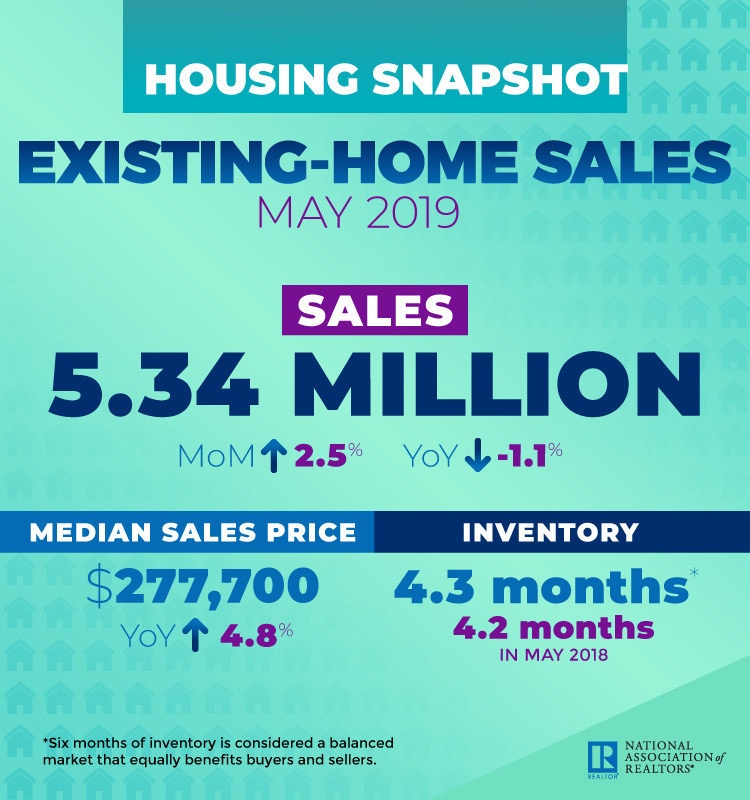

Existing-home sales rebounded in May, recording an increase in sales for the first time in two months, according to the National Association of Realtors®. Each of the four major U.S. regions saw a growth in sales, with the Northeast experiencing the biggest surge last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, jumped 2.5% from April to a seasonally adjusted annual rate of 5.34 million in May. Total sales, however, are down 1.1% from a year ago (5.40 million in May 2018).

NAR Chief Economist, Lawrence Yun

Lawrence Yun, NAR’s chief economist, said the 2.5% jump shows that consumers are eager to take advantage of the favorable conditions. “The purchasing power to buy a home has been bolstered by falling mortgage rates, and buyers are responding.”

The median existing-home price for all housing types in May was $277,700, up 4.8% from May 2018 ($265,100). May’s price increase marks the 87th straight month of year-over-year gains.

Total housing inventory at the end of May increased to 1.92 million, up from 1.83 million existing homes available for sale in April and a 2.7% increase from 1.87 million a year ago. Unsold inventory is at a 4.3-month supply at the current sales pace, up from both the 4.2 month supply in April and from 4.2 months in May 2018.

Though inventory is up, the months’ supply numbers remain near historic lows, which has a direct effect on price, according to Yun. “Solid demand along with inadequate inventory of affordable homes have pushed the median home price to a new record high,” he said.

Properties remained on the market for an average of 26 days in May, up from 24 days in April and equal to the 26 days in May of 2018. Fifty-three percent of homes sold in May were on the market for less than a month.

Given that housing and properties have been selling so quickly, Yun continues his call for new construction. “More new homes need to be built,” he said. “Otherwise, we risk worsening the housing shortage, and an increasingly number of middle-class families will be unable to achieve homeownership.”

Realtor.com®’s Market Hotness Index, measuring time-on-the-market data and listing views per property, revealed that the hottest metro areas in May were Rochester, N.Y.; Fort Wayne, Ind.; Lafayette- West Lafayette, Ind.; Boston-Cambridge-Newton, Mass.; and Midland, Texas.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage decreased to 4.07% in May, down from 4.14% in April. The average commitment rate across all of 2018 was 4.54%.

“The month of May ushered in the home sales upswing that we had been expecting,” said NAR President John Smaby, a second-generation RealtorÒ from Edina, Minnesota and broker at Edina Realty. “Sales are strengthening in all regions while we see price appreciation for recent buyers.”

First-time buyers were responsible for 32% of sales in May, unchanged from the 32% the month prior and up from the 31% recorded in May 2018. NAR’s 2018 Profile of Home Buyers and Sellers – released in late 20184 – revealed that the annual share of first-time buyers was 33%.

All-cash sales accounted for 19% of transactions in May, down from April and a year ago (20% and 21%, respectively). Individual investors, who account for many cash sales, purchased 13% of homes in May, down from 16% in April and from 14% a year ago.

Distressed sales5 – foreclosures and short sales – represented 2% of sales in May, down from 3% in April and from 3% in May 2018. Less than 1% of May 2019 sales were short sales.

Single-family and Condo/Co-op Sales

Single-family home sales sat at a seasonally adjusted annual rate of 4.75 million in May, up from 4.63 million in April and down 0.8% from 4.79 million a year ago. The median existing single-family home price was $280,200 in April, up 4.6% from May 2018.

Existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 590,000 units in May, up 1.7% from the prior month and down 3.3% from a year ago. The median existing condo price was $257,100 in May, which is up 5.4% from a year ago.

Regional Breakdown

May existing-home sale numbers in the Northeast increased 4.7% to an annual rate of 670,000, about equal to a year ago. The median price in the Northeast was $304,100, up 6.6% from May 2018.

In the Midwest, existing-home sales jumped 3.4% to an annual rate of 1.22 million, which is 3.9% below May 2018 levels. The median price in the Midwest was $220,500, an increase of 5.6% from a year ago.

Existing-home sales in the South grew 1.8% to an annual rate of 2.32 million in May, up 1.3% from a year ago. The median price in the South was $241,400, up 3.6% from a year ago.

Existing-home sales in the West grew 1.8% to an annual rate of 1.13 million in May, 3.4% below a year ago. The median price in the West was $409,100, up 4.1% from May 2018.