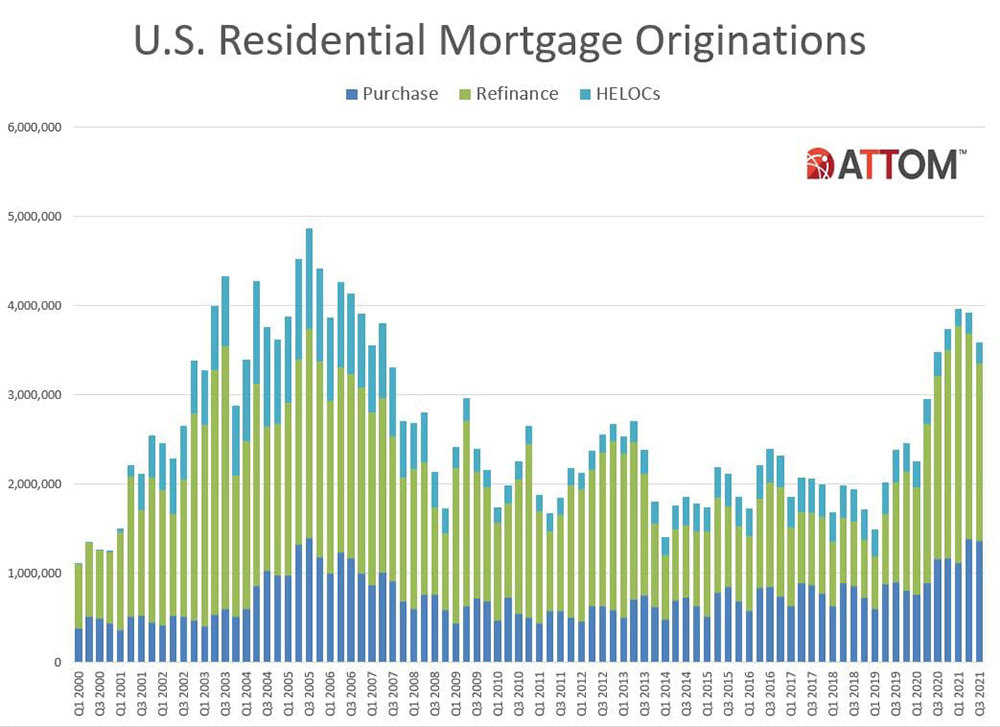

ATTOM, curator of the nation’s premier property database, today released its third-quarter 2021 U.S. Residential Property Mortgage Origination Report, which shows that 3.59 million mortgages secured by residential property (1 to 4 units) were originated in the third quarter of 2021 in the United States. That figure was up 3 percent from the third quarter of 2020, but down 8 percent from the second quarter of 2021 – the largest quarterly dip in over a year.

The quarterly decline also was the second in a row and pointed to two unusual patterns developing in the lending industry. It marked the first time in more than two years that total lending decreased in two consecutive quarters. More notably, it was the first time in any year since at least 2000 that lending activity declined in both the second and third quarters, which usually are peak buying seasons.

That pattern emerged amid declines in both refinance and purchase lending which more than made up for a bump up in home-equity lines of credit.

Overall, with average interest rates remaining below 3 percent for 30-year home loans, lenders issued $1.15 trillion worth of mortgages in the third quarter of 2021. That was up annually by 11 percent, but down quarterly by 6 percent. The quarterly decrease in the dollar volume of loans was the first since the early part of 2020.

On the refinance side, 1.99 million home loans were rolled over into new mortgages during the third quarter of 2021, a figure that was down 13 percent from the second quarter and down 3 percent from a year earlier. The total number of refinance mortgages has declined for the second straight quarter, while the quarterly decrease was the largest in three years. The dollar volume of refinance loans was down 10 percent from the second quarter of 2021, to $624.1 billion, although still up annually by 1 percent.

Refinance mortgages remained a majority of all residential lending activity during the third quarter of 2021. But that portion dipped to 55 percent, down from 59 percent in both the second quarter of 2021 and the third quarter of 2020.

