While shoppers look for ways to make the holidays festive, inflation is weighing on the season’s spirit. As consumers are creating their gift lists and checking them twice, Deloitte’s “2022 Black Friday-Cyber Monday Survey” examines what retailers can expect from shoppers between Thanksgiving and Cyber Monday. Conducted online Oct. 19-28, the report surveyed 1,200 adults, ages 18 and over, who plan to shop for holiday gifts.

Thanksgiving spending to spark joy for retailers

Despite continued inflationary pressures, consumers are opening their wallets to help ensure the season is merry and bright for family and friends. Over the BFCM period, shoppers plan to spend half of their holiday budgets, with all income groups expected to spend more year-over-year.

- Shoppers are sticking to their initial holiday spending plans: 81% plan to spend the same or more compared to two months ago. Nearly half (48%) of those planning to spend more will do so due to higher prices, up from 41% last year.

- Shopping during the BFCM period is on the rise and at par with pre-pandemic levels: 80% of consumers plan to shop during the five-day holiday period, up from 71% in 2021 and compared to 79% in 2019. Younger generations are driving the charge: 86% of Gen Z and 89% of Millennials plan to spend during the timeframe.

- Spending is set to increase across income groups. Lower-income earners (those making less $50,000 per year) plan to increase their spending the most over the five days, up 19% year-over-year to $320. In comparison, higher-income earners (those making more than $100,000 per year) plan to increase their spending by 4% to $650.

Consumers count on credit to stretch holiday budgets

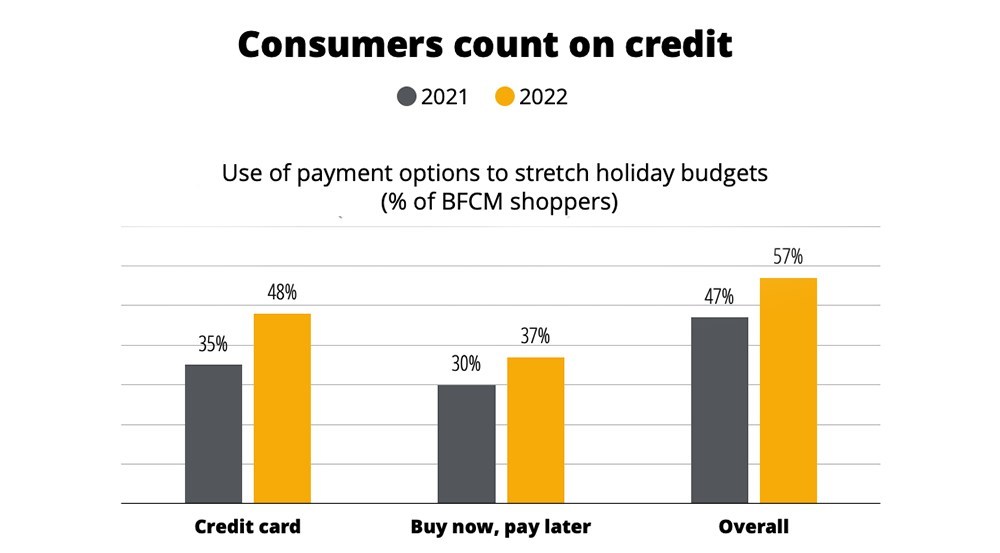

Amid higher prices, consumers are increasingly relying on credit to stretch their holiday budgets. This comes as one-third (33%) of BFCM shoppers are concerned about making upcoming payments, up from 26% in 2021.

- Nearly half of BFCM shoppers (48%) plan to use credit cards to stretch their holiday budgets, up from 35% in 2021. Moreover, credit use is on the rise among all income groups – lower-income families (50% versus 27% in 2021), middle-income families (45% versus 38% in 2021), and higher-income earners (49% versus 45% in 2021).

- Buy now, pay later (BNPL) is also on the rise: 37% of BFCM shoppers plan to take advantage of this option to make the most of holiday gift-giving.

- Among shoppers planning to spend during the holiday shopping weekend, 43% say they will delay large purchases.

