Each quarter, CFO Signals tracks the thinking and actions of leading CFOs representing North America’s largest and most influential companies. Since 2010, the survey has provided key insights into the business environment; company priorities and expectations; finance priorities; and CFOs’ personal priorities. Participating CFOs represent diversified, large companies averaging more than $10 billion in annual revenue.

This quarter, not surprisingly, the vast majority of CFOs mentioned worries related to COVID-19 — especially around new virus waves, further shutdowns, and unstable consumer health/demand. As stock markets continue to climb, 84% of CFOs now say equities are overvalued — the second-highest level in survey history — with just 2% saying markets are undervalued. Furthermore, with ongoing low-interest rates, debt attractiveness rose from 63% to 87%. After dipping to 27% last quarter, the proportion of CFOs saying it is a good time for risk-taking rebounded to the pre-pandemic norm of 41% — still low relative to the levels from 2017 and 2018.

Overall, just 37% of CFOs say they expect to achieve 95% or more of their originally-budgeted 2020 revenue, and another 36% say between 75% and 94%. Health care/pharma, energy/resources, and financial services are the most optimistic, expecting an average of 95%, 83% and 79% of their targeted 2020 revenue, respectively. Retail/wholesale and manufacturing were the least likely to expect 95% or more of their target, with just 21% of their CFOs expecting to achieve this level.

Well over half of CFOs said one of their most important roles has been managing cash and liquidity, with significant mentions of related roles around refinancing the business and managing bank/creditor relationships. In fact, two-thirds of CFOs say they have raised or accessed additional cash, with most saying they are using it to fund cash reserves in the face of uncertainty. The most common other uses are around funding operations, acquisitions and projects planned pre-pandemic. Overall, just over 40% of CFOs report cash levels at least 10% above their pre-pandemic levels, with the average reporting 25% more cash.

“CFOs are recognizing that remote work, virtual sales and customer interactions will continue to be the primary operating state for some time. The strategic shifts they’re making as a result—including accelerated investments in digitization and heightened focus on achieving better flexibility in capacity and cost structure can help put their organizations in a better position to navigate the uncertain trajectory of the pandemic.” – Steve Gallucci, national managing partner, U.S. chief financial officer program, Deloitte LLP.

“Overall, nearly one-quarter of CFOs say their company is already at or above its pre-crisis operating level, and another 19% say they expect to be there by the end of 2020—an improvement from our 2Q20 survey in May and our supplemental poll in June.” – Sanford Cockrell III, global leader, global chief financial officer program, Deloitte Touche Tohmatsu Limited.

Overall, 45% of CFOs say they are operating at 95% or higher capacity, with an additional 39% saying 75% to 94%. Technology, financial services and services lead, with at least 92% of each citing 75% of capacity or higher. Just 16% overall say they are below 75% capacity, led by retail/wholesale, manufacturing and services. Retail/wholesale CFOs are the most likely to cite current capacity below 55% and also below 35%.

