The vital importance of FDI in the economic growth and development of developing nations cannot be denied. The Southeastern region has remained an essential receiver of concurrent global investments due to the vast potential in this geographical area. In ASEAN, FDI inflows have been gradually increasing since 2015, but the area encountered a decline of 25% in 2020 from 2019’s record high. The primary reason for this drop was the COVID-19 pandemic that affected a majority of the ASEAN states.

The region has retaliated by introducing significant measures to bridge the road towards recovery and further development. Some of the steps include expanding multinational enterprises, developing a recovery framework, pandemic response plan, and the foundation of the monumental Regional Comprehensive Economic Partnership (RCEP) agreement. In addition, these states are actively advancing towards incorporating Industrial 4.0 technology to enhance manufacturing potential and industrial productivity.

Trends of foreign investment inflows

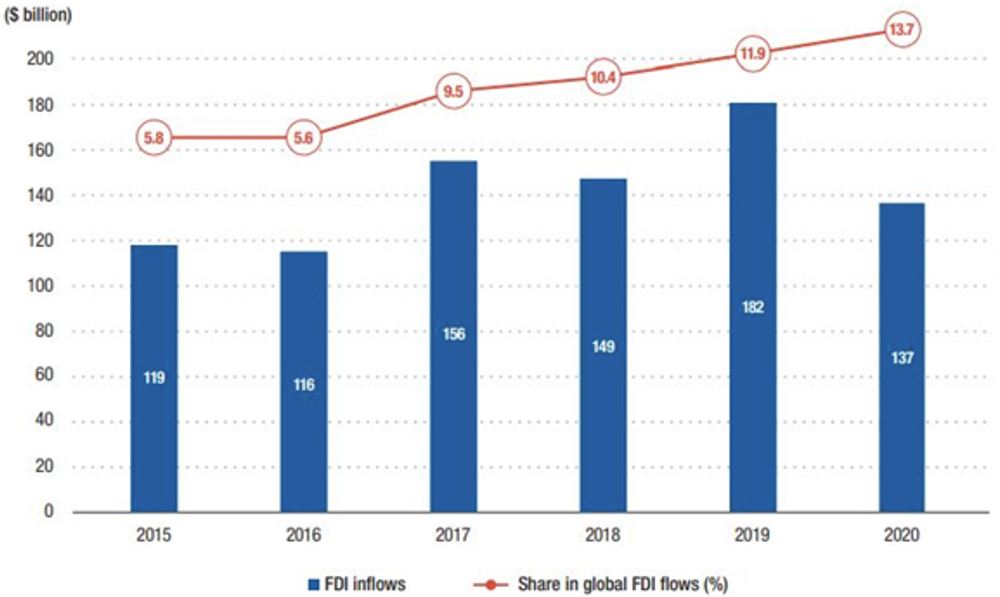

Southeast Asian states are a lucrative target for foreign investors due to their immense resources and development potential. The region encountered continuous FDI growth till 2019 but took a hit in 2020 due to pandemic disruptions and investment speculations. As a result, the investments declined to $137 billion in 2020 compared to the previous year. Despite the decline, the global share of investments climbed from 11% in 2019 to 13.7% in 2020, indicating the retained interest of foreign investors and MNE’s in this region.

ASEAN share in global FDI inflows (2015–2020). Source: UNCTAD

In the five developed Southeast Asian countries, Inflows declined in 2020, which accounted for more than 80% of FDI before 2020. The investment contraction in these significant states is the primary reason for the 25% FDI reduction from the previous year. On the other hand, three smaller states, i.e., Brunei, Laos, and Myanmar, saw an increase in investments but a low base amount. FDI in Cambodia did not face any change and remained resilient.

One of the top 10 investors of ASEAN, investments from Japan dropped majorly from $23.5 billion in 2019 to $8.5 billion in 2020. Inflows from European Union and the United Kingdom also plummeted. In contrast, FDI from Thailand, United States, and Switzerland rose, with Thailand leading the list, incrementing from $3.8 billion to $5.5 billion.

Intra-regional investments increased to $23 billion and pushed the intra-ASEAN share of FDI from 12% to 17% in the region. Numerous economic and regional integration opportunities are the driving force behind intra-regional investment expansion.

Intra-ASEAN investment flows (2015–2020). Source: UNCTAD

The challenges of emerging “Neo-Colonialism” in Southeast Asian geopolitics

The world has transformed immensely after World War II, and former colonies are enjoying their autonomy and independence in this era. Foreign direct investment is an appealing source of development in these states, but significant world economies can risk their economic and political culture. Over-dependence on foreign investments without any substantial national development plans can jeopardize the road to progress. ASEAN states should develop viable policy measures to escape the clutches of neocolonialism that can permeate the present system.

Recipient countries adopt practices like liberalization of markets and introduction of incentives including duty-free imports and tax exemptions to attract FDI. Such methods can result in displacing national companies and firms. Similarly, it is not possible to mitigate all ASEAN development issues solely on foreign aid. Therefore, it is essential to optimize this inflow with developmental plans to maximize the benefits. It is estimated that these states’ natural resources and raw materials are rapidly depleting due to projects by foreign industrial enterprises. This practice is also generating dependency on income generated by these methods.

National authorities must flourish their educational, industrial, and health infrastructure through innovative policies for marching towards development. Host countries need to develop a healthy domestic environment for business opportunities. It can promote economic growth by generating local employment opportunities. In addition, these states should introduce incentives to encourage domestic investments for originating regional advancement.

Conclusion

With the rapid globalization process, developed countries are engaged in a race to maximize their benefits by directing investments to developing states. Lower costs with diverse potential and resources in these geographical areas are attractive attributes for MNE’s to divert their assets in this region. However, many determinants can either accentuate or derail the developmental impact of FDI on Southeast Asian states. Therefore, host states must draft holistic policies to maximize this foreign inflow for local improvements and strategic development.

James Raussen is the Managing Director of SEA Solutions in Southeast Asia. He can be reached at solutions-sea.com.