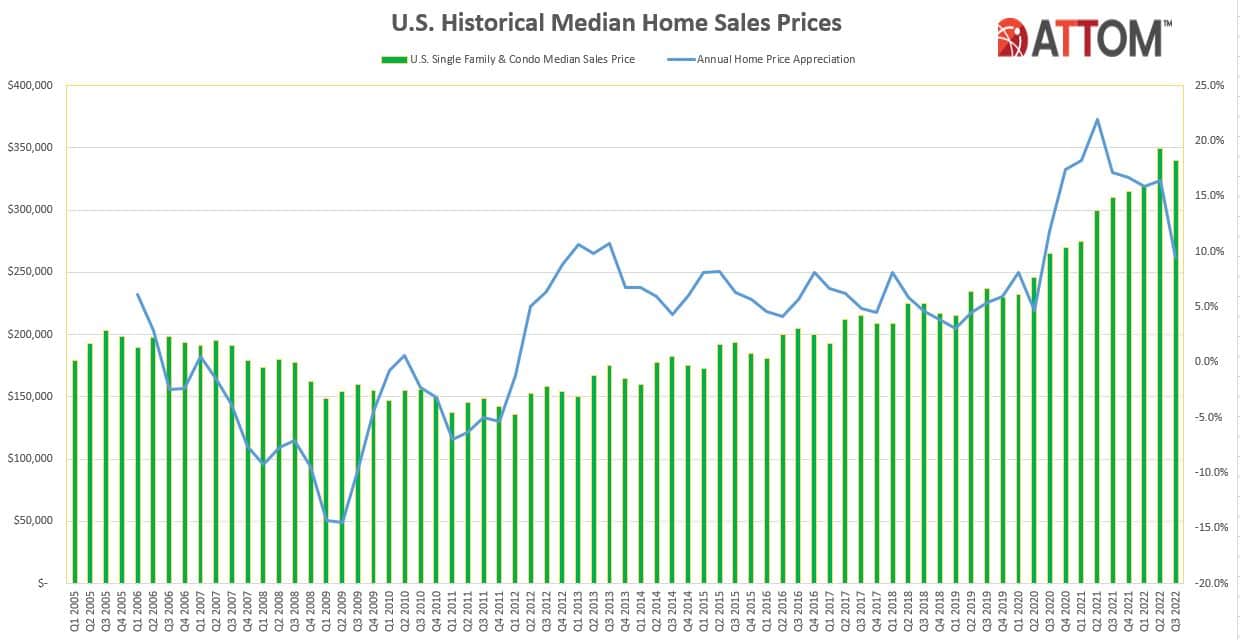

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its third-quarter 2022 U.S. Home Sales Report, which shows that profit margins on median-priced single-family home and condo sales across the United States decreased to 54.6 percent as home prices declined for the first time in almost three years.

The drop-off in typical profit margins, from 57.6 percent in the second quarter, came as the median national home value went down 3 percent quarterly, to roughly $340,000.

“Rapidly-rising mortgage rates have not only resulted in fewer home sales, but have begun to impact home prices as well,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “With rates the highest they’ve been in over 20 years, homebuyers face serious affordability challenges, with monthly payments in some markets up 50 percent year-over-year. It’s very likely that home prices will continue to weaken in many markets in the coming months.”

Typical investment returns for home sellers did remain up from 48.8 percent in the third quarter of 2021 and were still at near-record levels for this century – some 20 points higher than just two years earlier. The national median home price also stayed near its all-time high – more than double where it stood a decade earlier.

But the investment-return decline during this year’s summertime home-selling season marked the largest quarterly downturn since 2011, when the nation was mired in the aftereffects of the Great Recession that hit in the late 2000s. The third-quarter reversal also represented the first time since 2010 that seller returns went down from a second quarter to a third quarter period.

Gross profits also decreased from the second quarter to the third quarter of 2022, dropping 6 percent on the typical single-family home and condo sale across the country to $120,100. That quarterly decrease was the largest since early 2017.

