Canadian Pacific Railway Limited (TSX: CP) (NYSE: CP) said that the executive order signed by President Biden addressing competition in the U.S. economy sends clear messages: no rail mergers that reduce competition or hurt passenger service and that the U.S. economy needs more competition among railways.

A CP-KCS combination would be a positive step toward more competition – not less – in the freight rail industry with no need for regulatory solutions. In contrast, a proposed CN-KCS combination creates competitive issues and reduces options for rail customers that will require additional regulation to overcome.

Additionally, CN-KCS brings with it more challenges for existing Amtrak service on CN’s lines south of Chicago that already have a history of operating issues and one of the worst on-time performance records in the industry, and challenges for the desired establishment of future passenger service in Louisiana.

In contrast, CP has consistently received an A rating from Amtrak, leading the industry for the previous five years-plus, in its annual host railroad report card recognizing its industry-leading on-time performance record. CP is also the first Class 1 railroad to complete 100 percent certification of its Amtrak schedules. CP is supportive of working with all stakeholders to introduce intercity passenger rail service between New Orleans and Baton Rouge, an outcome that comes with far more capacity and operational flexibility, and less risk to Louisiana taxpayers.

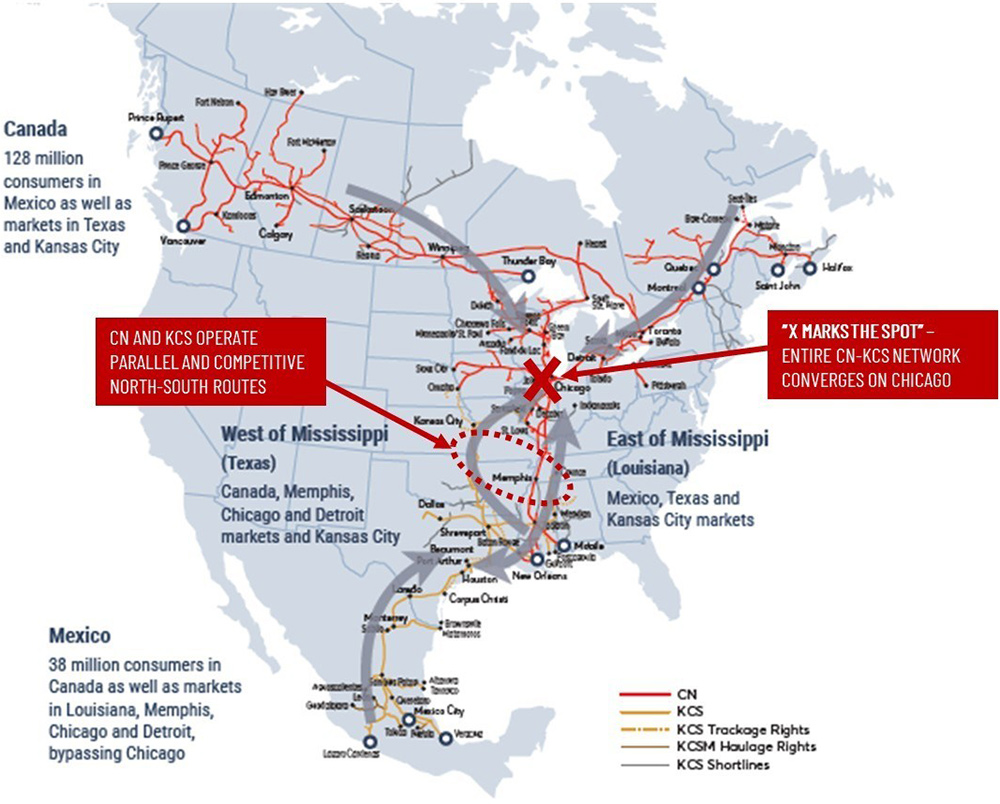

CN’s own map highlights the parallel route structure of a combined CN-KCS system that would funnel all of its traffic through Chicago. CN wrongly argues that the only rail competition worth protecting is where a shipper would suffer a reduction from two to one serving railroad. Even for those shippers, CN cannot solve the problems its deal creates. The proposed divestiture solution for the Baton Rouge to New Orleans corridor fails to solve the underlying competitive problem as it touches only the last mile for certain shippers, while failing to address the reduction in competitive alternatives inherent in combining these two railroads’ parallel route structures.

