Today, the non-profit American Public Education Foundation released the first-ever national report card on K-12 state-mandated personal financial education in all 50 states and the District of Columbia: Vision 2020 Financial Literacy Report Card, 2019-2020. The 50-state review points to a nation in crisis with regard to our schools’ failure to prepare and educate K-12 students in personal finance and decision-making.

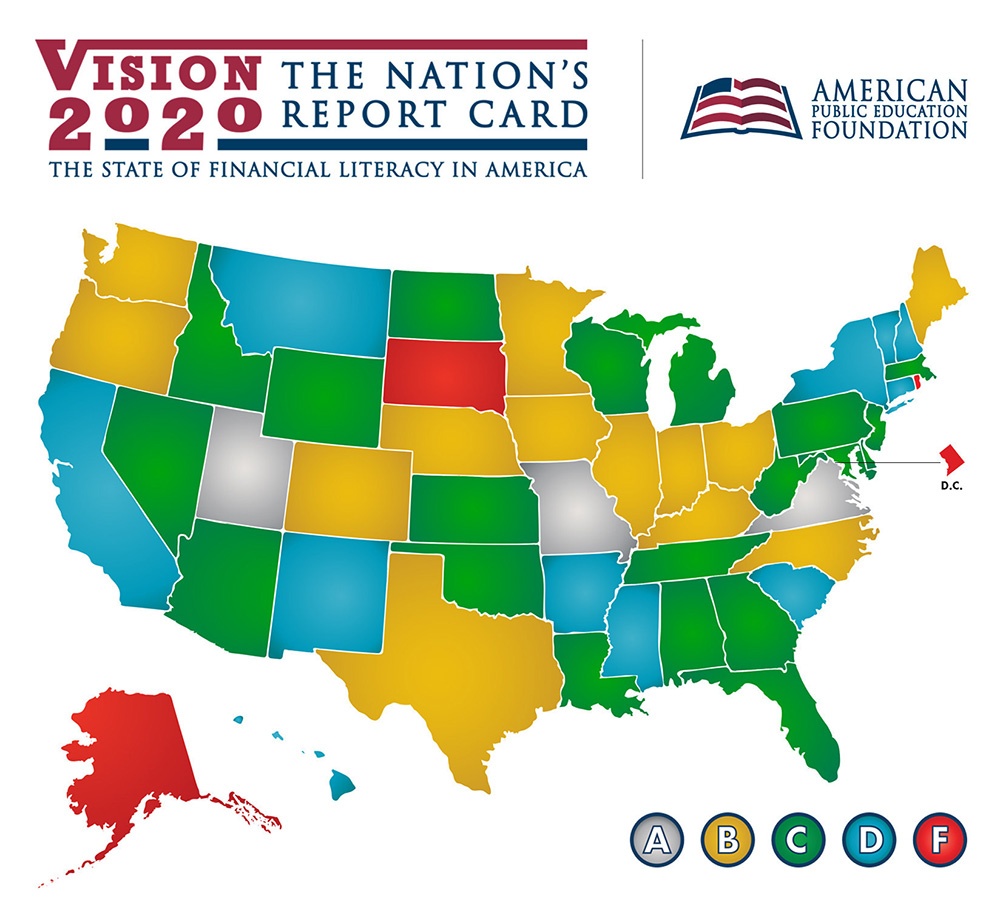

Financial illiteracy is an American epidemic and the crisis is growing. The analysis found that more than two-thirds of states (34 states, or 68 percent) earned grades of “C” or less for financial literacy instruction, with just 16 states (32 percent) earning grades of “A” or “B.”

The APEF statewide analysis team was led by David A. Pickler, J.D., CFP®, ChFC®, CDFA®, an award-winning wealth advisor and education leader and one of Financial Times’ 400 Top Advisors. Pickler also served as the past president of the National School Boards Association and has been an education leader for more than 30 years.

“America is facing a growing epidemic,” observes Pickler, who also serves as Executive Director of the non-profit American Public Education Foundation. “Our nation is rapidly sinking into a sea of debt and financial dependency. We have created a collective culture where it is acceptable to pursue a bankruptcy as a solution to irresponsible financial behavior and decision making. Each of us has a responsibility to change this culture, to become accountable partners in preparing our children to make sound financial choices, or face the consequences that will undermine America’s future and threaten our economic and national security interests.”

According to The Aspen Institute, 16% of suicides in the US occur in response to a financial problem. Further, a USA TODAY report states that less than one-fourth of young Americans ages 18 to 26 are “very optimistic” about their financial futures.

Classroom instruction is vital toward reversing a 2018 Forbes headline that warns “how badly America is failing at financial literacy.” APEF joins a growing roster of financial and education experts who call for financial education at an early age to combat our nation’s escalating financial crisis.

Report Card Methodology: Drawing upon state legislation, graduation requirements, standards, and curriculum, the APEF report card grades each state’s financial literacy instruction. The report card only gave three states – Missouri, Utah, and Virginia – an “A” grade for mandating personal financial education across grades K-12 and requiring a stand-alone personal finance course for high school graduation. Thirteen (13) states received a “B,” 20 states received a “C,” and 11 states received a “D.” Four states – Alaska, D.C., Rhode Island, and South Dakota – received an “F” for failing to guarantee any financial literacy instruction in K-12 schools.

Model Legislation: In addition to aggregating and disseminating best practices around financial literacy, APEF has available for immediate download model state legislation of benefit to policymakers or educators seeking to require a stand-alone personal finance course as a mandatory prerequisite to high school graduation.

View the APEF Vision 2020 Financial Literacy Report Card: vision2020reportcard.org