Building cryptocurrency infrastructure has traditionally required years of development, extensive regulatory compliance work, and millions in capital investment. The technical complexities of blockchain integration, combined with a patchwork of state-by-state money transmission laws, have created formidable barriers for companies seeking to offer crypto services. Neil Bergquist, co-founder and CEO of Coinme, claims his company has fundamentally altered this timeline through comprehensive API solutions that compress development cycles from years to weeks.

The transformation arrives at a critical inflection point for digital asset adoption. Industry analysis projects international B2B blockchain transactions could reach $1.7 billion by 2025, with much of this activity flowing through standardized programming interfaces rather than custom-built implementations. This shift represents more than mere convenience—it signals the maturation of cryptocurrency infrastructure into enterprise-ready tooling.

“An integration timeline can be weeks,” Bergquist states. “The APIs themselves are turnkey, ready to go, so depending on the front-end application, it might be plug and play.” This assertion challenges the conventional wisdom that meaningful crypto integration requires extensive blockchain expertise and years of compliance work.

The Infrastructure Development Challenge

The traditional approach to cryptocurrency infrastructure development presents a labyrinth of technical and regulatory obstacles that have historically deterred mainstream business adoption. Companies attempting to build crypto capabilities face the daunting task of constructing payment processing systems, implementing know-your-customer protocols, developing secure custody solutions, and creating comprehensive reporting frameworks—all while satisfying regulators across multiple jurisdictions.

Coinme’s own developmental journey illustrates these complexities. The company invested years obtaining 37 money transmitter licenses to operate across states, each presenting distinct regulatory requirements, compliance standards, and approval processes. This regulatory infrastructure alone represents millions of dollars in legal fees, operational overhead, and ongoing compliance costs that most startups cannot absorb.

“To go create all that infrastructure yourself is expensive, risky, redundant, and it doesn’t make sense unless you’re doing billions in volume,” Bergquist explains. “No product does billions in volume right out of the gates, so being able to leverage that infrastructure is going to inspire a lot of entrepreneurs.”

The technical challenges compound these regulatory hurdles significantly. Traditional blockchain integration demands specialized expertise in cryptographic protocols, distributed systems architecture, and secure key management—technical domains that extend far beyond typical software development skill sets. Companies attempting custom solutions frequently encounter unexpected complications that extend development timelines and inflate budgets well beyond initial projections.

Financial institutions face additional constraints when evaluating cryptocurrency integration. Banks and fintech companies must balance innovation imperatives with rigorous risk management requirements, often preferring established, proven solutions over experimental technology approaches. This conservative stance has created a substantial gap between emerging crypto capabilities and traditional financial service offerings.

