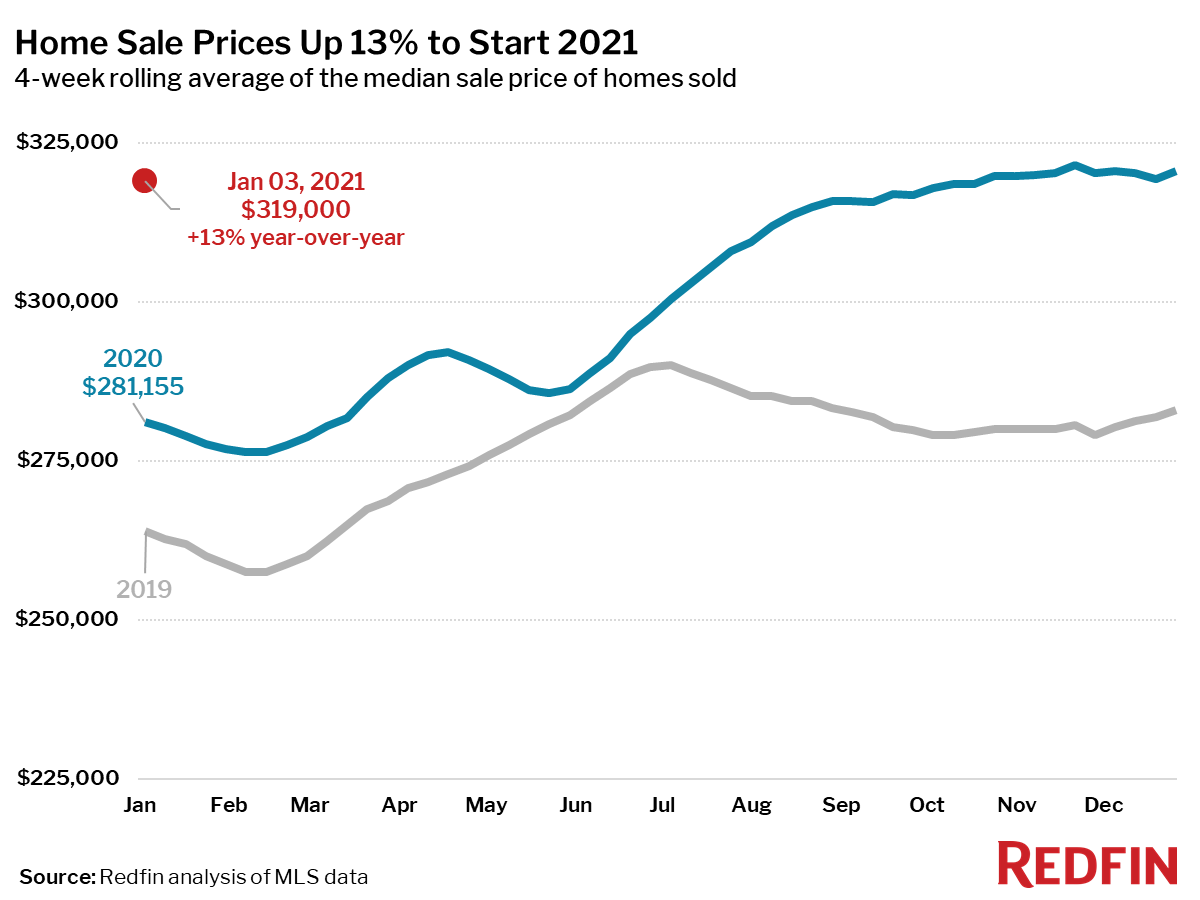

The median home sale price increased 13% year over year to $319,000 during the 4-week period ending January 3, according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage.

Below are other key housing market takeaways for 400+ U.S. metro areas during the 4-week period ending January 3.

