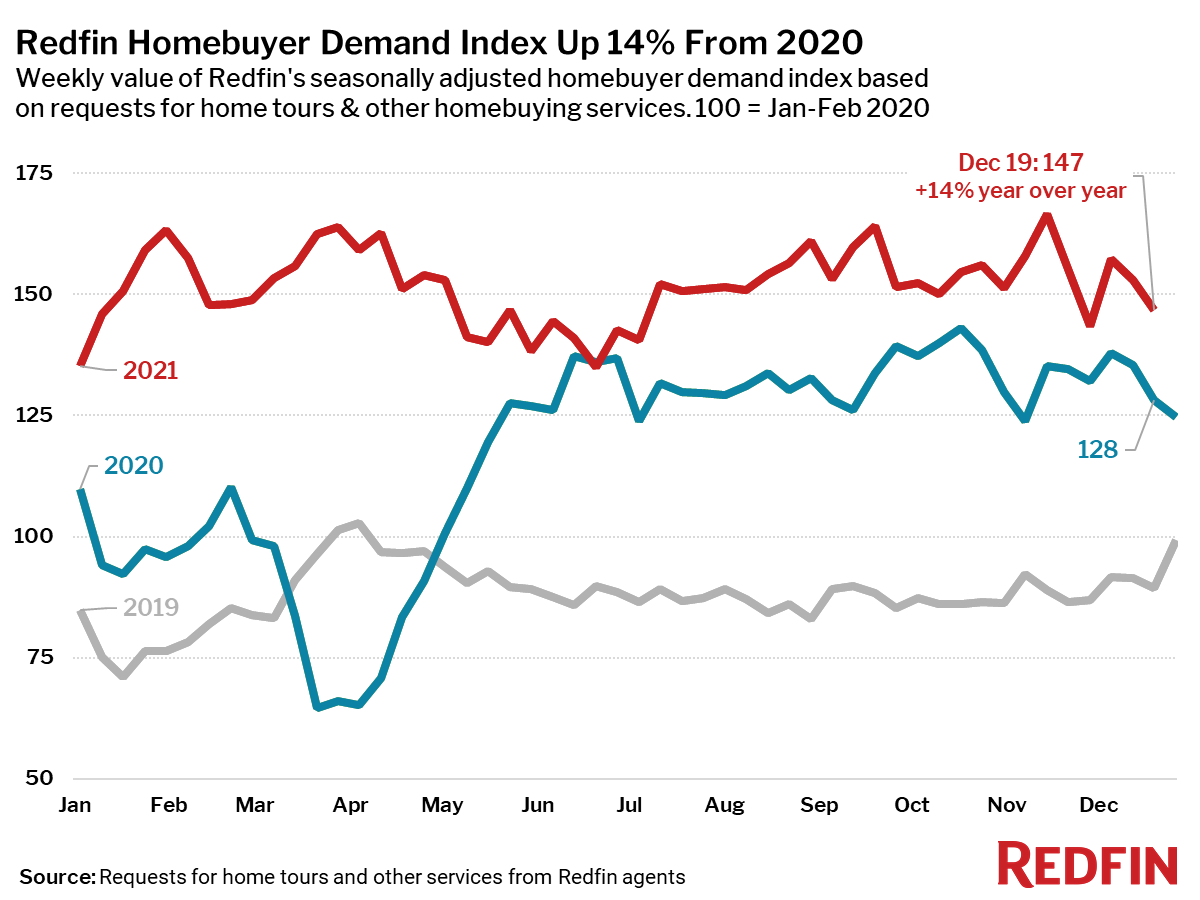

- The Redfin Homebuyer Demand Index fell 4% during the week ending December 19 and was up 14% from a year earlier.