Weeks Instead of Years: The API Revolution

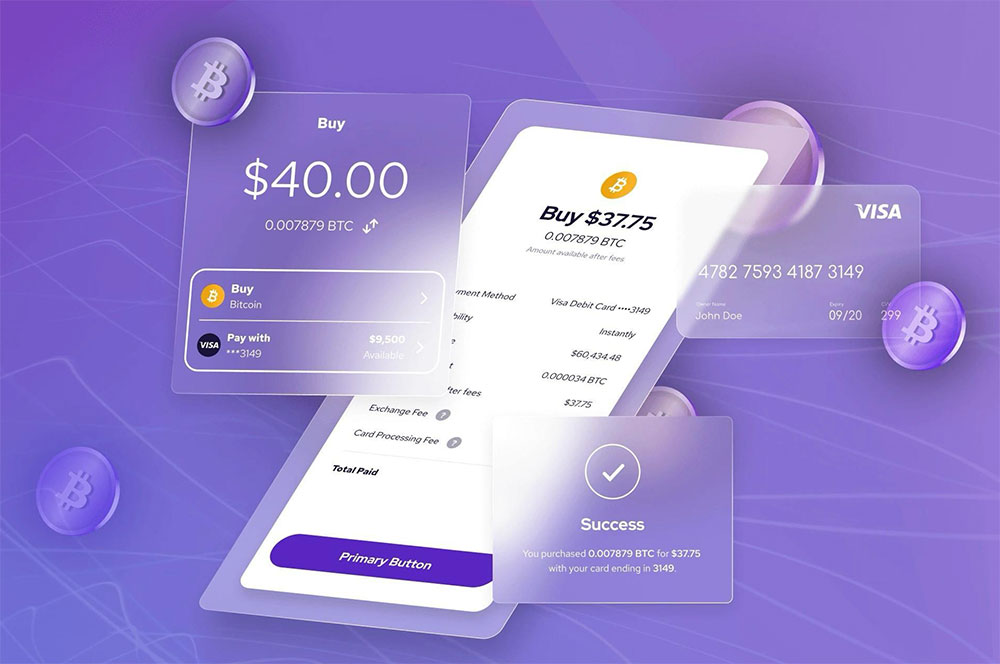

Coinme’s API-first architecture addresses these systemic barriers by providing pre-constructed infrastructure components that businesses can selectively implement based on specific operational requirements. The platform delivers discrete functional modules covering payment processing, automated compliance, secure custody services, and regulatory reporting—all accessible through industry-standard programming interfaces.

“If they can just build against our back-end APIs, which have taken years to develop, then they can go to market a lot faster,” Bergquist notes. The modular design philosophy enables companies to concentrate development resources on core business logic while delegating cryptocurrency complexities to Coinme’s tested infrastructure layer.

The platform’s architecture follows established best practices for enterprise API development, emphasizing developer experience and integration simplicity. Rather than requiring development teams to master blockchain intricacies, the APIs abstract these complexities behind familiar web service patterns. This approach enables traditional software engineers to implement sophisticated cryptocurrency features without acquiring specialized blockchain development expertise.

Integration complexity varies significantly depending on specific use case requirements and existing system architectures. “There might be some customization on their end, or they might want to build an entirely new use case, which will require more dev work on their side,” Bergquist acknowledges. However, even complex implementations benefit substantially from the foundation of pre-built, battle-tested infrastructure components.

The regulatory compliance dimension represents perhaps the most valuable aspect of Coinme’s offering. The company’s existing licensing framework and compliance infrastructure enable partner organizations to operate legally without independently navigating the complex licensing process. This regulatory backbone covers anti-money laundering requirements, know-your-customer procedures, and state-specific transaction monitoring, functions that typically require dedicated compliance teams and ongoing regulatory expertise.

Case Study: Exodus Wallet Integration

The integration between Coinme and Exodus Wallet demonstrates the practical application of this API-driven development approach in a real-world deployment. Exodus operates as a self-custody wallet provider, meaning users maintain control of their private keys rather than relying on third-party custodial services. This architectural model provides enhanced security benefits but creates significant challenges for implementing traditional payment processing capabilities.

“We just launched the crypto-as-a-service API integration with Exodus,” Bergquist explains. “Exodus is a Web3 wallet, meaning that they’re a self-custody wallet. They don’t hold your crypto. You hold your keys.” The partnership enables Exodus users to purchase cryptocurrency with traditional debit cards directly within the wallet interface, effectively bridging the gap between conventional payment methods and self-custody solutions.

The integration preserves Exodus’s fundamental value proposition while adding payment functionality that would have required substantial independent development resources. Users maintain complete control of their private keys while gaining access to streamlined purchase flows powered by Coinme’s infrastructure, creating a user experience comparable to centralized exchanges without the associated custody risks.

“If Exodus goes bankrupt, it doesn’t matter, because your crypto is in your control, unlike what happened with FTX,” Bergquist observes, referencing the advantages of self-custody arrangements over centralized platforms. The API integration enables this enhanced security model while providing a user experience quality comparable to traditional custodial services.

This case study illustrates how API-driven integration can serve both traditional Web2 companies and crypto-native Web3 organizations. Conventional fintech companies gain access to sophisticated cryptocurrency capabilities, while blockchain-native companies can integrate traditional payment rails without compromising their core architectural principles or security models.