The number of purchase loans also declined in the third quarter of 2021 as lenders issued 1.36 million mortgages to buyers. That was down 2 percent quarterly, although still up annually by 17 percent. The dollar value of loans taken out to buy property dipped to $482.6 billion, down 1 percent from the second quarter of this year but still up 30 percent from the third quarter of 2020.

Home-equity lending, meanwhile, rose for the second straight quarter, which last happened in mid-2019. The tally of home-equity lines of credit, while down annually by 9 percent, rose 2 percent between the second and third quarters of 2021, to about 238,500.

The continued dip in total loan activity during the third quarter represented a growing sign that the nation’s appetite for new home loans is easing – and that the nation’s decade-long housing market boom could even be cooling off.

The latest trends have reversed patterns seen from early 2019 through early 2021, when total lending activity nearly tripled amid various forces that pushed a frenzy of refinancing and purchasing. That surge came as interest rates dropped to historic lows and the Coronavirus pandemic which hit early last year spurred a rush of home buying among households looking for larger spaces and the perceived safety offered by a house and yard. That spike in buying has driven home prices to record highs.

“The overflow stack of work that was hitting lenders for several years shrank again in the third quarter across the U.S. amid a few emerging trends,” said Todd Teta, chief product officer at ATTOM. “It looks more and more like homeowner’s voracious appetites for refinance deals has eased notably, while purchase lending also dipped. It’s still too early to say if the trends point to major shifts in lending patterns or the broader housing market boom. But the drop-off is significant, especially for home buying, which could suggest an impending housing market slowdown. We will be watching the lending trends extra closely in the coming months.”

Total mortgages drop for second straight quarter in a pattern not seen this century

Banks and other lenders issued 3,591,794 residential mortgages in the third quarter of 2021. That was down 8.4 percent from 3,922,248 in second quarter of 2021, although still up 3.2 percent from 3,479,655 in the third quarter of 2020. The quarterly decrease was the second in a row, which had not happened since a period running from late 2018 into early 2019. It also stood out as the first time since at least 2000 that total lending activity went down from both the first to the second quarter and from the second to the third quarter of any year.

The $1.15 trillion dollar volume of all loans in the third quarter remained up 10.7 percent from $1.04 trillion a year earlier, but was down 6 percent from $1.23 trillion in the second quarter of 2021.

Overall lending activity decreased from the second quarter of 2021 to the third quarter of 2021 in 186, or 86 percent, of the 216 metropolitan statistical areas around the country with a population greater than 200,000 and at least 1,000 total loans in the third quarter. Total lending activity was down at least 5 percent in 126 metros (58 percent). The largest quarterly decreases were in Pittsburgh, PA (down 52.3 percent); Charleston, SC (down 48.2 percent); Myrtle Beach, SC (down 46.8 percent); Provo, UT (down 39.5 percent) and Peoria, IL (down 33.9 percent).

Aside from Pittsburgh, metro areas with a population of least 1 million that had the biggest decreases in total loans from the second quarter to the third quarter of 2021 were Buffalo, NY (down 29.8 percent); Baltimore, MD (down 20.9 percent); New Orleans, LA (down 20.4 percent) and Atlanta, GA (down 17.5 percent).

Metro areas with the biggest increases in the total number of mortgages from the second to the third quarter of 2021 were Ann Arbor, MI (up 122.7 percent); Des Moines, IA (up 70.5 percent); Sioux Falls, SD (up 51.5 percent); Yakima, WA (up 31.4 percent) and Dayton, OH (up 30.6 percent).

The only metro areas with a population of at least 1 million and an increase in total mortgages from the second quarter to the third quarter of 2021 were Jacksonville, FL (up 5.5 percent); Memphis, TN (up 4.3 percent) and Columbus, OH (up 2.7 percent).

