BUSINESS AND MONEY

Three-quarters of working professionals believe mentorship matters for their career growth. Yet more than half go without one. This disconnect between perceived value and actual access has created what workforce researchers call the mentorship gap—a structural problem that costs companies talent and costs individuals opportunity.

The numbers tell a striking story. According to a 2025 survey from MentorcliQ, 76% of professionals believe a mentor is important for growth, yet over 54% do not have one. Meanwhile, 98% of Fortune 500 companies now offer formal mentoring programs, and those that do report median profits more than twice as high as those without such programs. Organizations clearly recognize mentorship’s value. But access remains uneven, particularly for first-generation students and young people from under-resourced communities who lack the professional networks that often lead to mentorship in the first place.

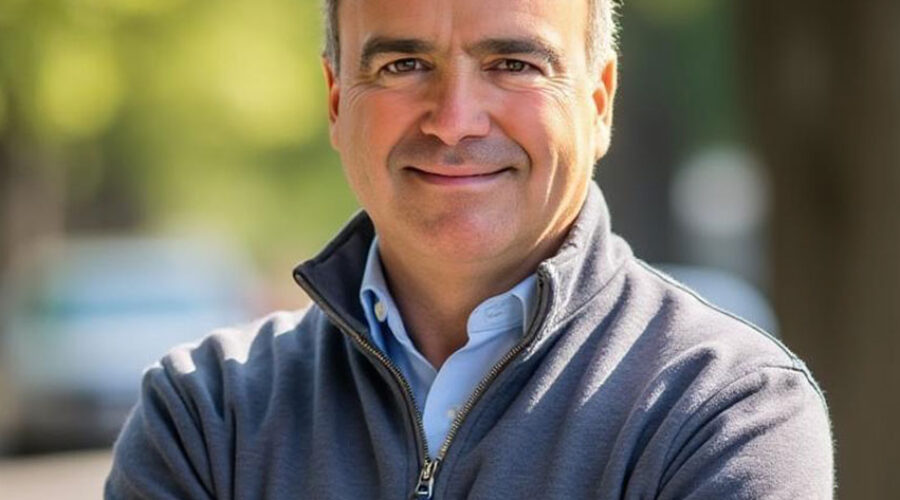

JP Conte, managing partner of family office Lupine Crest Capital and a former leader at a San Francisco-based private equity firm, has spent years working to close this gap. His approach combines financial support with something harder to scale: personal involvement. Through his work with SEO Scholars—a free, eight-year academic program that has achieved an 85% college graduation rate among students from low-income backgrounds—Conte has made mentorship a hands-on commitment.

“These are kids who, voluntarily in eighth grade, agree to go into this program and do after-school work, work on Saturdays, work during the summer, and extra tutoring to supplement their public school education,” Conte has said. “Plus, they agreed to mentoring to get them to go to college.”

The Gap Between Intention and Access

For Gen Z workers entering the labor force, the mentorship deficit is particularly acute. Research from…

CURRENT EDITION

RH

WASHINGTON BUREAU

Top US Military Enlisted Leader Urges Congress to Prioritize Service Member Quality of Life

Senior Enlisted Advisor to the Chairman David L. Isom testified before the Senate Armed Services

DHS and ICE Sound Alarm on ‘Sanctuary Calamity’ in California

The U.S. Department of Homeland Security and U.S. Immigration and Customs Enforcement (ICE) have issued

Alexander Schifter: The Hidden Costs of Starting a Business Nobody Warns You About

As Alexander Schifter notes, starting a business involves more than just a great idea—it requires careful planning, budgeting, and awareness of hidden expenses that can creep up. Many entrepreneurs focus on product development or client acquisition without realizing how much groundwork goes into building a sustainable operation. From…

Asad Malik Discusses the Impact of Awards and Recognition on Building a Hospitality Business

In the hospitality industry, awards carry weight as they reflect quality, consistency, and guest satisfaction. Accolades like Michelin Stars, AAA Diamonds, and TripAdvisor Travelers’ Choice often signal to potential guests that a business meets or exceeds industry standards. This kind of recognition helps hotels, restaurants, and resorts stand out…

Imports Fuel America’s Economy as Trade War Threatens Growth

Imports are the largest contributor to the U.S. economy, according to new research, underscoring how rising global trade tensions and tariffs could pose risks to future growth.

