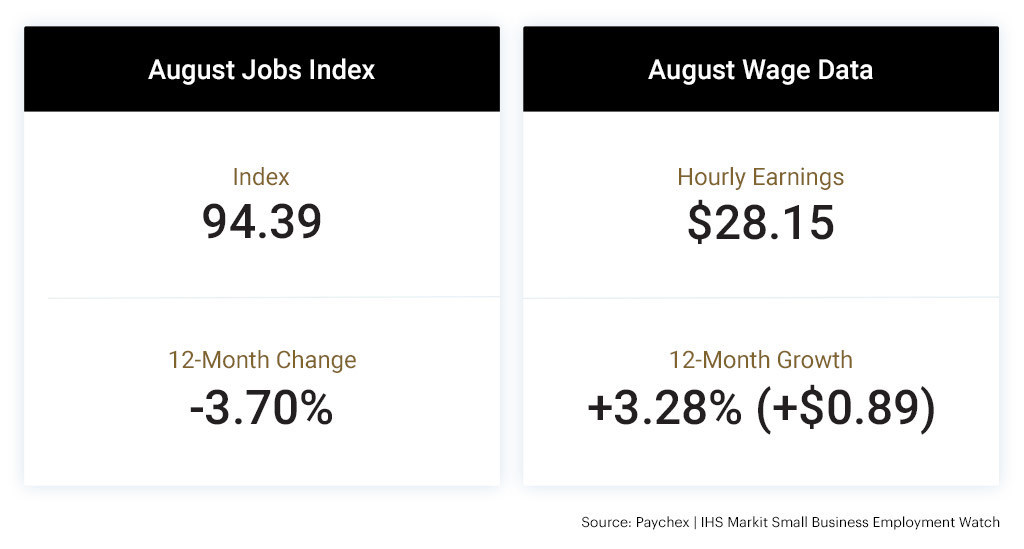

The latest “Paychex IHS Markit Small Business Employment Watch” shows that despite hiring remaining flat since its drop-off in April, employees of small business are seeing the benefits of solid wage growth. Hourly earnings growth was steady at 3.28 percent in August and weekly earnings continue to improve as the number of hours worked increases. The national jobs index stood at 94.39, moderating 0.21 percent from the previous month.

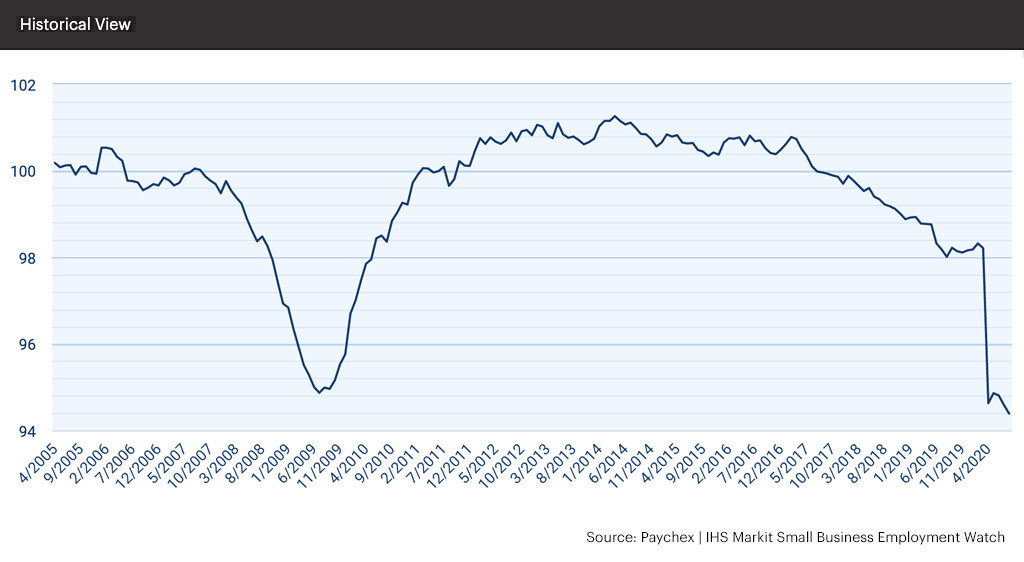

“The national index stalled this summer, with the month of August again, as it has since April, closing below 95,” said James Diffley, chief regional economist at IHS Markit.

“As the jobs index has remained near April levels, PPP loans appear to have provided stability and prevented further declines,” said Martin Mucci, Paychex president and CEO. “While employment levels remain challenging, wages continue to show positive momentum.”

The report also includes regional, state, metro, and industry-level analysis, showing:

- Amid a regional COVID-19 surge, the West and South reported the largest declines in employment growth, -0.38 percent and -0.31 percent, respectively.