The third-quarter profit and price trends emerged amid growing headwinds that threaten to end or significantly cool down the nation’s decade-long housing market boom. Average mortgage rates have doubled this year, passing 6 percent for a 30-year fixed-rate loan, while the stock market has slumped and consumer price inflation is at a 40-year high. Foreclosure activity by lenders also has more than doubled over the past year.

Those forces have raised home-ownership costs for buyers, cut into resources available for down payments on purchases and eaten into overall household budgets. They also have boosted the supply of homes for sale, putting further downward pressure on prices.

Profit margins drop quarterly while still up annually across most of U.S.

Typical profit margins – the percent change between median purchase and resale prices – decreased from the second quarter of 2022 to the third quarter of 2022 in 127 (68 percent) of the 186 metropolitan statistical areas around the U.S. with sufficient data to analyze. They declined by at least three percentage points in about half of those metro areas, although returns were still up annually in 145 of them (78 percent).

The biggest quarterly decreases in typical profit margins came in the metro areas of Claremont-Lebanon, NH (margin down from 72.8 percent in the second quarter of 2022 to 52.4 percent in the third quarter of 2022); San Francisco, CA (down from 85.1 percent to 65.4 percent); Prescott, AZ (down from 86.3 percent to 70.8 percent); Barnstable, MA (down from 74.5 percent to 59.6 percent) and Trenton, NJ (down from 74.5 percent to 61 percent).

Aside from San Francisco, the biggest quarterly profit-margin decreases in metro areas with a population of at least 1 million in the third quarter of 2022 were in Seattle, WA (return down from 87.2 percent to 73.7 percent); San Jose, CA (down from 87.5 percent to 76.7 percent); Raleigh, NC (down from 65.6 percent to 56 percent) and Birmingham, AL (down from 40.5 percent to 31.3 percent).

Typical profit margins increased quarterly in just 59 of the 186 metro areas analyzed (32 percent). The biggest quarterly increases were in Macon, GA (margin up from 44.7 percent in the second quarter of 2022 to 82.4 percent in the third quarter of 2022); Rockford, IL (up from 29.9 percent to 41.8 percent); Davenport, IA (up from 29.2 percent to 40 percent); Akron, OH (up from 52.8 percent to 60.3 percent) and Hilo, HI (up from 103.3 percent to 110.9 percent).

The largest quarterly increases in profit margins among metro areas with a population of at least 1 million came in Milwaukee, WI (up from 51.4 percent to 54.9 percent); Miami, FL (up from 68 percent to 70.9 percent); Cincinnati, OH (up from 50.6 percent to 53.4 percent); Nashville, TN (up from 56.4 percent to 58.7 percent) and Grand Rapids, MI (up from 73 percent to 75.3 percent).

Prices flat or down in half the metro areas around the U.S.

Median home prices in the third quarter of 2022 decreased from the prior quarter or stayed the same in 98 (53 percent) of the 186 metro areas with enough data to analyze, although they were still up annually in 180 of those metros (97 percent). Nationally, the median price of $339,815 in the third quarter was down 2.7 percent from $349,266 in the second quarter of 2022, but still up 9.4 percent from $310,500 in the third quarter of last year.

“If the Federal Reserve’s objective was to slow down the housing market, it has succeeded spectacularly,” noted Sharga. “The market has gone from double digit annual home price appreciation to below 3 percent, and declining quarter-over-quarter prices. But the impact of 6 and 7 percent mortgage rates means that many homes are still out of the reach of prospective buyers, even with prices declining slightly.”

The biggest decreases in median home prices from the second to the third quarter of 2022 were in San Francisco, CA (down 13 percent); Charleston, NC (down 12.8 percent); Crestview-Fort Walton Beach, FL (down 11.3 percent); San Jose, CA (down 8.3 percent) and Naples, FL (down 8.2 percent).