A new study by demand-planning software company Algo finds that imports generate more economic output than any other…

How to Turn Your Home Into a Profitable Long-Term Rental

Homeowners considering rental income, especially those relocating, inheriting a property, or holding onto a former primary residence, often face the same tension: sell for a clean exit or convert the home from sale to rent and build a long-term rental. The residential rental market can make renting feel like…

The Ultimate Guide to Buying Your First Yacht: A First-Time Buyer’s Handbook

There’s a specific kind of magic that happens when you first step onto a deck that belongs to you. It’s more than just a purchase. Honestly, it’s the beginning of a different kind of life. For many people, the idea of owning a yacht starts as a distant dream…

In today’s competitive and fast-moving business landscape, flexibility is no longer optional — it is essential. Startups, small businesses, and expanding companies all face a common challenge: how to build a credible, professional presence without committing to high operational costs. Traditional office leases, long-term contracts, utilities, and maintenance expenses can quickly drain valuable resources that could otherwise be used for growth.

This is where virtual office solutions come in.

Virtual offices provide businesses with the infrastructure and credibility of a physical location — without the burden of maintaining one. Companies like VOffice Services in Singapore have positioned themselves as key partners for entrepreneurs and growing enterprises seeking a smart, cost-effective way to establish and maintain a professional business presence.

The Shift Toward Virtual Business Models

Over the past decade, work culture has transformed dramatically. Remote teams, online collaboration tools, digital communication platforms, and cloud-based systems have reshaped how businesses operate. With these shifts, the concept of a traditional office is no longer a necessity for many companies.

Yet even in a digital age, certain elements remain crucial:

- A registered business address

- Mail management

- Professional meeting spaces

- Administrative support

- Regulatory compliance

Virtual office providers bridge the gap between modern flexibility and traditional business credibility.

For growing businesses, this…

The construction and infrastructure sectors have always been critical to the growth and development of any economy. These industries provide the foundational structures and systems that power our communities—from buildings and bridges to transportation networks and utilities. However, what is often overlooked is the skilled workforce behind these monumental achievements. As projects grow in scale and complexity, the demand for skilled tradesmen is higher than ever before. But this increased demand brings challenges—especially when it comes to recruitment.

Skilled trades such as carpentry, welding, plumbing, electrical work, and masonry are the backbone of construction. Yet, with a shrinking pool of qualified workers and an increasing number of projects, the industry faces a significant talent shortage. As the world enters a new era of infrastructure development and urbanization, the role of skilled trades is becoming even more vital. To meet these growing demands, companies are increasingly turning to specialized recruitment agencies to find the right candidates.

In this article, we’ll explore how skilled trades are shaping the future of construction and infrastructure, and how businesses are addressing the challenge of finding and retaining the right talent.

The Growing Demand for Skilled Trades in Construction

The construction industry is undergoing a transformation. In the past,…

Where Small Businesses Are Overspending (& How To Fix It)

As a small business owner, you will always want to find ways to reduce your budget. It is wise to keep your costs down to improve your bottom line, but you must also be smart about cuts and avoid any that could harm the business or cost more in…

Cove Capital Investments Discusses Why Debt-Free DSTs Are Becoming the Gold Standard for Risk-Conscious Investors

In this article, Cove Capital Investments, a leader in debt-free Delaware Statutory Trust (DST) real estate investments for 1031 exchange and direct cash investors, outlines why debt-free DST offerings continue to be the “gold standard” among investors seeking a risk mitigation strategy in an evolving real estate landscape.

As…

Gulf Coast Western Reviews: How Crisis Management Defines Industry Leadership

In the volatile oil and gas sector, how a company navigates economic downturns often reveals more about its character than how it performs during boom times. Gulf Coast Western reviews consistently highlight one critical strength: the company’s ability to weather industry crises while maintaining transparency and partner trust. Since…

The Business Case for Investing in Supply Chain Talent

Wilmington, NC, has grown into more than a coastal city with charm. It is now home to a mix of manufacturers, healthcare providers, distributors, and service businesses that rely on the steady movement of goods and materials. From the Port of Wilmington to regional distribution hubs, local companies depend…

Growing Demand for Immigration Lawyers Highlights Role of Glenn Immigration LLC in Navigating U.S. Immigration Law

Glenn Immigration LLC, accessible online at GlennImmigration.com, is advancing its role as a trusted destination for individuals and families seeking expert legal help in navigating the United States immigration system. With a strong focus on personalized service and comprehensive counsel, the firm’s principal attorney, Pepper N. Glenn, has positioned…

New SensaPay report shows commuting and food costs continue to strain workers’ budgets as return-to-office policies expand

By Sandy Di Angelis / Associate WriterNew York remains one of the most expensive states in the nation for employees returning to in-person work, even though nearly a third of workers rely on public transportation for their daily commute, according to a February 2026 report.