Refinance mortgage originations down 13 percent from second quarter

Lenders issued 1,993,407 residential refinance mortgages in the third quarter of 2021, down 13.4 percent from 2,301,654 in second quarter of 2021 and down 2.9 percent from 2,053,918 in the third quarter of last year. The total was down for the second straight quarter, which had not happened since late 2018 into early 2019, while the latest decrease was the largest since the first quarter of 2018. The $624.1 billion dollar volume of refinance packages in the third quarter of 2021 was down 10.1 percent from $694.3 billion in the prior quarter, while it remained up 1.4 percent from $615.6 billion in the third quarter of 2020.

Refinancing activity decreased from the second quarter of 2021 to the third quarter of 2021 in 199, or 92 percent, of the 216 metropolitan statistical areas around the country with enough data to analyze. Activity dropped at least 10 percent in 121 metro areas (56 percent). The largest quarterly decreases were in Pittsburgh, PA (down 61.5 percent); Myrtle Beach, SC (down 54.7 percent); Charleston, SC (down 49.9 percent); Tuscaloosa, AL (down 48.8 percent) and Buffalo, NY (down 47.5 percent).

Aside from Pittsburgh and Buffalo, metro areas with a population of least 1 million that had the biggest decreases in refinance activity from the second to the third quarter of 2021 were Rochester, NY (down 28.2 percent); Baltimore, MD (down 26.8 percent) and New York, NY (down 25.8 percent).

Counter to the national trend, metro areas with the biggest increases in refinancing loans from the second quarter of 2021 to the third quarter of 2021 were Ann Arbor, MI (up 128.8 percent); Des Moines, IA (up 91.3 percent); Sioux Falls, SD (up 36.6 percent); Dayton, OH (up 13.4 percent) and Yakima, WA (up 9.9 percent).

The only metro area with a population of at least 1 million where refinance mortgages increased from the second to the third quarter of 2021 was Jacksonville, FL (up 5.9 percent).

Refinance lending still represents at least 50 percent of all loans in two-thirds of metros

Refinance mortgages accounted for at least 50 percent of all loans in 151 (70 percent) of the 216 metro areas with sufficient data in the third quarter of 2021. But that was down from 83 percent in the second quarter of 2021 and 80 percent a year earlier. By the end of the third quarter, refinance mortgages took up a smaller portion of all loans issued in 174 (81 percent) of the metros analyzed.

Metro areas with a population of at least 1 million where refinance loans represented the largest portion of all mortgages in the third quarter of 2021 were Atlanta, GA (72.2 of all mortgages); Detroit, MI (66.9 percent); Kansas City, MO (63.2 percent); New Orleans, LA (62.2 percent) and New York, NY (62.1 percent).

Metro areas with a population of at least 1 million where refinance loans represented the smallest portion of all mortgages in the third quarter of 2021 were Rochester, NY (40.9 percent of all mortgages); Oklahoma City, OK (43.2 percent); Pittsburgh, PA (48.1 percent); Miami, FL (48.2 percent) and Cleveland, OH (48.6 percent).

Purchase originations decrease 2 percent in third quarter

Lenders originated 1,359,888 purchase mortgages in the third quarter of 2021. That was down 2 percent from 1,387,307 in the second quarter, although still up 16.8 percent from 1,163,790 in the third quarter of last year. The $482.6 billion dollar volume of purchase loans in the third quarter was down 0.7 percent from $486 billion in the prior quarter, but remained up 29.9 percent from $371.6 billion a year earlier.

Residential purchase-mortgage originations decreased from the second to the third quarter of 2021 in 111 of the 216 metro areas in the report (51 percent). The largest quarterly decreases were in Jackson, MS (down 57.1 percent); Charleston, SC (down 43.8 percent); Provo, UT (down 43.6 percent); Pittsburgh, PA (down 42.2 percent) and Myrtle Beach, SC (down 38.4 percent).

Aside from Pittsburgh, metro areas with a population of at least 1 million and the biggest quarterly decreases in purchase originations in the third quarter of 2021 were New Orleans, LA (down 21.4 percent); Atlanta, GA (down 18 percent); Austin, TX, (down 16.9 percent) and San Jose, CA (down 15.7 percent).