Aside from San Francisco and San Jose, the largest quarterly median-price declines in metro areas with a population of at least 1 million in the third quarter of 2022 were in New Orleans, LA (down 7.5 percent); Seattle, WA (down 7.2 percent) and San Diego, CA (down 5.3 percent).

The largest increases in median prices from the second to the third quarter of 2022 were in Trenton, NJ (up 14.6 percent); Albany, NY (up 8.7 percent); New York, NY (up 7.5 percent); Wichita, KS (up 7.1 percent) and Philadelphia, PA (up 6.7 percent).

Aside from New York and Philadelphia, the biggest quarterly increases in metro areas with a population of at least 1 million in the third quarter of 2022 were in Cleveland, OH (up 4.7 percent); Detroit, MI (up 4.5 percent) and St. Louis, MO (up 4.1 percent).

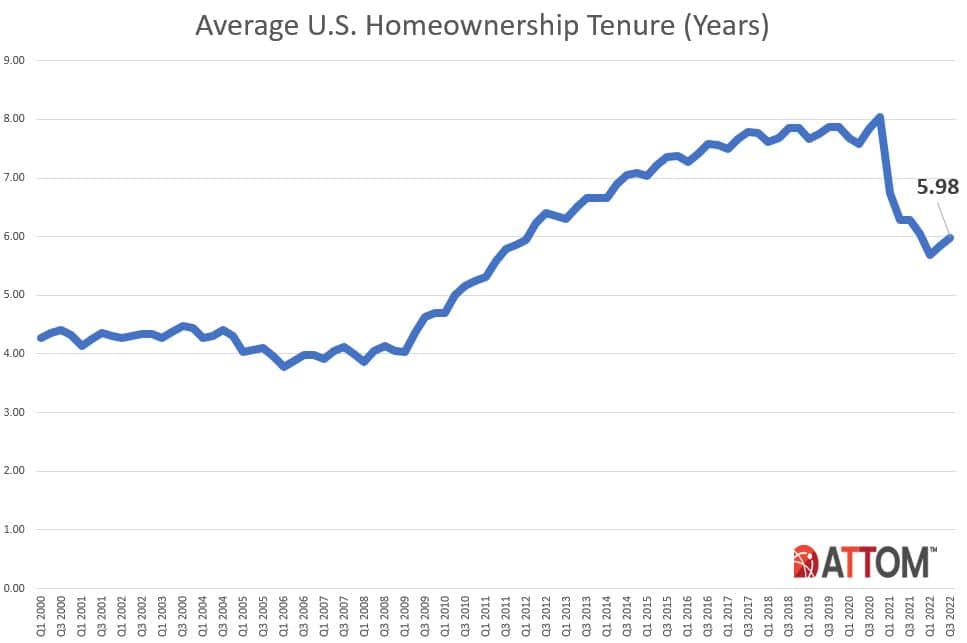

Homeownership tenure up, but remains historically low

Homeowners who sold in the third quarter of 2022 had owned their homes an average of 5.98 years. That was up from 5.84 years in the second quarter of 2022, but still down from 6.28 years in the third quarter of 2021.

Average tenure decreased from the third quarter of 2021 to the same period this year in 81 percent of metro areas with sufficient data.

Nineteen of the 25 longest average tenures among sellers in the third quarter of 2022 were in the Northeast or West regions. They were led by Manchester, NH (8.92 years); Kahului-Wailuku, HI (8.26 years); Claremont-Lebanon, NH (8.22 years); Bridgeport, CT (7.89 years) and Honolulu, HI (7.88 years).

The smallest average tenures among third-quarter sellers were in Lakeland, FL (1.32 years); Bremerton, WA (1.88 years); Gainesville, GA (2.48 years); Raleigh, NC (3.24 years) and Portland, ME (3.24 years).

Lender-owned foreclosures remain at low point for this century

Home sales following foreclosures by banks and other lenders again represented just 1 percent of all U.S. single-family home and condo sales in the third quarter of 2022 – tied for the lowest portion since at least 2000.

