Key Takeaways

- Low-cost franchising is achievable for small and micro-businesses, not just large corporations.

- Digital tools, creative structuring, and community-driven marketing keep costs down while maximizing growth.

- Following practical, realistic strategies leads to stronger financial performance and long-term franchise success.

Many business owners look at booming franchises and think, “There’s no way I could expand my own business like that—not without deep pockets or venture capital.” Here’s some news that might make them lean in: A whopping 70% of franchises require less than $250,000 to launch. That’s right—most franchise success stories didn’t start with huge investments. Modern franchising isn’t just the territory of household mega brands; it’s a proven, scalable method for passionate business owners with limited capital.

The real question now isn’t “Can a business owner afford to franchise their business?” but “How can they franchise their business without risking it all?” With new technology, flexible models, and creative support structures, this dream is more accessible than ever. For those thinking about low-cost franchising, it’s worth demystifying the steps and mapping out 5 budget-friendly strategies that turn small businesses into competitive franchise brands.

Why Franchising Is Within Reach: Busting the High-Investment Myth

Understanding Modern Franchise Costs

Let’s start by addressing the elephant in the room: those infamous “sky-high” startup costs. Digging into the data reveals the average initial investment for a franchise business lands comfortably between $50,000 and $200,000 (Gitnux, 2024). A bottomless bank account isn’t needed for low-cost franchising success.

So, where does this money typically go?

| Expense Category | Typical Cost Range |

| Legal & consulting fees | $5,000 – $20,000 |

| Franchise disclosure docs | $1,500 – $10,000 |

| Initial marketing | $2,000 – $10,000 |

| Training & support | $5,000 – $15,000 |

| Operations manual | $1,000 – $7,500 |

Modern advances—like cloud document delivery, eSignature legal tools, and digital onboarding—help slash overhead. Creative structuring (think: pilot locations or home-based ops) turns what used to be a six-figure obstacle into a manageable jump.

Franchising’s Success & Survival Rates

Here’s where things get even more interesting: the data shows the franchise model trumps independent business survival. Around 50% of franchise businesses are operating after 7 years, while only 20% of independent ventures last that long (Gitnux, 2024). So when someone steps into franchising, they aren’t just stretching dollars—they’re buying into a system with proven staying power.

Strategy #1: Streamline Your Franchise Offering With Essential Documents

Franchising Light—Focus on the “Must-Haves”

The advice to “keep it simple, stupid” applies perfectly to franchising on a budget. Entrepreneurs should ditch the “bells and whistles” in round one—focusing on must-have essentials:

- Legally compliant franchise agreement

- Federal and state disclosure documents

- A clear, practical operations manual

Going digital here is key. Using cloud-based digital manuals and handbooks that franchisees can update and access anywhere cuts out expensive printing and shipping. Those seeking an actionable, step-by-step overview will find the complete guide to franchising your business packed with tips.

People Also Ask:

What is the most important document in franchising?

The franchise agreement—this legally defines every right, obligation, and fee for both the franchisor and franchisee.

DIY vs. Professional Help: Where to Invest

Some tasks can be done independently—but when it comes to legal compliance, short-cuts can be costly. Here’s a handy way to prioritize:

- DIY: Operations checklists, workflow videos, brand guide basics.

- Hire Pros: Franchise disclosure documents, business registration, core legal agreements.