“While inflation continues to impact consumers at every turn, they are unwilling to let it dampen the holiday spirit. Participation in the holiday weekend promotions and spending are expected to increase this year, as consumers are willing to do whatever it takes to celebrate the season, including leveraging payment options to purchase gifts. Retailers who work to build consumer loyalty during this challenging time can be well positioned into the new year.” — Nick Handrinos, vice chair, Deloitte Consulting LLP, and U.S. retail, wholesale and distribution and consumer products leader.

Consumers add good deals to their holiday wish lists

Economic uncertainties prompted earlier bargain hunting and buying, continuing to pull the holiday season forward. However, Black Friday and Cyber Monday continue to capture a significant share of the shopping budget as inflation drives consumer demand for deals.

- Consumers are adjusting to the uncertain environment by shopping earlier and hunting for deals. By the end of October, shoppers spent nearly one-quarter (23%) of their holiday budgets.

- More than half of consumers (57%) say retailers are discounting the same or more compared to last year, and 87% of shoppers have already bought gifts on promotion.

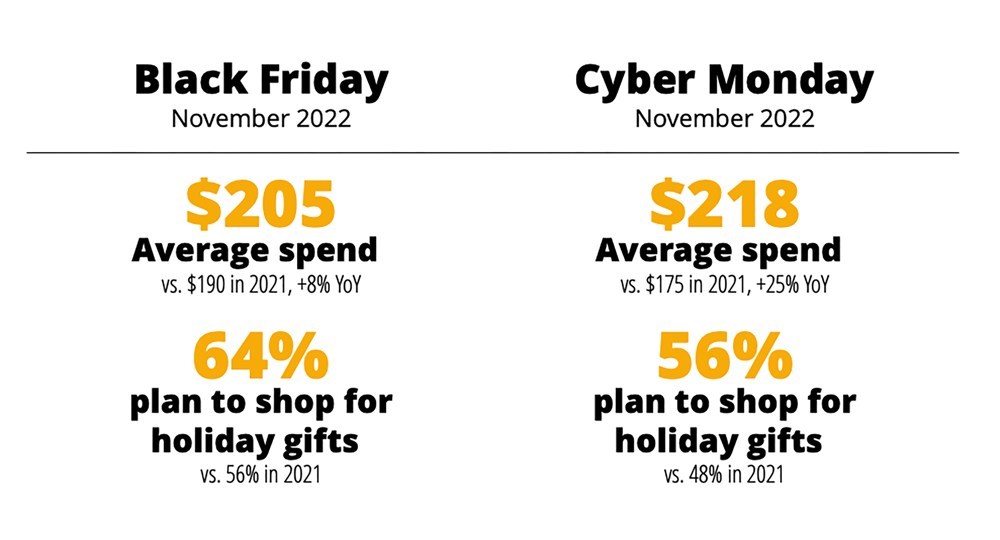

- Participation in Black Friday and Cyber Monday is on the rise, up to 64% and 56%, respectively. Black Friday shoppers are expected to spend $205 on average, up from $190 in 2021, while Cyber Monday shoppers are expected to spend $218 on average, up from $175 last year.

- BFCM events are becoming more channel agnostic. While Cyber Monday continues to capture a significant share of the online shopping budget, 69% of consumers say retailers offer comparable deals online and in-store during the holiday weekend. For example, the share of online and in-store sales for Black Friday is nearly the same at 16% and 17% due to better price transparency.

- While preference for online retailers remains flat at 54%, mass merchants (63%, up from 57% in 2021) and department stores (35%, up from 29% in 2021) regain lost share as consumers seek out traditional BFCM promotions.

“With half of holiday budgets expected to be spent over the Thanksgiving shopping weekend, it’s a critical period for retailers. Consumers from every income level are looking to maximize their holiday budgets, therefore seeing value in the promotions set to last throughout the week. While Black Friday deals have traditionally been in-store, the event is becoming more channel-agnostic, with retailers offering in-store and online comparable deals. Retailers who can differentiate themselves through return policies, warranties and other perks can entice consumers and result in a successful a holiday season.” — Rod Sides, global leader of Deloitte Insights and vice chair, U.S. retail, wholesale and distribution and consumer products.