Residential purchase-mortgage lending increased from the second quarter of 2021 to the third quarter of 2021 in 105 of the 216 metro areas in the report (49 percent). The largest increases were in Tuscaloosa, AL (up 553.7 percent); Ann Arbor, MI (up 120.6 percent); Yakima, WA (up 66.2 percent); Dayton, OH (up 63.3 percent) and Sioux Falls, SC (up 61.7 percent).

Metro areas with a population of at least 1 million and the largest increases in purchase originations from the second to the third quarter of 2021 were Rochester, NY (up 50.4 percent); Buffalo, NY (up 37.4 percent); Philadelphia, PA (up 25.2 percent); Columbus, OH (up 24.5 percent) and Detroit, MI (up 20.1 percent).

Metro areas with a population of at least 1 million where purchase loans represented the largest portion of all mortgages in the third quarter of 2021 were Oklahoma City, OK (51.9 percent of all mortgages); Miami, FL (46.7 percent); Las Vegas, NV (45 percent); Virginia Beach, VA (43.7 percent) and San Antonio, TX (41.9 percent).

Metro areas with a population of at least 1 million where purchase loans represented the smallest portion of all mortgages in the third quarter of 2021 were Detroit, MI (25.8 percent of all mortgages); Salt Lake City, UT (26.9 percent); Atlanta, GA (27.4 percent); Kansas City, MO (29.2 percent) and Boston, MA (30.1 percent).

HELOC lending up for second straight quarter

A total of 238,499 home-equity lines of credit (HELOCs) were originated on residential properties in the third quarter of 2021, up 2.2 from 233,287 during the prior quarter, but still down 9 percent from 261,947 in the third quarter of 2020. HELOC activity rose for the second straight quarter – the first time that happened since the middle of 2019. The $46 billion third-quarter volume of HELOC loans, though, was still down 0.8 percent from the second quarter and down 15 percent from the third quarter of 2020.

HELOC mortgage originations increased from the second to the third quarter of 2021 in 60 percent of metro areas analyzed for this report. The largest increases in metro areas with a population of at least 1 million were in Jacksonville, FL (up 45.6 percent); San Diego, CA (up 25.4 percent); Houston, TX (up 24.7 percent); Riverside, CA (up 23.1 percent) and Tucson, AZ (up 22.2 percent).

The biggest quarterly decreases in HELOCs among metro areas with a population of at least 1 million were in Atlanta, GA (down 58.9 percent); Buffalo, NY (down 30.9 percent); Pittsburgh, PA (down 29.9 percent); Hartford, CT (down 29.3 percent) and New Orleans, LA (down 19.5 percent).

FHA and VA loan shares inch down

Mortgages backed by the Federal Housing Administration (FHA) accounted for 336,483, or 9.4 percent of all residential property loans originated in the third quarter of 2021. That was down slightly from 9.6 percent in the second quarter of 2020. It also was down from 10.5 percent in the third quarter of 2020.

Residential loans backed by the U.S. Department of Veterans Affairs (VA) accounted for 229,456, or 6.4 percent, of all residential property loans, originated in the third quarter of 2021, down from 6.9 percent in the previous quarter and 8.8 percent a year earlier.

Median down payments and loan amounts rise again

The national median down payment, the amount borrowed and the ratio of down payments to median home prices during the third quarter of 2021 again hit the highest levels since at least 2005.

The median down payment on single-family homes purchased with financing in the third quarter of 2021 stood at $27,500, up 5.8 percent from $26,000 in the previous quarter and up 41 percent from $19,502 in the third quarter of 2020.

The median down payment of $27,500 represented 8 percent of the national median sales price for homes purchased with financing during the third quarter of 2021, up from 7.8 percent in the previous quarter and 6.5 percent a year earlier.

Among homes purchased in the third quarter of 2021, the median loan amount was $295,954. That was up 2.8 percent from the prior quarter and up 13 percent from the same period last year.

Report methodology

ATTOM analyzed recorded mortgage and deed of trust data for single-family homes, condos, townhomes, and multi-family properties of two to four units for this report. Each recorded mortgage or deed of trust was counted as separate loan origination. Dollar volume was calculated by multiplying the total number of loan originations by the average loan amount for those loan originations.