Millennials make up the largest group of homebuyers in the United States, surpassing members of older (and wealthier) generations like Generation X and baby boomers. While the COVID-19 pandemic has thrown a wrench into Millennial homebuying plans, many members of this generation are still looking to take advantage of near record-low mortgage rates to buy a home.

Location is typically a primary factor to consider when buying a home, but the pandemic has affected many aspects of the U.S. economy including various industries and local job markets. For its annual report, LendingTree analyzed mortgage purchase requests made on the LendingTree platform across the nation’s 50 largest metros from Jan. 1 through Dec. 15, 2020 to better understand where the largest homebuying cohort is interested in purchasing a home. Nationally, 51% of total mortgage purchase requests were made by the Millennial generation in this time period.

Key Findings

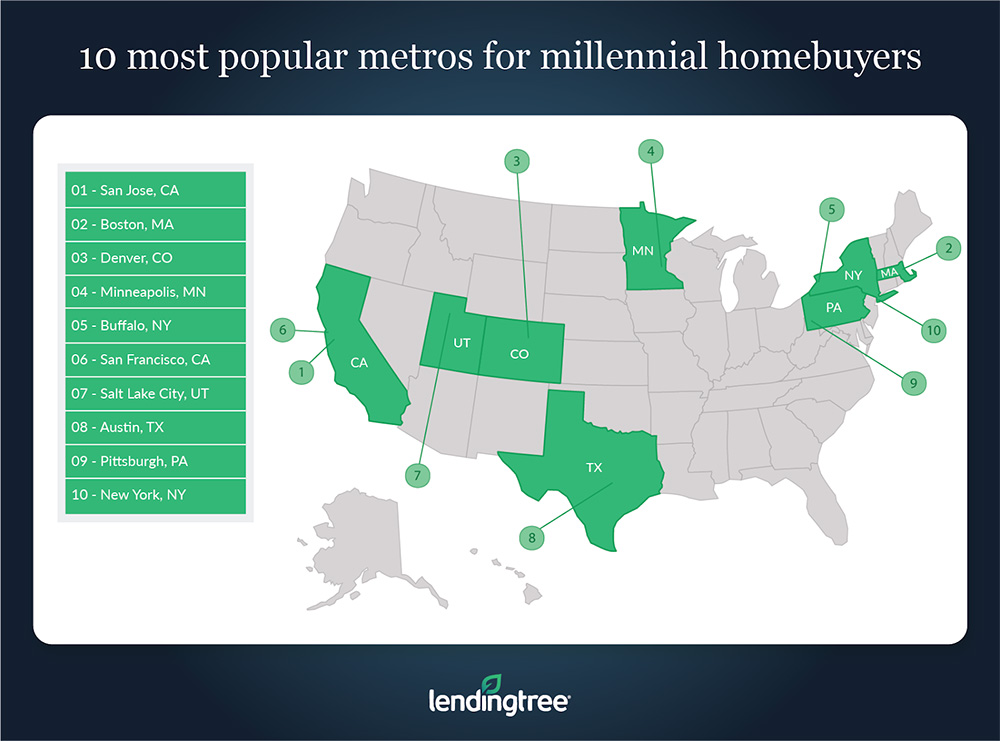

- San Jose, Calif., Boston and Denver are the metros where millennials make up the largest share of purchase requests. In San Jose, 61.79% of purchase requests came from millennials. In Boston and Denver, the numbers are 59.09% and 59.07%, respectively.

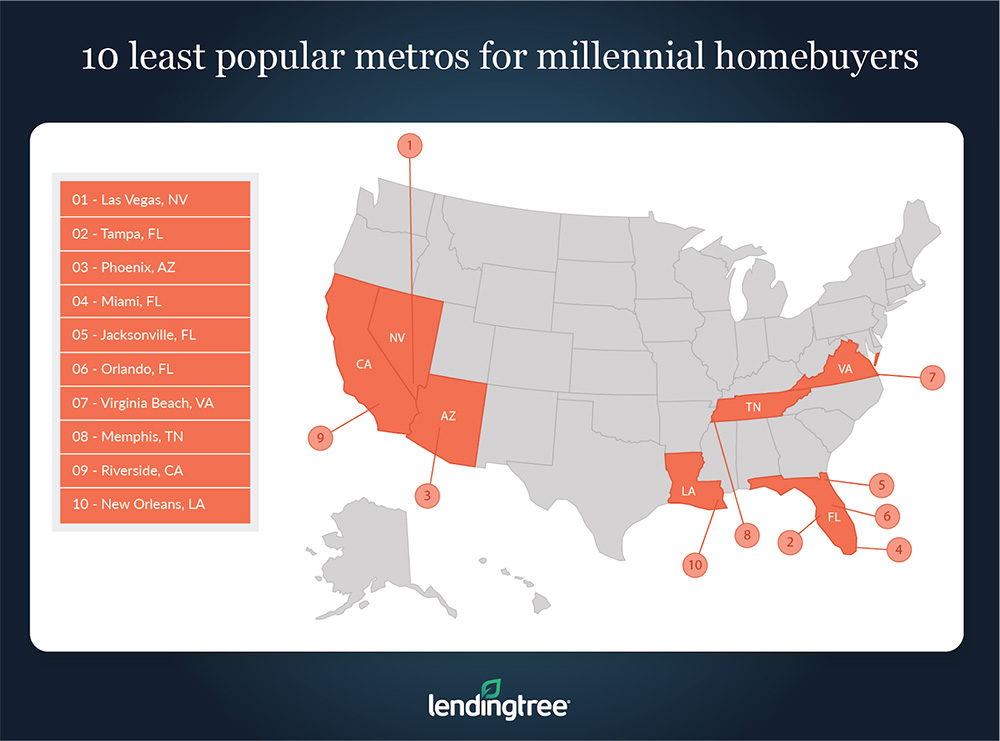

- Las Vegas, Tampa, Fla. and Phoenix have the lowest percentages of millennials making purchase requests among the metros. Millennials made just 42.58% of the purchase requests in Las Vegas, 44.54% in Tampa and 46.33% of the purchase requests in Phoenix, indicating these metros may not be that popular with millennials.

- Millennial homebuyers in San Francisco, San Jose, Calif. and New York City are the oldest in our study. The average age for these three areas was 32.10 years old, about half a year older than the average 31.57 across all 50 of the largest metros in the country. Since these metros are so expensive, millennials likely need to spend more time saving before they’re ready to buy a house.

- Salt Lake City, Buffalo, N.Y. and Detroit are the metros with the youngest millennial homebuyers. The average age for these three areas was 31.03 years old.

- San Jose, Calif., San Francisco and New York City are markets where potential millennial homebuyers had the highest average credit scores. The average credit score for these three areas combined was 721. By comparison, the average credit score for millennial homebuyers across the 50 largest metros in the country was 669.

- Memphis, Tenn., Virginia Beach, Va. and Birmingham, Ala., had the lowest average credit scores. Credit scores in these three areas were approximately 638, 639 and 640, respectively.

Methodology

LendingTree analyzed mortgage requests and offers for borrowers ages 24 to 39 across the nation’s 50 largest metropolitan areas from Jan. 1, 2020 to Dec. 15, 2020, along with requests from the total population of mortgage seekers based on the property location.

The metro rankings were generated by looking at the percentage of total purchase mortgage requests received by LendingTree from borrowers in the millennial generation. The larger the share of requests from millennials, the higher ranking a metro received.