The U.S. government’s efforts to flood the markets with cash in the aftermath of the COVID-19 pandemic propped up borrowers but also left institutions flooded with excess liquidity, according to the newly released 2022 Banking Industry Outlook Report from S&P Global Market Intelligence.

Published by S&P Global Market Intelligence’s Financial Institutions Research team, the report says that the excess cash created by government relief efforts and forbearance provided by U.S. banks will remain on their balance sheets for the foreseeable future, leaving bank margins below pre-pandemic levels for the next few years. Amid a tough earnings environment and changing competitive landscape, some banks are working to modernize their offerings, while others are pursuing mergers in the face of daunting challenges. M&A allows institutions to right-size their costly branch networks, while making necessary technology investments that enable more effective competition with fintechs.

“Emergency relief efforts during the pandemic moved credit risk off the table but have directly contributed to margin pressure at U.S. banks,” said Nathan Stovall, principal research analyst at S&P Global Market Intelligence. “Banks have been forced to adjust to customers shifting business to digital channels as well as new competition from fintech and big tech firms. This has put a premium on achieving scale to invest in technology, become more efficient and compete more effectively, prompting a greater number of banks to look at deals.”

Key highlights from the report include:

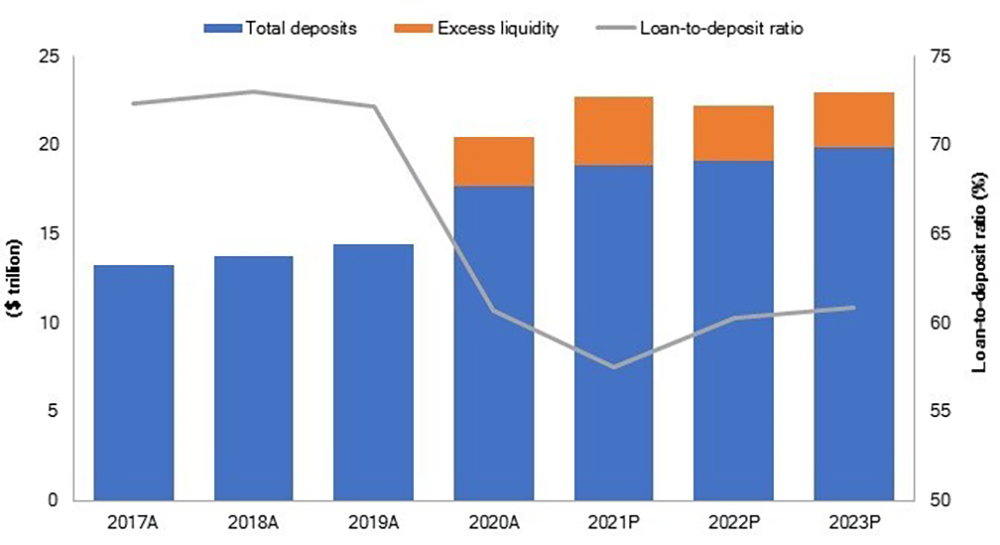

- Trillions of dollars in government relief efforts led to historic deposit growth at U.S. banks during the pandemic, while loan growth remained weak. The dynamic caused an estimated $3.72 billion in excess liquidity to build on bank balance sheets as of June 30, 2021, and excess funds are expected to remain above $2.9 trillion through 2023 even as the economic recovery continues.

- Against a challenging revenue environment, more banks have sought scale to invest in technology and reduce costs, leading to increased M&A activity. U.S. bank M&A aggregate deal value in 2021 has already reached the highest level since the global financial crisis, and buoyant deal activity is expected to continue in 2022.

- Heightened digital adoption and cost-cutting efforts prompted a record 2,414 net branch closures in 2020. The pace of closures accelerated in 2021, with net closures totaling 3,609 over the 12-month period ending Aug. 31. Both trends should continue as increased M&A activity allows for future technological investments and more branch consolidation.

- Major fintech players have attracted massive capital and added new financial services product lines and features aimed at further entrenching customers to grow market share and improve profitability. Fintech companies in the U.S. attracted nearly $7.5 billion in venture capital funding in the second quarter of 2021 across 194 transactions, up nearly 70% year over year.

Excess liquidity should remain headwind for foreseeable future

The S&P Global Market Intelligence 2022 Banking Industry Outlook is part of a “Big Picture Outlook” series published by the division’s research group that provides a look ahead to key strategic trends and opportunities. To learn more about this “Big Picture Outlook” research series, please visit here.