Each quarter, CFO Signals tracks the thinking and actions of leading CFOs representing North America’s largest and most influential companies. Since 2010, the survey has provided key insights into the business environment; company priorities and expectations; finance priorities; and CFOs’ personal priorities. Participating CFOs represent diversified, large companies. More than a quarter of respondents reported revenue in excess of $10 billion.

Economic outlook:

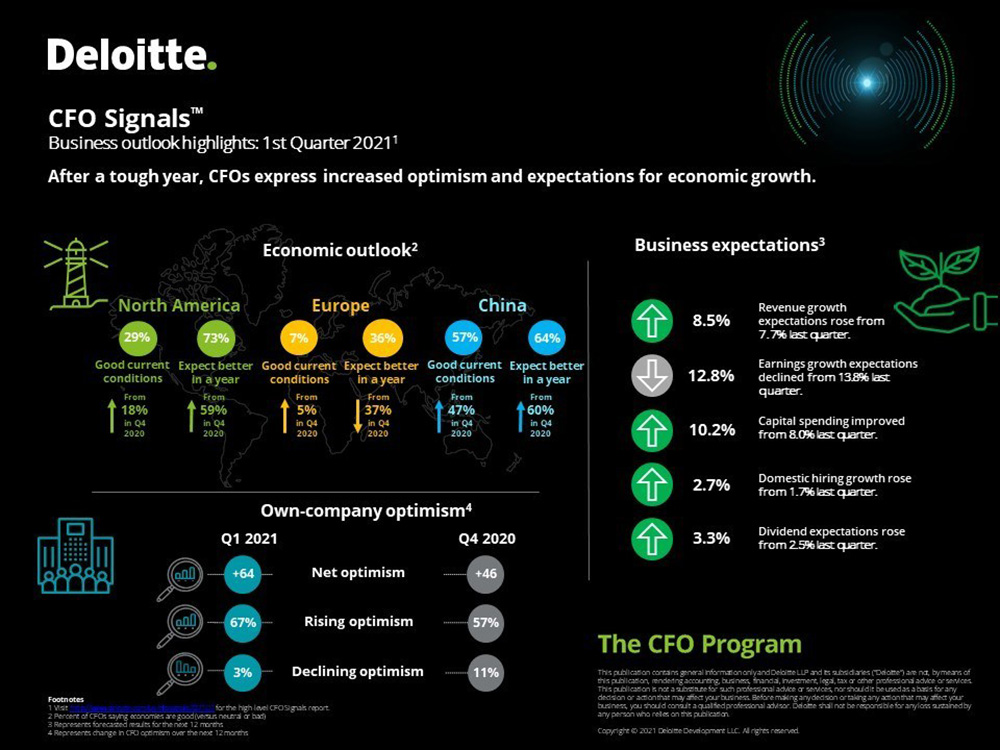

The rollout of COVID-19 vaccines appears to have buoyed CFOs’ views on the North American and Chinese economies, and China’s ongoing reopening may have added to the increased positivity. In the latest quarterly CFO Signals survey, CFOs’ assessments of North America’s economy rose, with 29% citing it as good now and 73% as better in the next year. The percentage of CFOs viewing Europe’s current conditions as good also inched up from 5% in the fourth quarter of 2020 to 7%, while the percentage of those expecting improvement in a year fell slightly from 37% to 36%. Regarding China’s economy, 57% of CFOs cite current conditions as good, and 64% expect they will be better in a year.

Capital markets:

More than three-fourths (83%) of CFOs consider the equity markets overvalued; 2% see them as undervalued. On debt financing, 91% of CFOs view it as attractive, while 55% say the same for equity financing.

Risk-taking and risk concerns:

Some 66% of CFOs think this is a good time to take on greater risk, up from 49% in the fourth quarter of 2020, and a survey high. Internal risks cited by CFOs include a concern for the well-being and retention of talent, strategy execution and growth, as well as cost containment. Among the top external risks, CFOs cited ongoing concerns over the pandemic and timing of reopening, potential regulatory changes, the health of the economy, and cyberthreats.