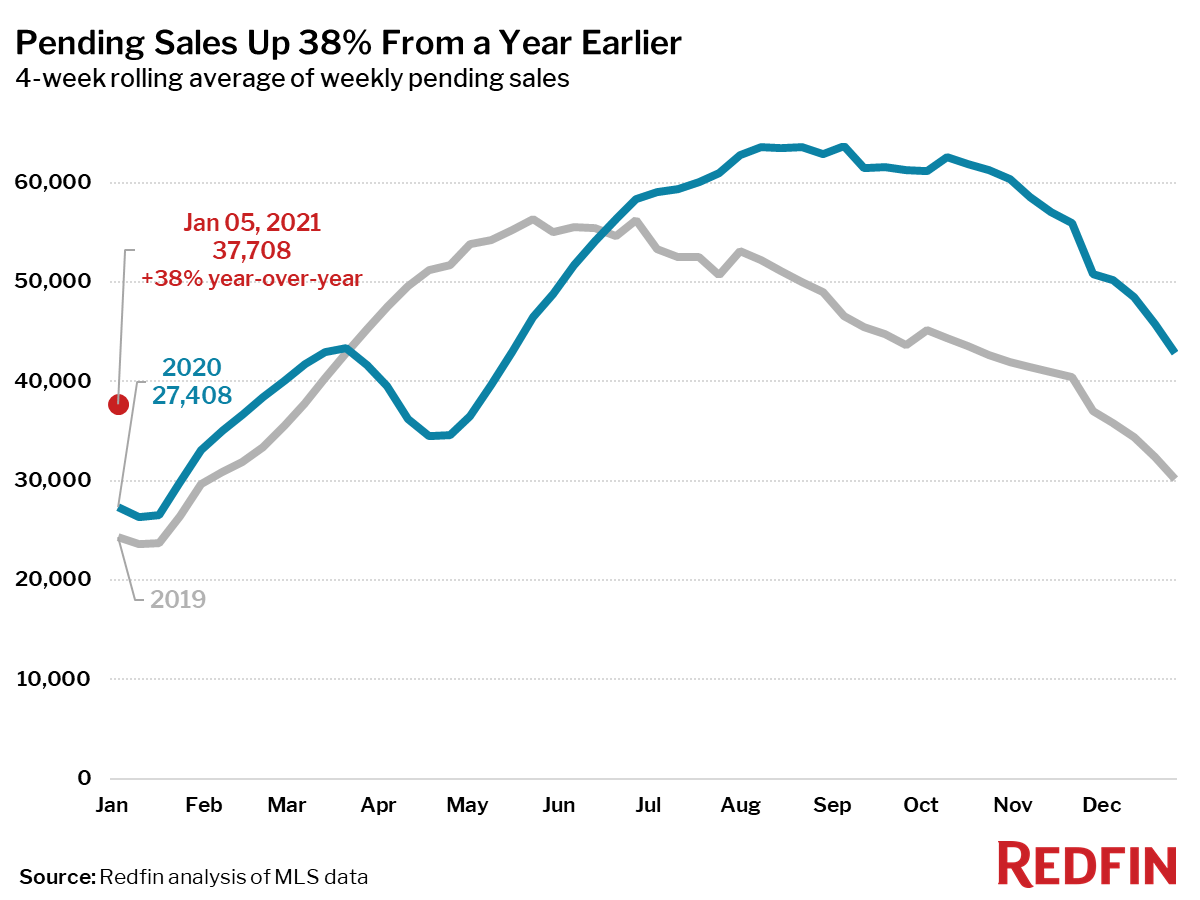

- Pending home sales were up 38% year over year.

