Cryptocurrencies, particularly Bitcoin, have been promoted as a store of value or “digital gold.” However, extreme price volatility undermines their ability to serve as a stable store of value. People may be hesitant to hold their savings in assets that can lose a substantial portion of their value in a short time.

Rapid price fluctuations can result in significant financial losses for investors. Cryptocurrency prices can surge or plummet in a short period, which makes it a risky investment, especially for those who are risk-averse or have limited risk tolerance.

For a currency to be used for everyday transactions, it should be relatively stable in value. High volatility makes it challenging to use cryptocurrencies for everyday purchases because the price of goods and services can change rapidly in terms of cryptocurrency, making budgeting and financial planning difficult.

Volatility can lead to speculative behavior, where investors buy and sell cryptocurrencies solely to profit from price swings rather than for their utility or as a medium of exchange. This can create bubbles and market instability.

Highly volatile markets can be more susceptible to price manipulation by large players or “whales.” This can lead to unfair advantages and market distortions, potentially harming smaller investors.

The volatility of cryptocurrencies can be a barrier to mainstream adoption. Many people are hesitant to use or invest in cryptocurrencies because they view them as too speculative and risky. This limits the potential benefits of blockchain technology for broader use cases.

MUQT is the solution

When it comes to price charts of cryptocurrencies you are probably used to charts like this:

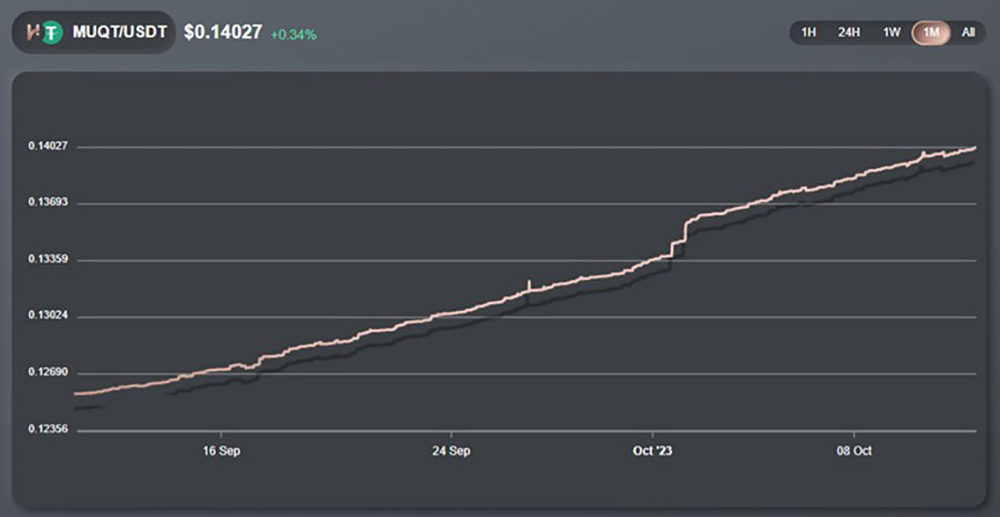

What if your chart was looking more like this:

At press time, Bitcoin is 58% below its all time high. So we consider being in the midst of a bear market. So how is it possible that a cryptocurrency is printing that chart while liquidity is exiting the market?

The answer is ABS (automatic balance supply).

MUQT is the native token of Muquant and features the unique ABS protocol.

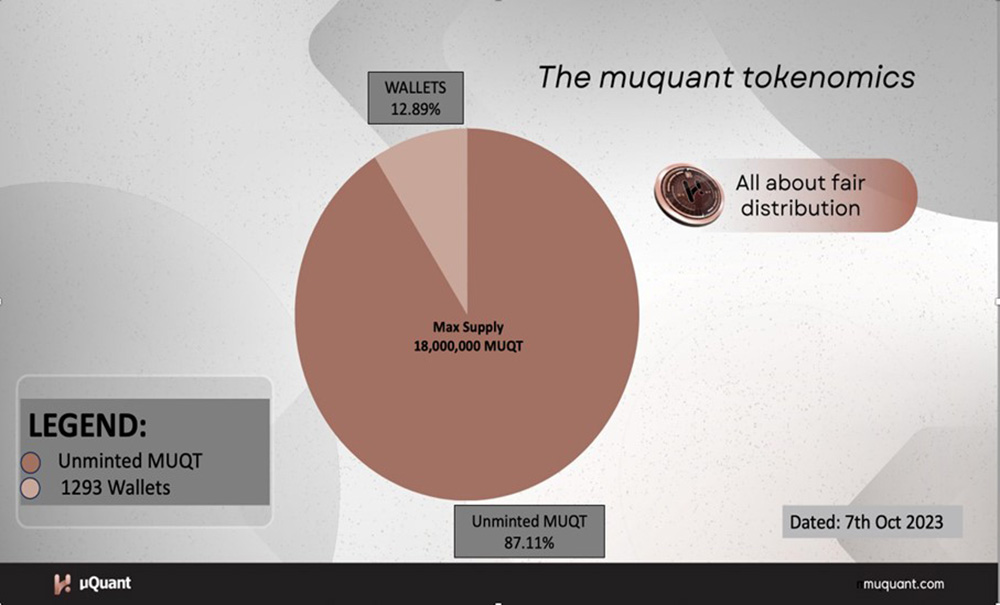

This unique protocol operates differently from what people are used to, ensuring a maximum supply that cannot exceed 18 million tokens.

