Employers globally report significant declines in hiring intentions for Q3, reflecting the impact of the COVID-19 crisis on health, the economy and employment across the world. ManpowerGroup’s Employment Outlook Survey (NYSE-MAN) asks 38,000 employers across 43 countries whether they intend to hire additional workers or reduce the size of their workforce in the coming quarter. The report reveals weaker hiring intentions in all 43 countries compared with this time one year ago, and a dip to a 20 year low in 27 markets, reflecting the magnitude of the pandemic’s impact. The survey is the most comprehensive, forward-looking employment survey of its kind, used globally as a key economic indicator and the research was conducted in April 2020.

“These results show the impact the health crisis has had on hiring plans as COVID-19 moved in waves across the globe,” said Jonas Prising, ManpowerGroup Chairman & CEO. “The significant declines across many countries reflect the unprecedented speed and magnitude of shutdown, which resulted in an almost total activity freeze across many industries. Typically, structural labor market changes take months if not years to impact. We believe this crisis will accelerate transformation that we have been tracking and predicting for some time. Employers will continue to require increasingly specific technical and soft skills, digitization will accelerate, and individuals will demand a way of working that is closer to what they have wanted all along – more inclusive, more flexible and more wellbeing-oriented than we could ever have imagined.”

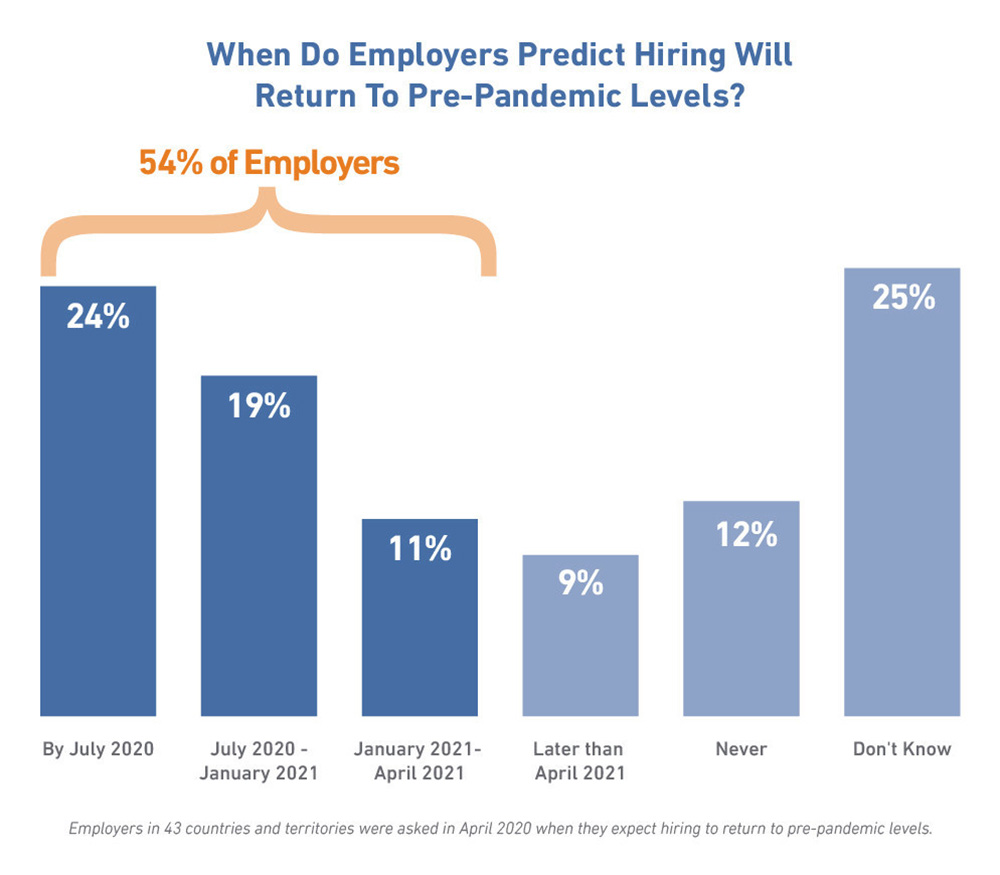

Employers were also asked when they expect hiring to return to pre-COVID-19 levels, with results revealing cautious optimism, and 54% predicting a return by April 2021:

Global Hiring Plans by Region

EMEA: Q3 employment outlooks decline quarter-over-quarter in all 26 countries.

- UK employers report the weakest hiring prospects since the survey began in 1992 with hiring plans weakening considerably quarter-over-quarter (declining by 17 percentage points).

- Employers in France report the weakest outlook since the survey began 17 years ago. The most significant declines are reported by employers in the Restaurants & Hotels sector and in Wholesale & Retail Trade, declining by 66 and 27 percentage points respectively.

- In Italy employers report the weakest hiring intentions in six years (-15%) driven by deep declines in the Restaurants & Hotels and the Finance & Business Services sectors.

- Employers in Germany report weaker quarter-over-quarter outlooks across all seven sectors, with the outlook in Finance & Business Services declining by 17 percentage points to an 11 year low.

Americas: This quarter marks a record low outlook for nine of the 10 Americas countries surveyed in almost twenty years, excluding the U.S.

- In the U.S. employers expect very modest hiring with outlooks declining by 16 percentage points when compared with the previous quarter and are the weakest since 2009. One of the most significant declines is reported in Leisure & Hospitality with employers reporting the weakest outlook in more than ten years.

- Employers in Mexico report the weakest hiring prospects since the survey began 18 years ago, the most significant declines are reported by employers in Commerce, Construction, Services and Transport & Communication.

- In Argentina hiring plans weaken quarter-over-quarter in all nine industry sectors with employers in Finance, Insurance & Real Estate, Manufacturing and Transportation & Utilities reporting their weakest outlooks since the survey began 13 years ago.

Asia Pacific: Outlooks from employers in Japan and India rank as the strongest globally, while Singapore has the weakest employment outlook globally.

- Employers in Singapore report the weakest outlook in 11 years. In both the Manufacturing sector (-21%) and the Services sector (-35%), employers anticipate a considerable decline in hiring plans.

- Hiring intentions are the weakest in 17 years in Australia (-12%), the weakest outlooks are reported by employers in Finance, Insurance & Real Estate (-21%) and Wholesale & Retail Trade (-19%).

- The employment outlook in India has hit a 17 year low, with employers in Manufacturing, Services and Wholesale & Retail Trade reporting their weakest forecasts since the survey began in 2005.

To view complete results for the ManpowerGroup Employment Outlook Survey, visit manpowergroup.com/meos.

*The Net Employment Outlook is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting a decrease in hiring activity.