Mortgage rate hikes, a weak stock market and general economic concerns, particularly regarding the housing market, combined to deter many buyers from purchasing a luxury second home in Q3 2022 resulting in a 28% quarter-over-quarter decline in mortgage rate locks across the country, according to data analyzed by Pacaso’s research team.

“The pandemic unleashed unprecedented, unsustainable demand for luxury second homes,” said Austin Allison, Co-Founder and CEO of Pacaso. “While market conditions deterred many buyers from making purchases in Q3, mortgage rate locks are still flowing at double the pace from before the pandemic. Remote work has become so prevalent that it’s created a new normal for luxury second homes, and we should continue to see elevated demand in historical terms even as market conditions take the froth off.”

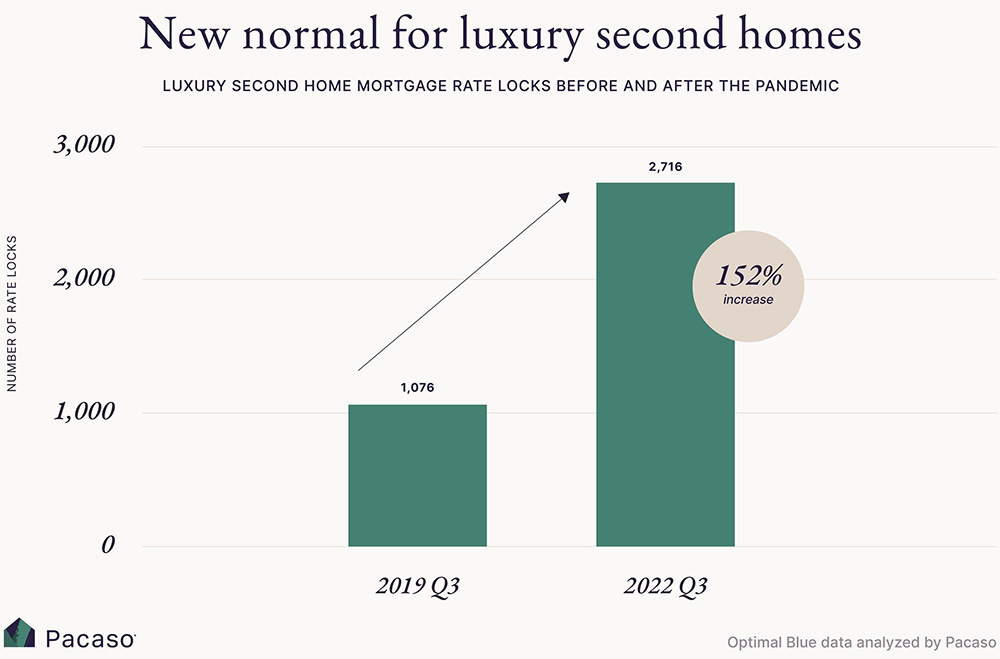

Luxury second home rate locks were 152% higher in Q3 2022 than they were in Q3 2019, the last reading for the same season before the pandemic. In fact, every quarter from Q3 2020 to Q3 2022 saw rate locks on luxury second homes clock in at more than double the level in the corresponding quarter of 2019.

Luxury second home rate locks were 152% higher in Q3 2022 than they were in Q3 2019, the last reading for the same season before the pandemic.

In 2018, according to the U.S. Census, just 8 million people in the U.S. worked from home, or 5.3% of workers. Today, a recent McKinsey survey found that “58% of employed respondents…equivalent to 92 million [workers]…report having the option to work from home for all or part of the week.” That is a historic development that will continue to fuel second home demand for many years to come.

“Market conditions are temporary, but remote work and the desire to spend time with your people in amazing places are here to stay. That’s why I remain bullish on second homes in the long-run, especially in the luxury tier and despite the short-term challenges,” continued Allison.

Reviewing regional data for Q3 2022, Pacaso observed a steeper decline in rate locks in premium destination communities, and an increase in more affordable locales, suggesting that buyers are adjusting their second home purchases to account for market conditions by opting for less expensive destinations closer to home.

Despite the decline in rate locks, luxury second homes maintained their value in Q3 2022. Prices have held up due to low inventory, as sellers who are also seeking to buy want to avoid trading a low mortgage rate for a high one, and as demand remains well above pre-pandemic levels. Some parts of the housing market began to see price declines in Q3 2022, particularly the middle and lower tiers in pandemic boomtowns. While that may extend to luxury second homes in destination communities down the line, second home prices in those communities did not lose ground in Q3 2022.