The world of investing often presents an interesting dichotomy; opportunities that seem too good to be true pitted against a healthy skepticism that can either protect or limit one’s financial journey. One company that has recently found itself in this spotlight is iQSTEL Inc. (OTCQX: IQST). Initially, my skeptical gaze was drawn towards the firm due to its ambitious growth plan across several sectors and its forthcoming NASDAQ uplisting. However, as I delved deeper into its operations and strategic pursuits, my skepticism gradually transformed into an optimistic curiosity.

Busting the Telecom Myth: iQSTEL’s Multifaceted Growth

iQSTEL’s operations extend beyond the realms of a typical telecom company. Its transformation into a technology-driven conglomerate, with notable presence in sectors such as fintech, Internet of Things (IoT), electric vehicles (EVs), and the nascent yet promising metaverse, is remarkable. These diversified business divisions are not just fanciful expansions; they are already showing signs of early revenue generation, providing an additional boost to iQSTEL’s growth story.

Shareholder Concerns: NASDAQ Uplisting and Share Buyback

An impending NASDAQ uplisting has understandably raised concerns among some shareholders. Traditionally, companies may conduct share buybacks before uplisting to consolidate ownership and potentially enhance share value. However, iQSTEL is eschewing this approach. The company maintains that it’s committed to organic growth and meeting NASDAQ’s minimum requirements without resorting to buybacks. The company’s sustained growth and performance offer a persuasive argument in favor of this strategy.

Q1 2023: Robust Figures Amid Economic Challenges

Despite a challenging economic environment, iQSTEL’s Q1 2023 results inspire confidence. The company reported a 27.02% year-over-year increase in revenue, reaching over $24 million. This robust growth, despite inflationary pressures and rising interest rates, speaks volumes about iQSTEL’s resilience and operational efficiency. Its gross margin witnessed a remarkable 151.36% increase year over year, a positive sign for future profitability.

CEO’s Confidence: Weathering the Economic Storm

In a recent letter to shareholders, CEO Leandro Iglesias expressed confidence in iQSTEL’s ability to weather current economic headwinds. The company managed to decrease its consolidated net loss to just $158,822 in Q1 2023 from a loss of $524,731 the previous year. Backed by a healthy cash position of over $1.77 million, iQSTEL is well-equipped to handle potential economic turbulence.

© Steven Leinard aka Boiler_Master on Stocktwits.

The Growth Continues: An Aggressive Strategy

Even in uncertain times, iQSTEL continues its aggressive pursuit of growth. The company is committed to its merger and acquisition strategy while simultaneously improving commercial operations and developing new revenue streams through its fintech, EV, and metaverse divisions.

Picturing the Potential: Gazing into a Future Giant

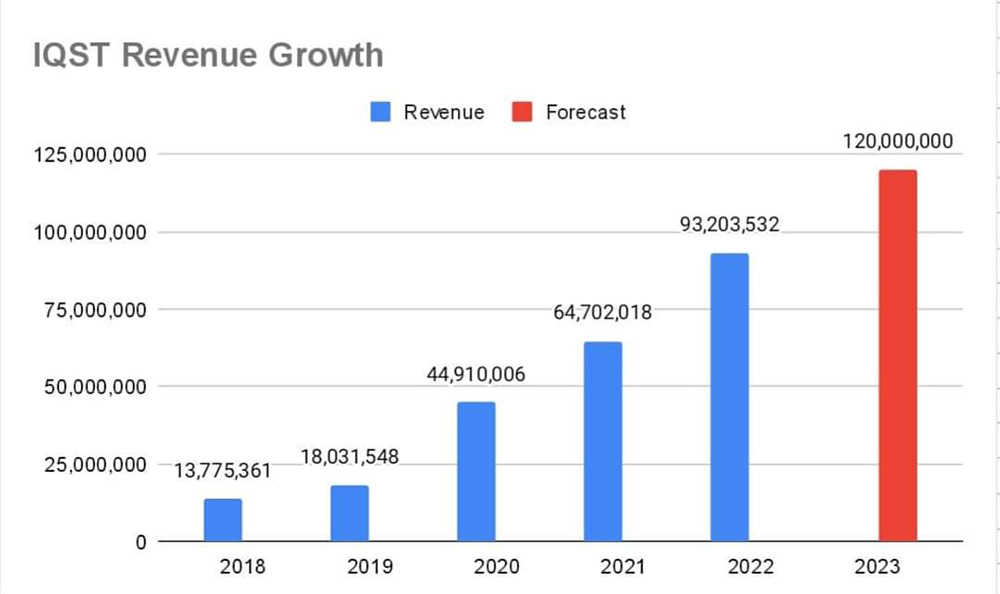

Considering these facts and the company’s ambitious growth strategy, it’s difficult to overlook the potential for iQSTEL to transform into a powerhouse. Preparing for a NASDAQ uplisting, with a revised FY 2023 revenue forecast of $120 million, iQSTEL stands on the brink of significant expansion.

In a world where technology and innovation are key to meeting human needs, iQSTEL is defining its place across multiple sectors. Its commitment to growth and resilience in the face of economic adversity suggests that iQSTEL is more than just another stock to watch; it’s a company with the potential to shape the future.

Starting this journey with skepticism, I found myself captivated by iQSTEL’s growth story. I came to realize that the company isn’t just making lofty claims but is substantiating them with robust financial performance and strategic expansions. iQSTEL, in its journey, is challenging the conventional wisdom of the market. It is breaking free from traditional corporate protocols, like share buybacks prior to NASDAQ uplisting, and displaying a commitment to organic growth that’s encouraging to witness.

The company’s Q1 results stand as a testament to its operational efficiency and its ability to thrive amidst economic turbulence. It’s not just the revenue growth that’s impressive but also the considerable increase in gross margins. This demonstrates an improving profitability matrix, providing additional assurance of the company’s solid financial footing.

Furthermore, iQSTEL’s CEO, Leandro Iglesias’s proactive communication and transparency with shareholders lend credibility to the company’s future plans. His optimism, backed by solid results and a clear strategy, inspires confidence in the company’s capacity to deliver on its promises.

In conclusion, iQSTEL has proven that it’s not just another telecom company. It’s a technology powerhouse, ambitiously expanding into fintech, electric vehicles, IoT, and the metaverse – industries that represent the future. The journey from skepticism to belief is seldom a linear one, but in the case of iQSTEL, the company’s performance and potential have made the transition feel more like an inevitable realization. Today, I view iQSTEL not just as an investment opportunity, but as a company that’s shaping the future by leveraging innovation and technology to serve humanity’s essential needs in an increasingly digital world.

Legal Disclaimer: https://bit.ly/3McxTKZ