The maximum supply is determined by the formula:

x * y = K, where x initially holds a value of 18 million in the launcher contract.

As per the formula, the maximum supply (x) cannot be greater than 18 million.

To illustrate, x can be calculated as K divided by y, and since K is constant, y represents the Total Value Locked (TVL) in USDT. Consequently, as y increases, x decreases, and the maximum supply remains at 18 million tokens.

The ABS protocol works in conjunction with the burn mechanism to effectively increase prices. This means that token printing is not a risk as there can never be more than 18 million tokens in circulation.

The project has been designed transparently, with no pre-minted tokens held by creator or excessive pre-mining, eliminating the risks associated with rug pulls or massive dumps.

Furthermore, participants must actively engage by using USDT to earn Muquant (MUQT) tokens.

The growth of the MUQT token operates differently from other tokens in the market. It is determined by the amount of rewards claimed through a unique formula developed by the Muquant technology team.

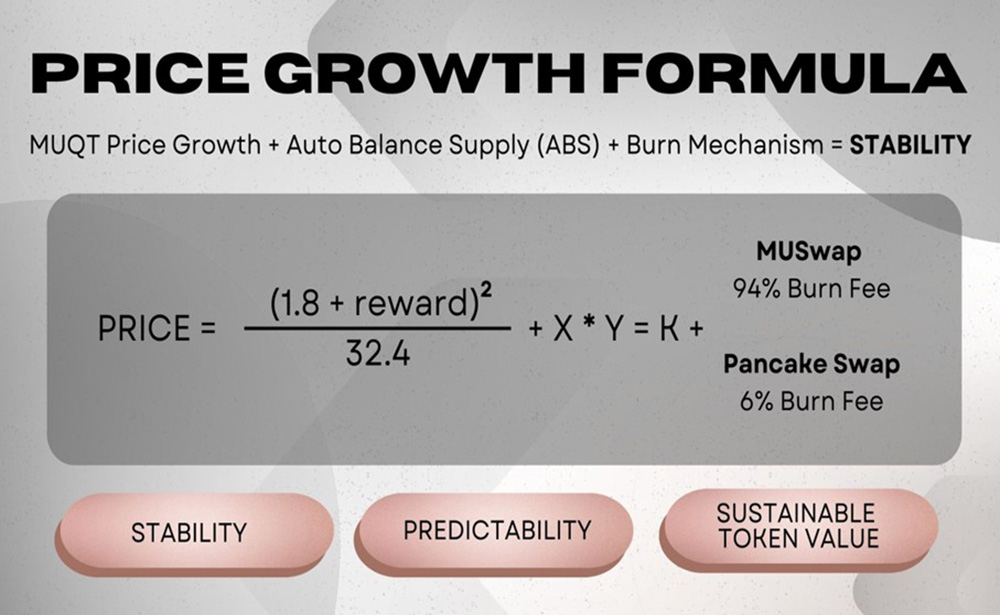

The relationship between the price and reward is calculated using the formula:

x * y = K,

where x represents MUQT and y represents USDT.

By combining these variables, the price is derived as K divides by y squared.

Initially, there are 18 million tokens with a starting price of $0.1, yielding x = 18 million and y = 1.8 million. Therefore, the formula translates to 18 million tokens multiplied by 1.8 million, resulting in 32.4 million.

As the pool grows over time and y represents the pool with an initial value of 1.8 million, y can be calculated as 1.8 million plus the reward.

In summary, the price formula becomes (1.8 + reward) squared divided by 32.4. This is a simple quadratic function that allows for the calculation of the price based on different reward values.

As a deflationary token, Muquant has a comprehensive reduction plan in place, incorporating a robust burn mechanism for tokens. When the community sells their tokens on Muswap, 94% of the tokens are automatically burnt forever. Additionally, with every buy and sell transaction on Pancake Swap, there is a 6% burn feature, further promoting stability in the token’s value.

Here is an example:

When you sell 50,000 tokens, 94% of these sold tokens will be locked to null address. Selling pressure doesn’t increase as there is only a small drop in price keeping the price more stable. Then the buying force will automatically equalize.

Predicting the future price of MUQT can be achieved using an algorithmic formula, offering predictability to its holders.

The MUQT price action is triggered by members claiming their token rewards that will be generated by the high performance decentralized MEV arbitrage trading.

This way, the MUQT price can be easily predicted.

With 1M USDT worth of tokens claimed, MUQT will reach a price of $0.242.

How to get MUQT?

You cannot buy MUQT on the market as of now. Currently you can only earn it by locking up USDT in the Muquant Vault.

The high performance MEV arbitrage trading bot will generate from 7% to 15% monthly profit for you, that will be paid in MUQT.

Check the full review here: https://marketsherald.com/muquant-review-scam-or-legit-mev-arbitrage-trading/