Tokenomics, short for “token economics,” is a critical aspect of any cryptocurrency project. It refers to the design and management of a cryptocurrency’s economic system, including the creation, distribution, and utilization of its tokens. A good tokenomics model should strike a balance between the interests of various stakeholders, ensure the sustainability of the project, and provide incentives for network participants.

Here are some key elements of a good tokenomics model in crypto:

Clear Purpose: The cryptocurrency should have a well-defined purpose or use case. It should solve a real-world problem or serve a specific function within its ecosystem. This purpose gives the token intrinsic value.

Limited Supply: A capped or limited supply of tokens can create scarcity and potentially drive up demand and value over time. Bitcoin’s limited supply of 21 million coins is a prime example of this.

Distribution: Fair and transparent distribution of tokens is crucial. It’s essential to avoid centralization of wealth and power. Consider methods like initial coin offerings (ICOs), airdrops, mining, staking, or liquidity provision.

Security and Scalability: The underlying blockchain should be secure and scalable to handle a growing user base. A congested or insecure network can deter users and investors.

Burn Mechanisms: The ability to burn or destroy tokens can create scarcity and increase the value of the remaining tokens. For example, tokens may be burned as transaction fees or in certain network activities.

Transparency: The project’s team and development should be transparent about tokenomics. Detailed information about token allocation, release schedules, and the project’s future plans should be readily available.

Economic Models: Consider economic models such as deflationary (reducing supply over time), inflationary (increasing supply over time), or stablecoin-based models, depending on the project’s goals and use case.

External Factors: Be aware of external factors that can affect tokenomics, such as regulatory changes, market sentiment, and technological advancements.

In summary, a good tokenomics model in crypto should be designed with a clear purpose, fair distribution, strong incentives, governance mechanisms, and scalability in mind. It should also adapt to the changing crypto landscape and regulatory environment. Tokenomics is a complex and evolving field, and projects that prioritize these factors are more likely to succeed and gain the trust of the crypto community.

So which crypto has best tokenomics?

The MUQT token ticks all above boxes and provides the best tokenomics in crypto.

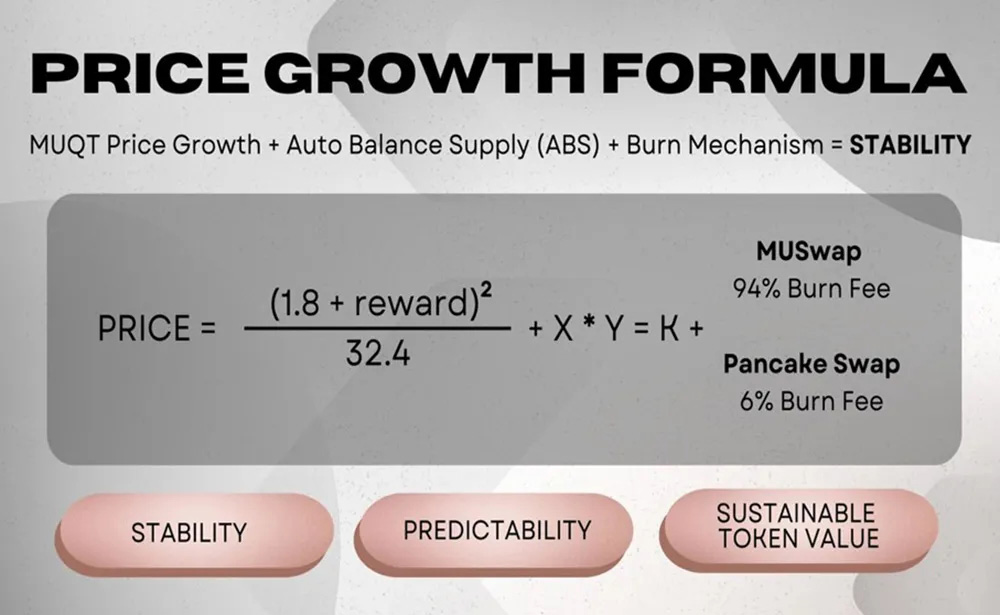

The tokenomics of MUQT, the native token of Muquant, are designed to stand out with the unique ABS protocol. Unlike conventional protocols, the ABS protocol maintains a maximum supply that is capped at 18 million tokens, ensuring scarcity. This maximum supply, denoted as “x,” is determined by the formula: “x * y = K,” with an initial value of 18 million in the launcher contract. This formula explicitly stipulates that “x” cannot surpass 18 million. To elaborate, “x” is calculated as the constant “K” divided by “y,” where “y” signifies the Total Value Locked (TVL) in USDT. Consequently, when “y” increases, “x” decreases, guaranteeing that the maximum supply remains steadfast at 18 million tokens.

The ABS protocol collaborates with a burn mechanism, augmenting price appreciation. Thus, the risk of excessive token printing is effectively mitigated, as there will never be more than 18 million tokens in circulation. This project boasts transparency, eliminating concerns related to pre-minted tokens held by the creator or extensive pre-mining, which often triggers risks such as rug pulls or massive sell-offs. Notably, active engagement with USDT is required for participants to earn Muquant (MUQT) tokens.