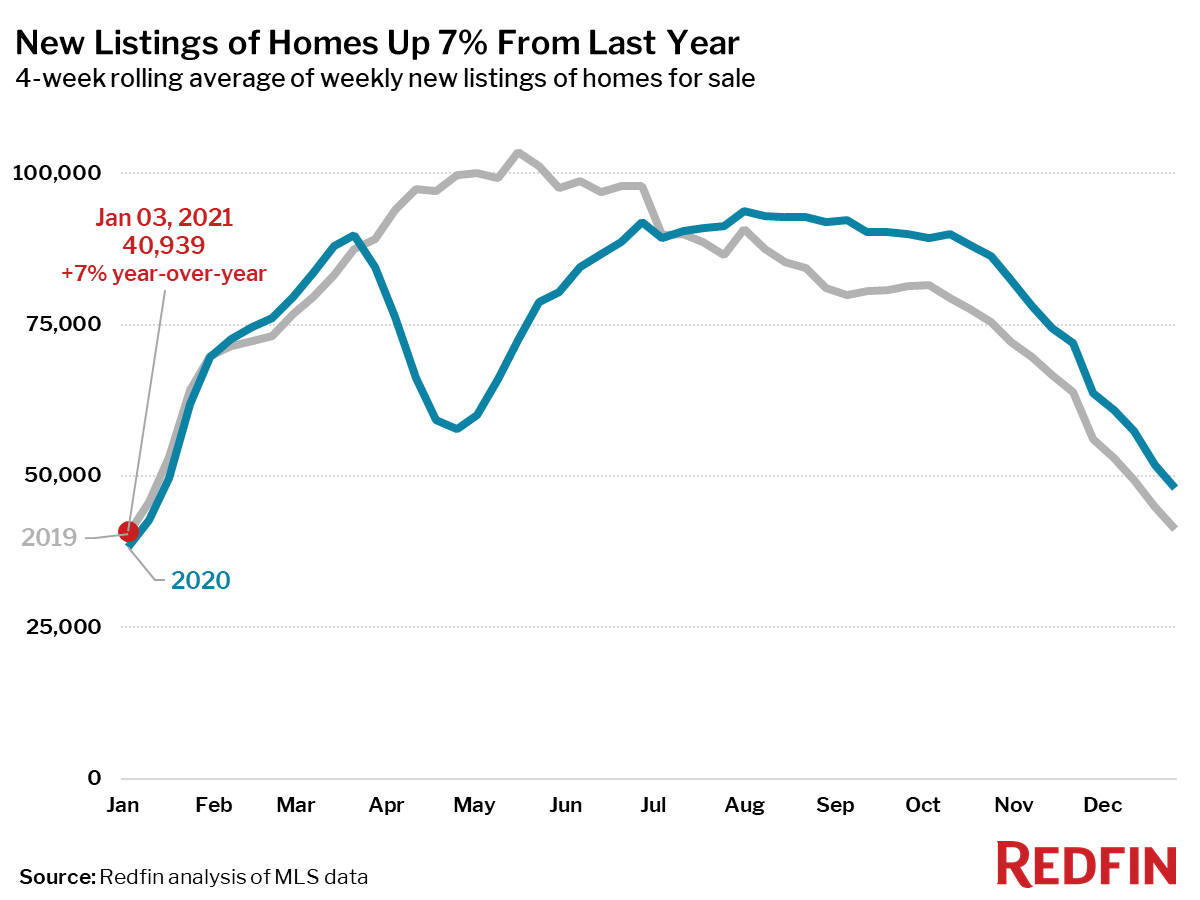

- New listings of homes for sale were up 7% from a year earlier—the smallest increase since July.

