The reason I want to write this article about real and fake investors because I see too many fake investors call themselves an expert and “educated wealth manager.” It is sad for people who believe how fake smart they are and lose people’s money again and again. However, they don’t lose money because they will charge their clients management fee and get money from that. For example, many hedge fund and private equity managers will charge a 2% management fee even when they have bad performance on the market.

Most people will go to school and learn stock market or trading class about investment bank such as M&A. However, 90% of school teachers don’t have real experience in the stock market or never work with investment banks. So how can they teach investment? And how could people learn from them? I will give an excellent example of the trading stock market and fake teacher vs. real teacher. Many teachers will tell you to try paper trading, which is fake money, and imagine people buy stocks to avoid making mistakes. However, good wealth managers are learning from their mistakes like Ray Dalio and Peter Lynch. If we don’t make mistakes, how could we learn from trading and avoid making the same mistake? This is a fake teacher.

Another point is about emotions. Real money and fake money will treat investors differently. After all, you probably will lose your lunch meal for next week because you can’t hold your emotions and are scared to lose all your or your parents’ money. The fake teacher will lead to fake students. And fake students will become future fake wealth managers.

I started trading stocks three years ago and still make a lot of mistakes. Even Ray Dalio went bankrupt when he was 30 years old. We are humans. We will make mistakes, which is how we could learn more knowledge from our mistakes and change it then make them better.

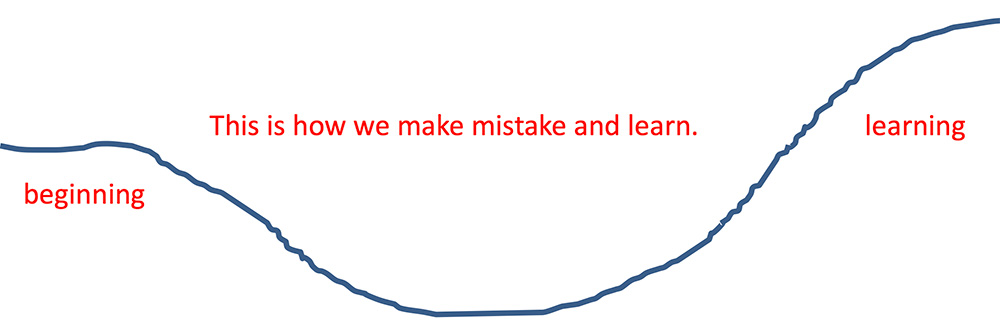

From the beginning, we think we know more things than we know. Then, we will make mistakes, and we notice that our actual knowledge. Then we will study it and learn from the error and make it better. This is how real-life learning and studying circle. Most people just avoiding mistakes and keep move to another part, but they will make the same mistake again and again.

This is the biggest gap between real investors and fake investors. Learning, most hedge fund managers and private equity managers don’t study from their mistakes. They try to avoid it, and they don’t try to change it. My weakness is the financial report. Then, I try to read one report every week and find the most critical information in the company’s report and study for it. I am not saying that I am a real investor. However, I study hard for my mistake and my weakness. Also, I will keep posting my thoughts on the market and my personal investing life with people.

Sincerely,

Xingyu Yang (James)

About Xingyu Yang (James)

Xingyu Yang established and operates private equity fund T&J Brothers group, LLC in Los Angeles. I specialized in private equity fund investment and public transaction, financial advisory, planning, and strategic asset allocation. I was involved in the IPO (initial public offering) of INmune Bio (biotech) and the merge of Armo company. I am a follower of value investing and focused on future growth and enhancing private equity. I am also currently one of the youngest fund managers in Los Angeles.

Currently, I’m a senior finance student at UC Riverside with a finance major. Participated in the school UCR investment club, and in the East Los Angeles College, I founded the investment club for students to study and learn finance investment.

After I interviewed with Howard Marks (Oaktree Capital Investment Company CEO), I established my own investment beliefs, long-term value investment. I am also SkyBridge Alternative (salt) young leader membership. And a member of the California alternative investment association. And one of the young members of the California Association of municipal finance officials. Previously, I was a speaker at the Opal group’s financial summit in the 2019 winter. I focus on the concept of value investment and analysis. In the private equity fund, T&J Brothers group, LLC will publish views on investment and analysis about market review and opinions. I have had five years of investment and analysis experience in US stocks and have published an analysis of individual companies with James Early (Motley Fool manager).