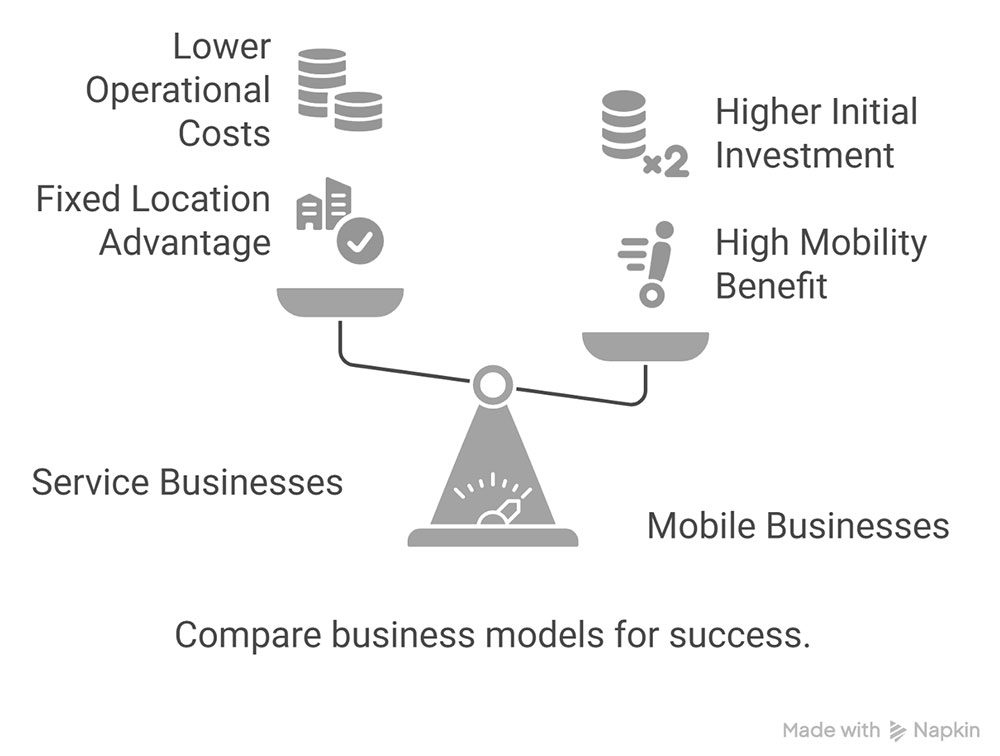

Strategy #2: Offer Scalable, Low-Cost Franchise Models

Micro-Franchising and Home-Based Franchises

Think of micro-franchising as franchising’s nimble, budget-friendly cousin. Home-based, mobile, or consulting models allow franchisors to skip big real estate, complex buildouts, and expensive equipment. Some of today’s fastest-growing concepts in food, retail, and services took off using this very strategy.

Which business types work best?

- Service businesses (cleaning, tutoring, consulting)

- Food trucks, kiosks, pop-ups

- Mobile health/beauty and fitness

With 70% of franchises requiring less than $250,000 to start (Gitnux, 2024), creative, small-footprint formats are thriving.

Flexible Royalty Structures

Traditional franchises use a flat royalty, but offering a tiered or performance-based model can lower the barrier. Standard royalty averages hover at 6.7% of gross sales (Gitnux, 2024), but franchisors can incentivize early adopters or low-volume operators with a sliding scale.

This keeps franchises “affordable-to-own” and attractive to cost-conscious entrepreneurs who don’t want big ongoing fees.

TIP: Showcasing projected earnings and flexible fees in the Franchise Disclosure Document builds transparency and trust.

Strategy #3: Tapping Into Affordable Funding and Support

Accessible Franchise Financing Options

For those concerned about startup costs, here’s a silver lining: 85% of franchisors offer their franchisees financial help—from in-house loans to deferred fee structures (Gitnux, 2024). Plus, another 40% provide direct in-house financing options.

These funding avenues should be added to the toolkit:

| Funding Source | Typical Features |

| SBA small business loans | Low rates, long terms |

| Crowdfunding platforms | Community-driven, no equity loss |

| Franchisor payment plans | Lower or deferred upfront payments |

| Family/friends investment | Fast, little paperwork |

| Vendor financing | Extended terms for bulk orders |

Leveraging Franchisor & Government Support

Entrepreneurs shouldn’t overlook grants, workforce assistance, and low-interest government loans often available for new franchises, minority or women-owned businesses, or youth entrepreneurs. State or local small business associations should have up-to-date lists.

Strategic co-op marketing and buying groups also let a small franchisor punch above its weight when negotiating supplies or promo deals.