Market Dynamics and Competitive Positioning

Coinme’s approach reflects broader technological trends within financial technology, where API-driven architectures have become standard practice for accelerated product development cycles. The fintech industry increasingly relies on specialized infrastructure providers to handle complex backend functions while focusing internal development resources on user-facing features and unique value propositions.

Industry data substantiates this shift toward API-centric development methodologies. Infrastructure providers report that companies utilizing pre-built APIs can reduce engineering timelines by three months or more compared to custom development approaches. This acceleration proves particularly valuable in competitive markets where time-to-market advantages often determine business success or failure.

The cryptocurrency sector has been comparatively slower to adopt this API-centric model, partly due to persistent regulatory uncertainties and technical complexities inherent in blockchain technology. However, recent regulatory clarity initiatives and infrastructure maturation have created favorable conditions for more widespread API adoption across the digital asset ecosystem.

“We’re seeing high demand from both Web2 and Web3 companies,” Bergquist observes, noting substantial interest from gaming companies, traditional financial institutions, and established technology firms exploring cryptocurrency integration opportunities. This diverse demand profile suggests that API-driven crypto infrastructure appeals to a broad market beyond specialized blockchain companies.

The economic advantages extend well beyond reduced initial development time. Organizations utilizing Coinme’s APIs can avoid the substantial ongoing costs of maintaining internal compliance teams, updating regulatory procedures, and managing infrastructure scaling requirements. These operational efficiencies become increasingly significant as transaction volumes grow and regulatory requirements continue expanding across jurisdictions.

The Infrastructure Democratization Effect

The convergence of regulatory clarity and mature infrastructure capabilities creates what Bergquist characterizes as “building season” for cryptocurrency innovation. Companies that previously avoided crypto integration due to complexity and regulatory uncertainty now have access to enterprise-grade infrastructure through straightforward API implementations.

This infrastructure democratization could substantially accelerate cryptocurrency adoption across industries that have remained largely separate from digital assets. E-commerce platforms, gaming companies, and financial services firms can now experiment with crypto features without making substantial infrastructure investments or acquiring specialized technical expertise.

The implications extend beyond individual company adoption patterns to the broader cryptocurrency ecosystem dynamics. As more businesses integrate crypto capabilities, the network effects of digital asset usage compound exponentially. Increased utility drives user adoption, which creates additional business opportunities and stimulates further infrastructure development.

“By having that infrastructure in place and making it turnkey, that enables the entrepreneurs of today and product managers of larger companies who are innovative and forward-thinking,” Bergquist explains. The platform positions itself as foundational infrastructure for the next wave of cryptocurrency applications, potentially catalyzing broader mainstream adoption.

The technological underpinning of blockchain technology offers unique advantages over traditional financial infrastructure. Unlike conventional payment systems that rely on centralized authorities and intermediaries, cryptocurrency networks operate on distributed protocols that can function across borders without traditional banking relationships. This architectural difference enables new business models and payment flows that were previously impossible or prohibitively expensive.

“Crypto truly is a digitally native form of money and has solved the problem of trust in a digitally native world,” Bergquist notes. The Crypto-as-a-Service API infrastructure that Coinme provides extends this digital-native capability to traditional businesses, enabling them to participate in decentralized financial networks without rebuilding their entire technology stack.

The success of API-driven crypto infrastructure will ultimately depend on continued regulatory stability and technical reliability metrics. Early indicators suggest that Bergquist’s promise of weeks-instead-of-years integration timelines reflects a genuine technological shift in how businesses can access cryptocurrency capabilities. For companies exploring digital asset integration, the fundamental question may no longer center on whether they can afford to build crypto infrastructure, but whether they can afford to overlook the existing solutions that make such integration increasingly accessible and economically viable.

Related: Coinme’s B2B Stablecoin Strategy: Building Compliant Payment Rails for Enterprise