CN-KCS map. © Canadian Pacific Railway Limited

Promises, promises…

CN keeps adding promises that are no more than band-aid solutions to the competition problems CN-KCS would create. The promises keep stacking up and now include:

- A rate-freeze for so-called 2-to-1 shippers

- A divestiture of a 70-mile segment, still lacking in important details

- Maintaining the level of capital spending on critical KCS lines south of Kansas City

- Keeping KCS intact if it’s divested

- A bottleneck rate commitment that CN claims would preserve CP-KCS routes as competition against CN

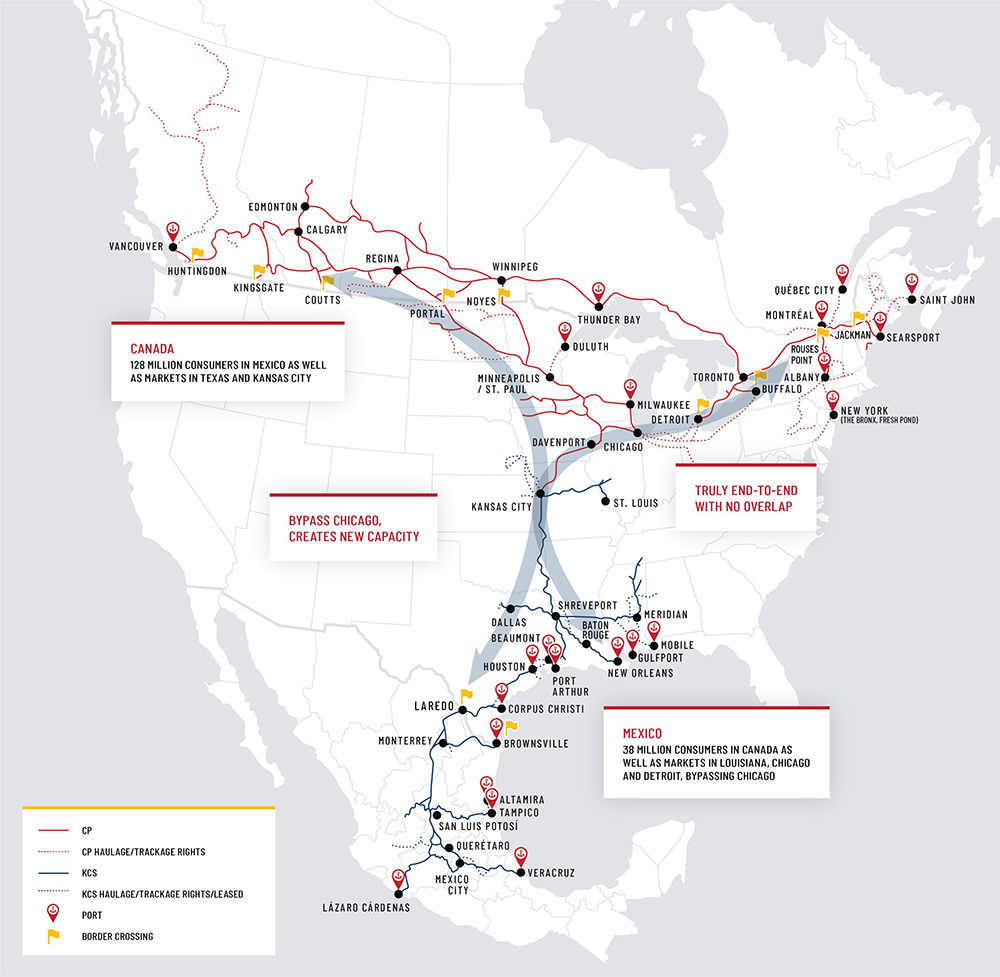

All of these promises would require regulatory oversight to enforce, and none would preserve true structural competition like the CP-KCS combination would create. A CP-KCS combination offers all the same benefits – and more – to rail shippers and the supply chain with none of these harms, or need to enforce CN’s growing list of promises through regulation. The CP-KCS combination:

- Unlocks new capacity for Amtrak passenger service, rather than interfering with passenger service between Baton Rouge and New Orleans and south of Chicago

- Creates single line routes to all the markets that a CN-KCS network would reach

- Brings new competition to and from Upper Midwest markets dominated by BNSF or UP that CN-KCS cannot address

- Creates new competition versus CN that CN-KCS actually eliminates

- Has a route network that does not funnel all of its traffic through the congested Chicago area

CP-KCS would be better for Amtrak and achieves the goals of President Biden’s executive order, while CN-KCS would reinforce the problems the order is trying to solve.

CP-KCS remains the only viable Class 1 combination

As previously announced, CP is continuing to pursue its application process to acquire KCS so that the pro-competitive CP-KCS combination can be reviewed by the STB and implemented without undue delay, in the event KCS’ agreement with CN is terminated or CN is otherwise unable to acquire control of KCS.

For more information on the benefits of a CP-KCS combination and the risks that a CN-KCS transaction would pose to the railway industry and North America, visit FutureForFreight.com.

CP-KCS combination. © Canadian Pacific Railway Limited