Own-company sentiment:

Compared to three months ago, more than half of CFOs (57%) feel somewhat more optimistic about their companies’ financial prospects, and 10% are significantly more optimistic. Only 3% are somewhat or significantly less optimistic, while the remainder see their companies’ financial prospects as broadly unchanged.

Operating levels:

More than one-third (37%) of CFOs say their company is already at/above pre-crisis (or near-normal) operating levels, but for 10%, recovery is significantly delayed. These results show some improvement from the fourth quarter 2020 survey when just 18% of CFOs said they were already at/above their pre-crisis operating levels or would be by the end of 2020. Looking ahead, 2% and 3% of CFOs expect to return to near-normal operating levels in the first quarter of 2021 and the second quarter of 2021, respectively.

“Overall, we are seeing optimism from CFOs and an expectation that the economy will continue strengthening as society emerges from the pandemic. The lasting impact that the past year has had on business is becoming clearer as organizations shift to new ways of working, and new ways of engaging with customers, enabled by the acceleration of digital transformation.” – Joe Ucuzoglu, Chief Executive Officer, Deloitte US.

“After a year of upheaval, we are seeing a significant uptick in CFO confidence this quarter regarding both macro-economic trends and individual company performance. More than one-third of CFOs indicated their companies are operating at or above pre-crisis levels, an encouraging sign compared to prior surveys. Still, a large percentage project it will take longer, 10% as far out as third quarter of 2022 or later. And while COVID-19 cases are falling and progress is being made on vaccine deployment, CFOs remain highly concerned about the well-being of their talent and potential burnout.” – Steve Gallucci, national managing partner, U.S. Chief Financial Officer Program, Deloitte LLP.

Vaccination requirements

Less than one-fifth (18%) of CFOs expect to require all employees or employees in some functional areas/roles to receive a COVID-19 vaccination in order to return to on-site work (with the exception of those with a medical/religious or other reason). In addition, 41% of CFOs do not expect a COVID-19 vaccination to be required for any of their employees to return to work on-site.

Post-pandemic travel

Eighty-six percent of CFOs expect their post-pandemic travel expenses, as a percentage of their pre-pandemic levels, to be less than 81%. That figure includes 60% of CFOs who expect their post-pandemic travel expenses to be less than 71% of their pre-pandemic levels. Breaking it down further: More than one-third (36%) of CFOs anticipate their post-pandemic travel expenses to fall to 60% or less than their pre-pandemic levels.

Finance operations

Less than one-third (31%) of CFOs expect the majority of their finance staff to work four or more days on-site post-pandemic, and 45% expect the on-site work week to be three days. While results vary by industry, some industries appear to have similar expectations for on-site work. As for the functions they would most like to improve, CFOs overwhelmingly cite financial planning and analysis (63%) and management reporting (46%). Data analytics and forecasting top the areas of expertise CFOs seek to strengthen their finance teams.

Pandemic’s impact on the scope of the CFO’s role

More than half of CFOs (54%) report having higher demands from their executive/leadership teams since the beginning of the pandemic, while 37% say they have more work/volume within the pre-pandemic areas of their functional responsibility. More than one-quarter (26%) report having broader functional responsibility than pre-pandemic (e.g., more groups reporting to them).

Key takeaways:

- CFOs show greater optimism for their organizations’ financial prospects, with 67% reporting they are somewhat or significantly more optimistic compared to three months ago.

- More than half of CFOs (54%) report having higher demands from their executive/leadership teams since the beginning of the pandemic, while 37% say they have more work/volume within the pre-pandemic areas of their functional responsibility.

- More than one-third (36%) of CFOs anticipate the percentage of their post-pandemic travel expenses to fall to 60% or less than pre-pandemic levels.

- Less than one-fifth (18%) of CFOs expect to require all employees or employees in some functional areas/roles to receive a COVID-19 vaccination before returning to on-site work (except those with a medical/religious or other reason).

- CFOs’ expectations for the majority of their finance staff to work on-site post-pandemic reveal a hybrid approach.

Methodology

Each quarter, CFO Signals tracks the thinking and actions of CFOs representing many of North America’s largest and most influential organizations. This report summarizes CFOs’ opinions in four areas: business environment, company priorities and expectations, finance priorities, and CFOs’ personal priorities.