- Weekly earnings and hours worked growth is strongest in the Northeast.

- New York posts the best weekly hours worked growth among states.

- Despite a significant downturn in August (-0.69 percent), Florida continues to lead states in employment growth with an index of 96.50.

- At 4.23 percent, hourly earnings growth in the Construction sector has improved every month in 2020.

The latest Paychex | IHS Markit Small Business Employment Watch shows that despite hiring remaining flat since its drop-off in April, employees of small businesses are seeing the benefits of solid wage growth.

The complete results for August, including interactive charts detailing all data at a national, regional, state, metro, and industry level, are available at paychex.com/employment-watch. Highlights are available below.

Note: Data presented for the month of August was collected from Friday, July 17 through Thursday, August 20, the cutoff date for the Small Business Employment Watch.

The national jobs index stood at 94.39, moderating 0.21 percent from the previous month.

National Jobs Index

- After a slight recovery in May, small businesses continue to experience the impacts of the COVID-19 pandemic, the national index has slowed for three consecutive months.

- At 94.39, the national index decreased 0.21 percent in August and 3.70 percent from last year.

National Wage Report

- At 3.28 percent, hourly earnings growth held at a solid pace, while weekly earnings growth continues to improve through a boost in hours worked.

- Weekly earnings growth improved to 3.96 percent, with both one-month and three-month annualized growth above four percent.

- Following four consecutive months of improvement, weekly hours worked stands at 32.81, up 0.84 percent year-over-year.

Regional Jobs Index

- Following COVID-19 case spikes, the West and South experienced the largest declines in August, down 0.38 percent and 0.31 percent, respectively.

- The Northeast was the only region to improve from the previous month, up a modest 0.02 percent.

Regional Wage Report

- The South ranks last among regions for earnings and hours worked growth; the South is the only region with hourly earnings growth below three percent and negative weekly hours worked growth.

- At 4.60 percent hourly earnings growth, the Northeast ranks first among regions; weekly earnings and hours worked growth is also strongest in the Northeast.

State Jobs Index

- Despite a significant downturn in August (-0.69 percent), Florida continues to lead states with an index of 96.50.

- Down 0.92 percent from the previous month, Washington, the lowest ranked state, dropped further than Florida; at 90.95,

- Washington is more than a point below the next weakest state, New York (92.52).

- Missouri, ranked last among states as recently as February, now ranks second among states for the second consecutive month.

Note: Analysis is provided for the 20 largest states based on U.S. population.

State Wage Report

- Concentrated in the Northeast, New Jersey, Pennsylvania, and Massachusetts have the strongest hourly earnings growth among states.

- Texas reported negative weekly earnings growth in August, with the weakest hourly earnings growth among states and negative weekly hours worked.

- New York has the strongest weekly hours worked growth among states as the rate of COVID-19 cases has slowed in recent months.

Note: Analysis is provided for the 20 largest states based on U.S. population.

Metropolitan Jobs Index

- At 98.23, Denver leads all metros by a wide margin, recovering 1.48 percent during the past quarter, best among metros.

- Tampa and Miami both slowed nearly one percent in August.

- Down 7.79 percent from last year, at 90.23, Seattle remains the weakest metro.

Note: Analysis is provided for the 20 largest metro areas based on U.S. population.

Metropolitan Wage Report

- Riverside, CA has the strongest hourly earnings growth among metros, 6.17 percent, while higher wage California metros San Diego, San Francisco, and Los Angeles are all below four percent.

- San Francisco, New York, and Detroit lead metros in weekly hours worked growth, all above one and half percent year-over-year.

- Houston ranks last among metros for earnings and hours worked growth, and is the only metro with negative weekly earnings growth.

Note: Analysis is provided for the 20 largest metro areas based on U.S. population.

Industry Jobs Index

- Ranked second to Construction, Financial Activities, which includes financial services, insurance, and real estate, is the only industry to improve in August.

- Leisure and Hospitality fell again, to 88.91, nearly four points lower than the next weakest sector, Manufacturing (92.86).

Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The Other Services (excluding Public Administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, dry cleaners, and other businesses.

Industry Wage Report

- Education and Health Services again reported the weakest hourly earnings growth among sectors, however, one-month and three-monthly annualized rates are signaling strong upward movement with both near or above six percent.

- Three industries are reporting weekly earnings growth above four percent (Other Services (except Public Administration); Trade, Transportation, and Utilities; and Construction.

- At 4.23 percent, hourly earnings growth in the Construction sector has improved every month in 2020.

Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The Other Services (excluding Public Administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, dry cleaners, and other businesses.