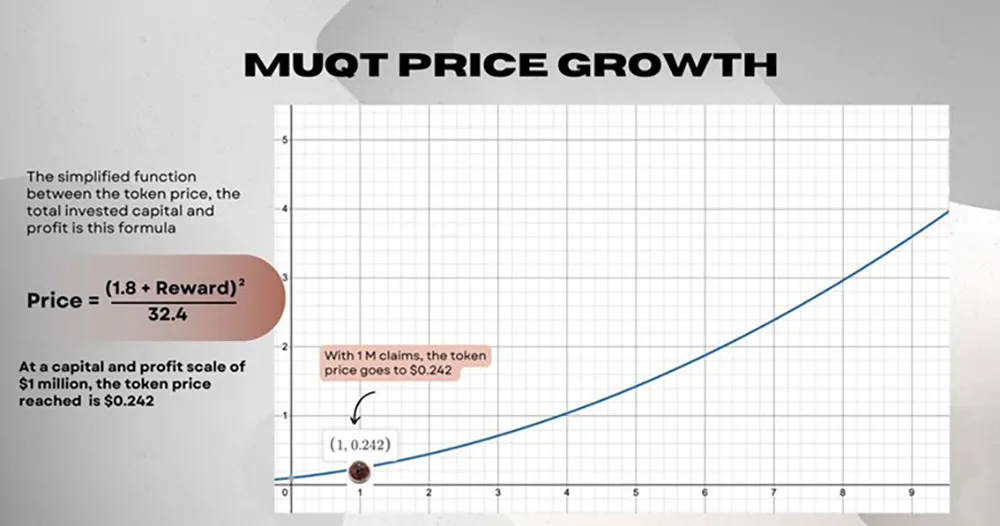

The growth dynamics of the MUQT token deviate from standard token models. Instead, it hinges on the amount of rewards claimed, following a distinctive formula established by the Muquant technology team. This formula is expressed as “x * y = K,” where “x” symbolizes MUQT, and “y” symbolizes USDT. Combining these variables, the price derives from “K” divided by “y” squared. Initially, with 18 million tokens and a $0.1 starting price, “x” equates to 18 million, and “y” to 1.8 million. Consequently, the formula translates to 18 million tokens multiplied by 1.8 million, yielding 32.4 million. As time progresses and the pool value increases, “y” factors in the initial 1.8 million as well as the reward. In summary, the price formula simplifies to (1.8 + reward) squared divided by 32.4, presenting a straightforward quadratic function for price calculations based on different reward values.

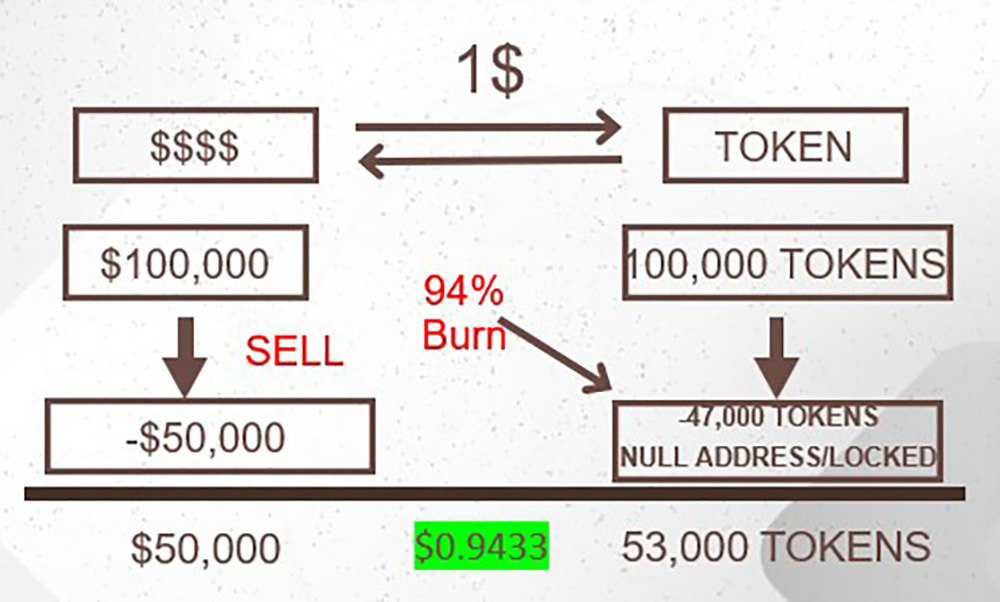

Functioning as a deflationary token, Muquant integrates a robust token-burning mechanism. When the community sells their tokens on Muswap, an impressive 94% of these tokens are automatically and permanently burned. Furthermore, with each transaction on Pancake Swap, whether buying or selling, a 6% burn feature is enacted, enhancing token value stability. For instance, in a sale of 50,000 tokens, 94% of these tokens are sent to a null address, ensuring that selling pressure doesn’t lead to significant price drops and subsequently allowing for price stabilization, with buying force leveling the field.

Predicting MUQT’s future price is achievable through an algorithmic formula, providing a degree of predictability for token holders. The price action of MUQT is chiefly driven by members claiming token rewards generated via high-performance decentralized MEV arbitrage trading. This mechanism affords a degree of predictability in determining the MUQT price.

Notably, the acquisition of MUQT is currently not feasible through market purchases. The exclusive avenue for obtaining MUQT is by locking up USDT in the Muquant Vault. Users are poised to benefit from a high-performance MEV arbitrage trading bot, which can generate monthly profits ranging from 7% to 15%, paid out in MUQT.

For further insights, a comprehensive review is available at this link: https://marketsherald.com/muquant-review-scam-or-legit-mev-arbitrage-trading/