The latest portion of REO sales was the same as the 1 percent level recorded in the second quarter of 2022 and down from 1.2 percent in the third quarter of last year. REO sales represented only one of every 98 sales in the third quarter of 2022, a rate that was 1/30th of this century’s high point of one in three in first quarter of 2009.

Among metropolitan statistical areas with sufficient data, those areas where REO sales represented the largest portion of all sales in the third quarter of 2022 included Flint, MI (3 percent, or one in 34 sales); Chicago, IL (2.6 percent); St. Louis, MO (2.5 percent); Syracuse, NY (2.3 percent) and New Haven, CT (2.3 percent).

Cash sales remain near eight-year high

Nationwide, all-cash purchases accounted for 35.7 percent of all single-family home and condo sales in the third quarter of 2022. The third-quarter-of-2022 number was down slightly from 36 percent in the second quarter of 2022 but still up from 33.9 percent in the third quarter of last year.

Among metropolitan areas with sufficient cash-sales data, those where cash sales represented a large share of all transactions in the third quarter of 2022 included Columbus, GA (76.8 percent); Augusta, GA (76.6 percent); Gainesville, GA (68.3 percent); Myrtle Beach, SC (67.3 percent) and Atlanta, GA (61.9 percent).

Those where cash sales represented the some of the smallest share of all transactions in the third quarter of 2022 included Lincoln, NE (14.9 percent of all sales); Vallejo, CA (17.6 percent); San Jose, CA (18.8 percent); Kennewick, WA (19.4 percent) and Spokane, WA (20.2 percent).

Institutional investment increases slightly

Institutional investors nationwide accounted for 6.7 percent, or one of every 15 single-family home purchases in the third quarter of 2022. That was up from 6.4 percent in the second quarter of 2022, but still down from 8.4 percent in the third quarter of 2021.

Among states with enough data to analyze, those with the largest percentages of sales to institutional investors in the third quarter of 2022 were Arizona (14.3 percent of all sales), Georgia (12.7 percent), Tennessee (10.7 percent), Nevada (10.6 percent) and North Carolina (10.2 percent).

States with the smallest levels of sales to institutional investors in the third quarter of 2022 included Hawaii (1.9 percent of all sales), Rhode Island (2.1 percent), Maine (2.1 percent), New Hampshire (2.3 percent) and Louisiana (2.5 percent).

FHA-financed purchases increase after year of declines

Nationwide, buyers using Federal Housing Administration (FHA) loans comprised 7.9 percent of all single-family home purchases in the third quarter of 2022 (one of every 13). That was up from 6.7 percent in the second quarter of 2022 – the first quarterly gain in a year. But it still remained down from 8.2 percent a year earlier.

Among metropolitan statistical areas with sufficient FHA-buyer data, those with the highest levels of FHA buyers in the third quarter of 2022 included Bakersfield, CA (20.8 percent of all sales); Visalia, CA (19.6 percent); Modesto, CA (17.9 percent); Hagerstown, MD (17.3 percent) and Vallejo, CA (16.9 percent).

Report methodology

The ATTOM U.S. Home Sales Report provides percentages of REO sales and all sales that are sold to institutional investors and cash buyers, at the state and metropolitan statistical area. Data is also available at the county and zip code level, upon request. The data is derived from recorded sales deeds, foreclosure filings and loan data. Statistics for previous quarters are revised when each new report is issued as more deed data becomes available.

Definitions

All-cash purchase: sale where no loan is recorded at the time of sale and where ATTOM has coverage of loan data.

Homeownership tenure: for a given market and given quarter, the average time between the most recent sale date and the previous sale date, expressed in years.

Home seller price gains: the difference between the median sales price of homes in a given market in a given quarter and the median sales price of the previous sale of those same homes, expressed both in a dollar amount and as a percentage of the previous median sales price.

Institutional investor purchases: residential property sales to non-lending entities that purchased at least 10 properties in a calendar year.

REO sale: a sale of a property that occurs while the property is actively bank owned (REO).