Strategy #4: Bootstrap Marketing and Franchisee Recruitment

Lean Marketing Tactics

A Madison Avenue ad budget isn’t necessary for growth. The average franchise spends about 3% of its revenue on marketing (Gitnux, 2024), and here’s how franchisors can get serious value from every dollar:

- Maximize social media: Organic posts, video walkthroughs, and live Q&As build brand buzz on a shoestring.

- Referral incentives: Reward followers and happy customers who bring in new franchisee leads.

- Community partnerships: Collaborate with business networking groups, local chambers, or industry meet-ups.

Example bootstrapped campaign: Launch an ambassador program, giving early franchisees special status (or better royalty rates), in exchange for helping recruit others.

Those needing more inspiration for low-budget growth can explore these business expansion strategies for actionable tips.

Build a Community-Driven Pipeline

Franchisors should tap into their most passionate customers—a well-timed social campaign or email outreach can help discover people who already “get” the business. They’re easier (and cheaper) to train and retain. Local business alliances or city entrepreneurship groups can source talent and support without paying for pricey recruiters.

Franchisee Screening On a Budget

Skip the expensive headhunting agencies:

- Use structured interviews via Zoom or Google Meet.

- Tap into low-cost background check apps.

- Leverage affordable online assessments (like Predictive Index or DISC) for personality and aptitude screening.

Keeping recruitment lean means more money is freed up for supporting early franchisees.

Strategy #5: Optimize Ongoing Operations for Profitability

Smart Systems for Ongoing Support

Efficient support doesn’t mean endless conference calls or flying consultants around. Cloud-based platforms (like Monday.com, Slack, Loom, or Trainual) streamline communication, training, and task tracking. Franchisees can:

- Access videos, updates, and manuals 24/7.

- Submit requests or questions instantly.

- Connect with a peer group for mentoring.

A hybrid support model—combining digital resources with limited live one-on-one help—keeps ongoing franchise support affordable yet personal. This allows flexibility as the franchise grows without ballooning the payroll.

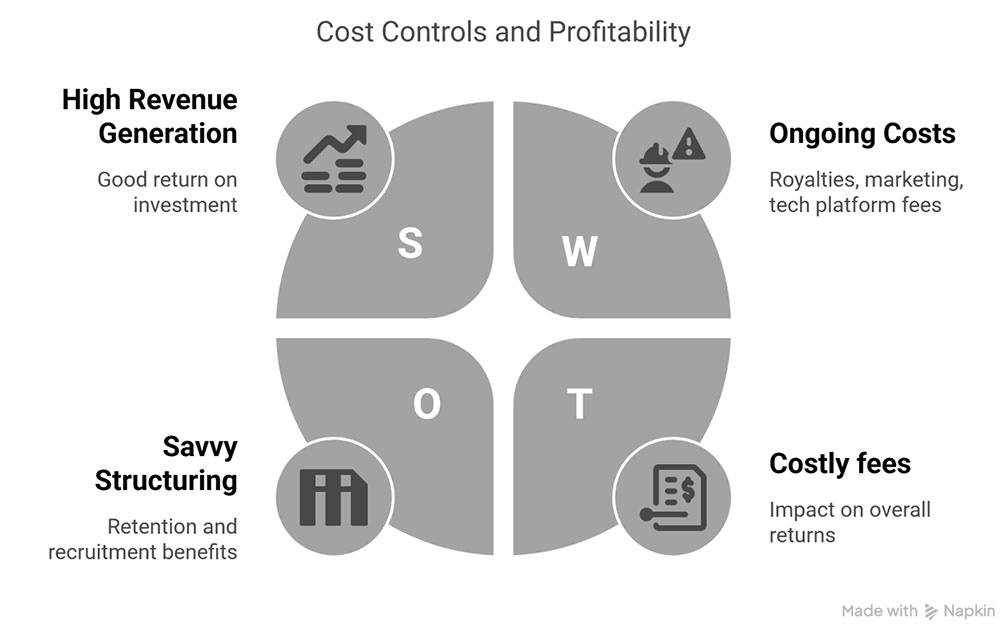

Focus on Cost Controls and Profitability

Here’s where the rubber meets the road: The average franchise generates $1.1 million in revenue and delivers a 10.5% ROI (Gitnux, 2024). But it’s the ongoing costs—royalties, marketing fund contributions, tech platform fees—that can eat into those returns if franchisors aren’t vigilant.