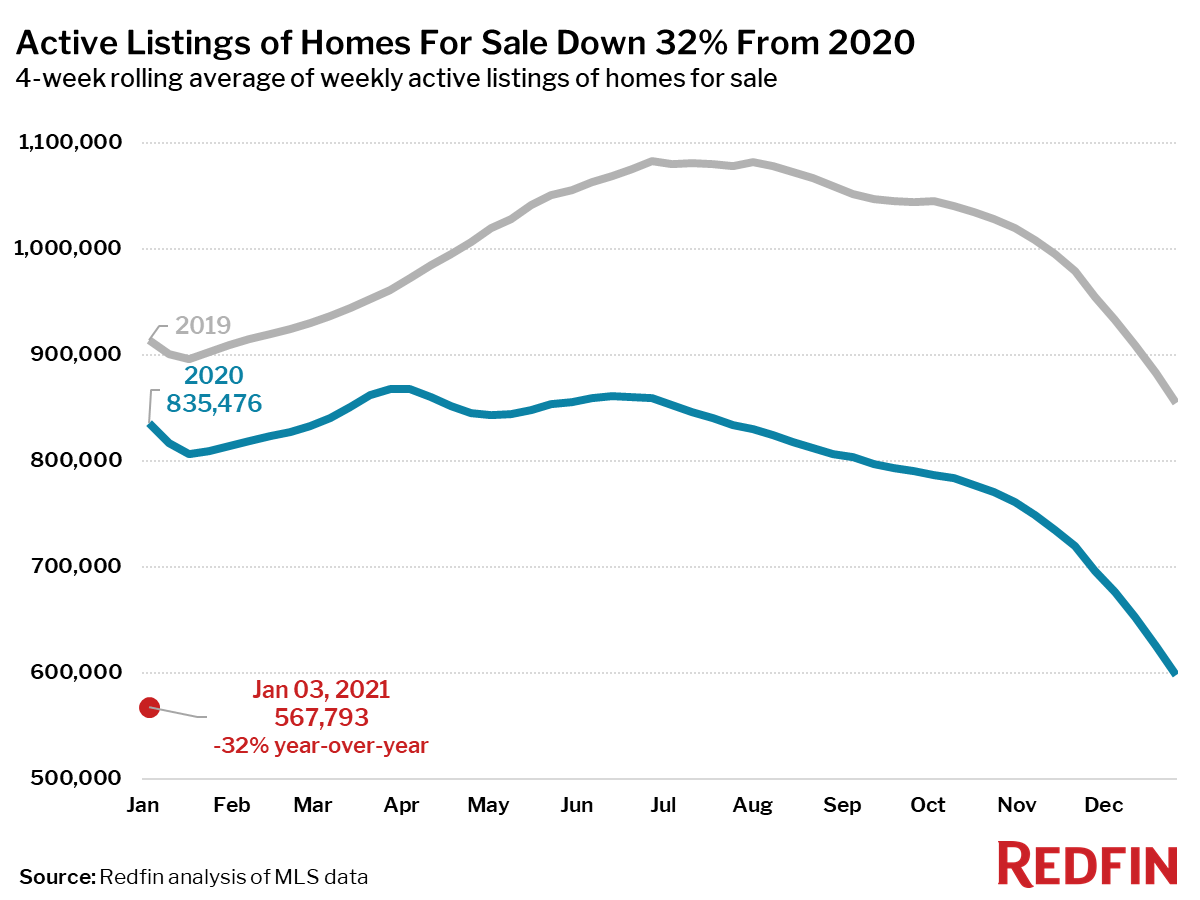

- Active listings (the number of homes listed for sale at any point during the period) fell 32% from 2020 to a new all-time low.

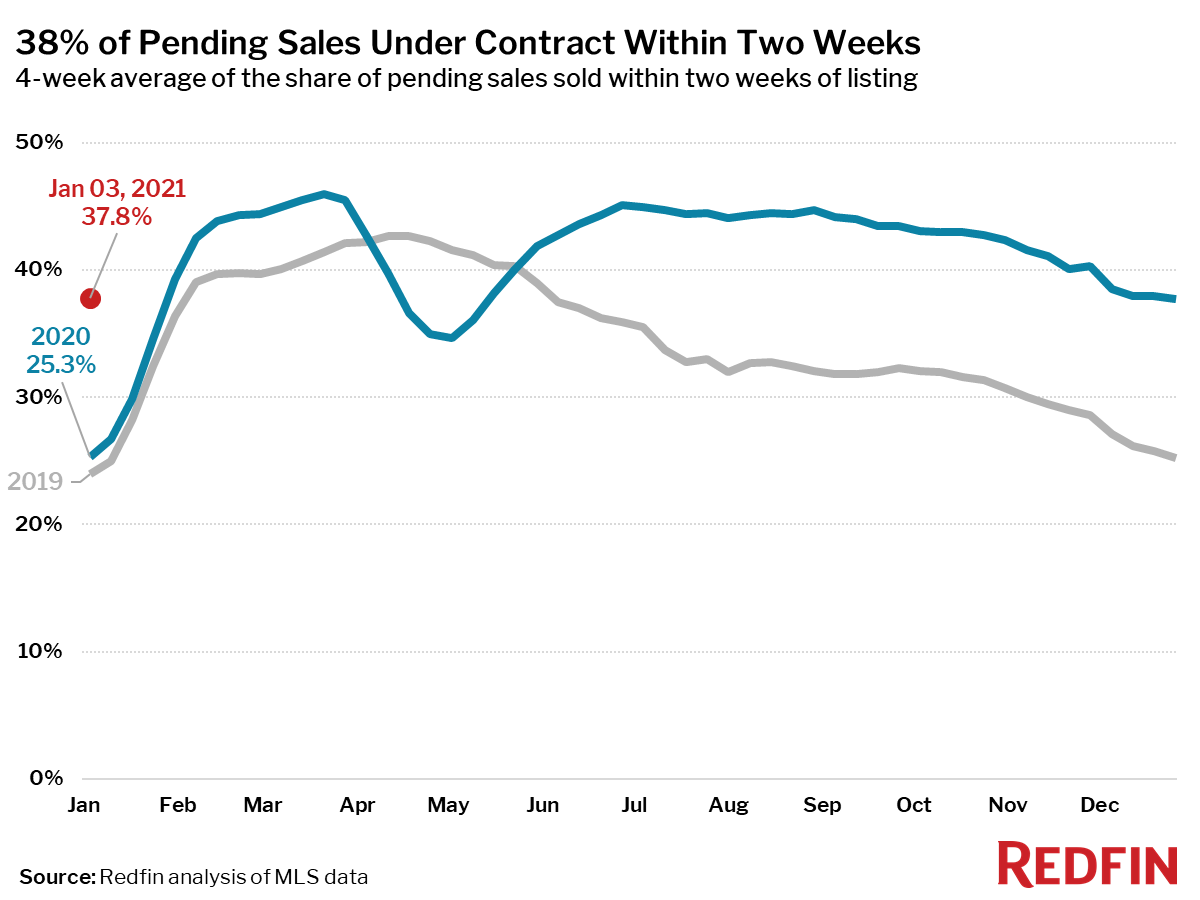

- 38% of homes that went under contract had an accepted offer within the first two weeks on the market, well above the 25% rate during the same period a year ago.