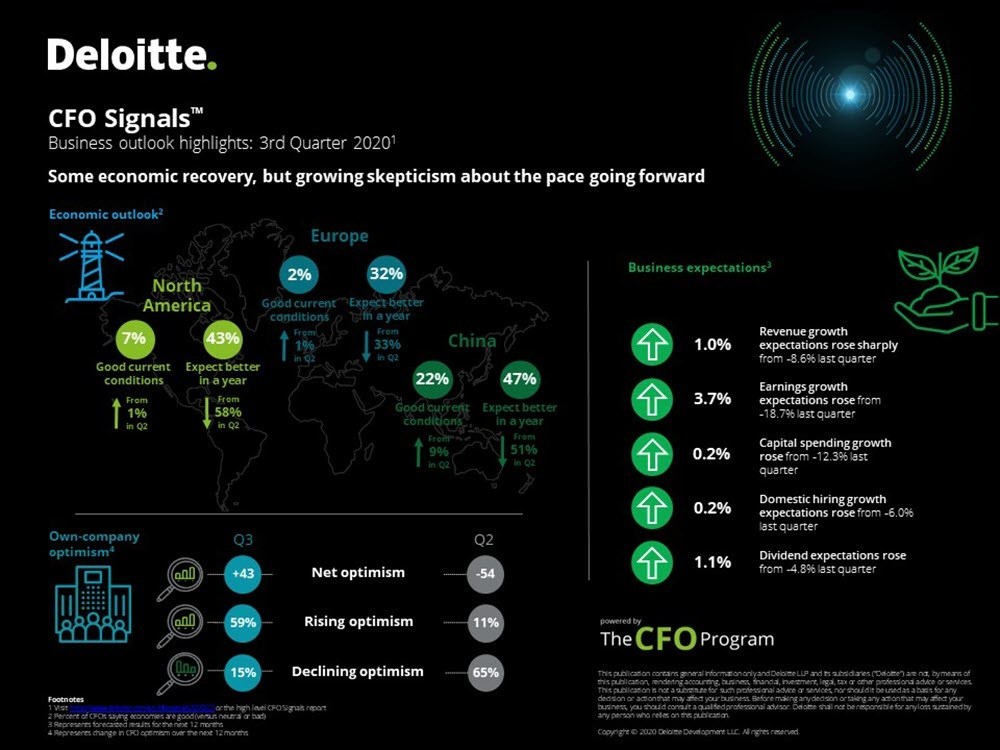

Assessments of Chinese economy better than those for North America

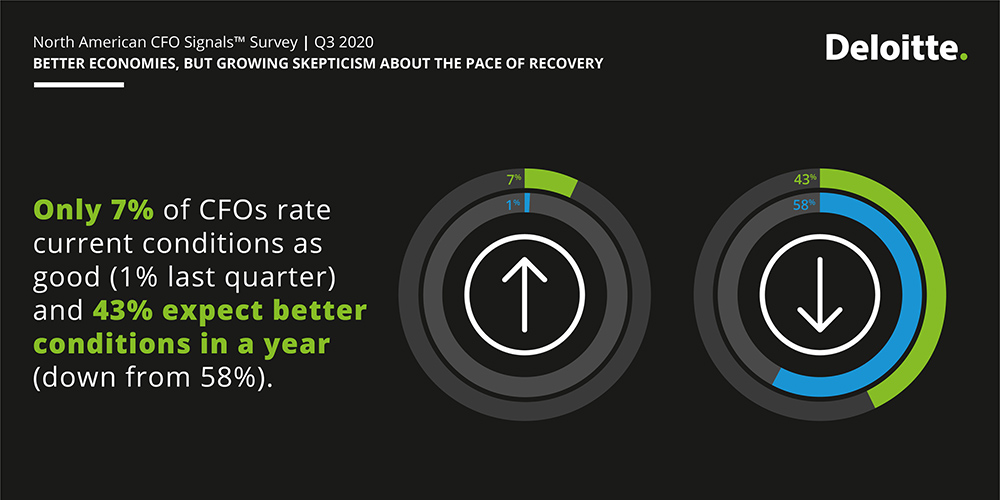

Perceptions of North America rose, with 7% of CFOs rating current conditions as good (1% last quarter), but only 43% now expecting better conditions in a year (down from 58%). Europe was flat, with 2% rating current conditions as good and 32% expecting better conditions in a year. China came in at 22% and 47% — above North America for the first time in survey history.

CFO optimism

The proportion of CFOs saying they are more optimistic rose sharply, with the optimism index vaulting from last quarter’s -54% to +43% — a muted finding since last quarter’s optimism was, by far, the lowest in survey history. Nearly 60% of CFOs expressed rising optimism, well above last quarter’s 11%.

To see additional results from Deloitte’s third-quarter 2020 CFO Signals survey, download a copy here.

Methodology

Each quarter, CFO Signals tracks the thinking and actions of CFOs representing many of North America’s largest and most influential organizations. This report summarizes CFOs’ opinions in four areas: business environment; company priorities and expectations; finance priorities; and CFOs’ personal priorities.

The CFO Signals survey for the third quarter of 2020 was conducted during the period opening Aug. 3, 2020, and ending Aug. 7, 2020. A total of 155 CFOs responded. This survey seeks responses from client CFOs across the United States, Canada and Mexico. All respondents are CFOs from the U.S., Canada and Mexico. The vast majority are from companies with more than $1 billion in annual revenue. Participation is open to all industries except for public sector entities.