- Royalty Fees: Remember, industry average is 7% of sales—but savvy structuring (lower for small operators, higher for mature units) pays off in retention and recruitment.

- Marketing Pool: Set a flat marketing fee or keep it percentage-based (like the 3% average), and offer franchisees flexibility (DIY vs pooled spend).

- Tech Fees: Negotiate volume discounts from vendors as the network grows.

For day-to-day tracking, simple financial dashboards (like QuickBooks Online or Xero) help owners and franchisees keep a pulse on profitability.

The big milestone? Target break-even in 3.5 years—a realistic goal that gives early franchisees a clear, achievable payoff (Gitnux, 2024).

Training and Knowledge Sharing on a Budget

Gone are the days when training meant flying everyone to a headquarters. Replace travel and seminar costs with:

- Self-serve digital courses (Thinkific, Teachable)

- Monthly group webinars

- Online peer mastermind sessions

This creates a scalable, replicable training model that keeps support costs predictable and low—even as the network grows.

Setting Realistic Financial Expectations

Understanding Break-Even Timelines

Franchisees want to know, “When will the investment pay off?” The national average is 3.5 years to reach break-even (Gitnux, 2024). Honest, up-front discussion is the greatest ally. Sharing a simple spreadsheet or break-even calculator helps lay out:

- Initial investment range: $50,000 – $200,000 for most models

- Average time to break even:5 years

- Typical royalty and marketing fees:7% and 3% of sales, respectively

Transparency means fewer surprises, happier franchisees, and more word-of-mouth referrals.

Benchmarking Franchise Performance

Thinking about the return? The average franchise ROI sits at 10.5%. Couple that with a business model where 50% survive past 7 years, and franchisors are offering a statistically safer path compared to striking out alone (Gitnux, 2024).

Essential Pitfalls to Avoid When Franchising on a Budget

Common Budget-Friendly Franchising Mistakes

If aiming for low-cost franchising, don’t trip over these common hurdles:

- Skipping legal compliance: Not registering a franchise or missing state filings can lead to expensive penalties.

- Under-investing in core operations: A skeleton support system may save cash upfront but can stall growth when franchisees feel stranded.

- Overpromising: Don’t guarantee support that can’t be sustainably provided at scale.

- Poor franchisee vetting: Rushed recruiting might fill seats quickly, but a misaligned franchisee will cost more in the long run.

Staying Compliant and Protecting Your Brand

Remember: Protect intellectual property, clearly define territory rights, and consistently update franchise documentation. It’s not just about legal safety—it’s about brand value and trust.

For a quick refresher on these critical topics, see this overview of the key components of a franchise agreement.

Quick Reference Table: Key Franchise Metrics

| Metric | Typical Value/Range |

| Initial Investment | $50,000 – $200,000 |

| Break-Even Timeline | 3.5 years |

| Royalty Fee (Avg.) | 6.7% of gross sales |

| Marketing Spend | 3% of revenue |

| Survival Rate (7 years) | 50% (franchises) |

| Average Revenue | $1.1 million/year |

| Return on Investment (Avg.) | 10.5% |

(Source: Gitnux, 2024 Franchise Statistics)

Wrapping Up: Small Steps, Smart Growth

So here’s the big picture: Franchising a business without a big investment isn’t a daydream—it’s a proven path, especially when leaning into today’s digital tools, micro-format models, and budget-friendly marketing. Most franchise businesses don’t just survive; they thrive, outpacing independent startups and delivering a strong, consistent ROI.

By following these five strategies—from streamlining offerings and creative funding, to lean marketing and agile support—business owners can franchise effectively, even when starting small. The keys are clarity, low overhead, and always putting scalability (not just speed) first.

Thinking about expanding your business? It can feel like a huge leap. The team at Franchise Creators provides personalized, budget-conscious guidance to help you navigate the franchising process. Get in touch and let’s start building your expansion story today!