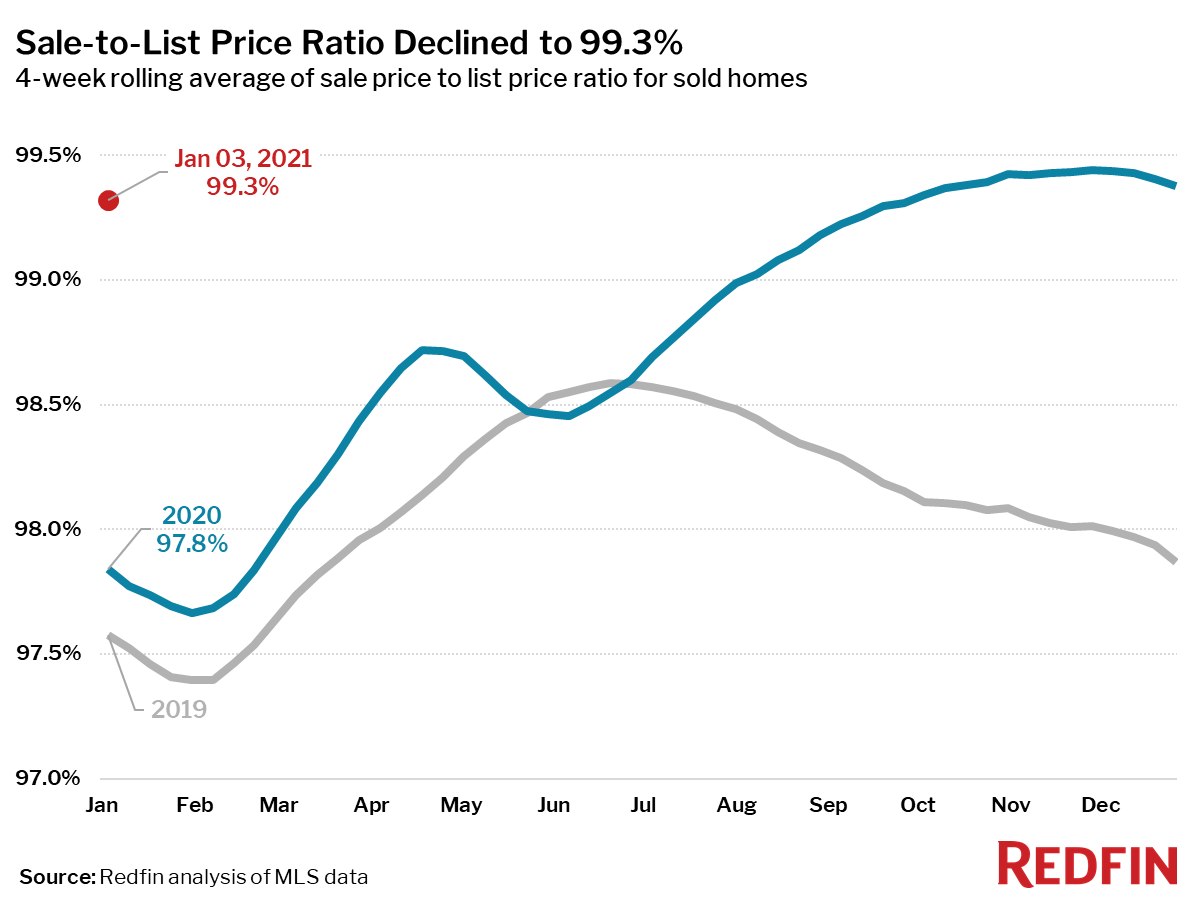

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, declined slightly to 99.3%—still 1.5 percentage points higher than a year earlier.

- For the week ending January 3, the seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other services from Redfin agents—was up 32% from pre-pandemic levels in January and February of 2020.

- For the week ending January 7, 30-year mortgage rates fell to another new record low of 2.65%.

“The economy faces new challenges in the next few weeks, which are likely to see continued political instability and rising coronavirus cases,” said Redfin chief economist Daryl Fairweather. “Still, it’s unlikely that either will have a meaningful or long-term impact on homebuying demand, which, already extremely strong, is now bolstered by even lower mortgage rates. Migration and progressive economic policies will shape the housing market in the months to come. The recent migration of Americans to affordable places like Atlanta, Phoenix and suburbs across the country has contributed to what will be a major change in fiscal and economic policy starting on January 20. While more government spending could lead to moderate mortgage-rate increases, it will also likely include programs to make homeownership affordable to more people.”