The study, conducted by fintech company SensaPay, ranks New York fourth nationwide among states where return-to-office requirements place the greatest financial burden on workers. The analysis examined key office-related spending categories, including annual commuting costs and food-away-from-home expenses.

Despite 28 percent of New York residents using public transportation, the report found that employees still spend an average of $3,711 annually commuting to and from work. Combined with food-away-from-home costs of $4,928 per year, the typical New York office worker spends approximately $8,639 annually to maintain a traditional 9-to-5 office schedule.

The findings place New York behind only Hawaii, Nevada, and California in total return-to-office expenses.

According to the report, transportation costs were calculated using a mix of commuting methods, including single vehicle use, public transit, active commuting, and remote work rates. These figures were combined with per-capita food-away-from-home spending to determine the overall cost of working from the office in each state.

Hawaii topped the ranking with a combined annual return-to-office cost of $9,650 per worker, followed by Nevada at $9,400 and California at $8,840. Wyoming rounded out the top five, driven by the highest commute costs in the country despite lower food expenses.

In New York, high meal costs are a major driver of office-related expenses. While public transportation helps reduce fuel and parking expenses, frequent restaurant lunches and…

$1,776 Warrior Dividend Declared Tax-Free by IRS for U.S. Service Members

The Internal Revenue Service (IRS) has officially confirmed that the one-time $1,776 “Warrior Dividend” paid to more than 1.5 million U.S. service members in December 2025 is not taxable, allowing recipients to retain the full amount without federal income tax withholding.

The announcement by the Department of the Treasury…

California Realtors Push for Broader Homeownership in Response to State Address

The California Association of Realtors (C.A.R.) issued a formal response following Governor Gavin Newsom’s State of the State address, urging lawmakers to prioritize policies that expand homeownership opportunities and address California’s ongoing housing affordability challenges.

In its statement, C.A.R. acknowledged the governor’s recognition that housing costs remain one of the…

How to Protect Your Finances and Thrive in a Recession

For busy parents juggling childcare and bills, hourly workers with unpredictable schedules, and retirees living on fixed incomes, a recession can turn everyday expenses into daily stress. When an economic downturn hits, paychecks can shrink or disappear while essentials keep climbing, and the recession’s impact on a daily budget…

Borrowing money is a reality for most people at some point in their lives. Whether you’re applying for a mortgage, financing a car, or opening a new credit line, lenders evaluate more than just your income. They look closely at your financial track record to decide how much risk they’re taking on, and that’s where borrowing power comes in.

Borrowing power refers to your ability to qualify for loans and secure favorable terms. The stronger your financial profile, the more likely you are to be approved with lower interest rates. But even responsible borrowers can unknowingly trigger red flags that make lenders hesitant.

Understanding these warning signs ahead of time can help you avoid costly surprises and keep your financial options open.

Why Lenders Pay Close Attention to Risk Signals

When lenders review an application, they’re trying to answer one simple question: Will this person reliably pay back what they borrow?

To determine that, banks and credit issuers assess multiple factors, including your credit history, outstanding debt, and repayment patterns. Even minor missteps can raise concerns, potentially limiting how much you can borrow, or whether you’re approved at all.

Fortunately, many of the most common red flags are also preventable.

Red Flag #1 – Missing Payments…

EDITOR'S

CHOICE

Simple Ways to Get More Value Out of Your Everyday Spending

Crisis on America’s Roads: Why Commercial Transportation Safety Is Falling Behind the U.S. Economy

Over the past five years, the U.S. transportation industry has faced a noticeable rise in safety-related challenges. FMCSA reports a continued increase in violations and risk indicators across commercial fleets, while industry analyses point to higher accident severity and growing insurance costs. Many carriers struggle to pass FMCSA audits…

Kelln Small Provides Benefit Administration Strategies That Boost Retention

As Kelln Small highlights, organizations today are under rising pressure to attract and retain top talent, and a compelling benefits plan plays a crucial role in achieving that goal. Beyond salary, the way companies design, communicate, and provide benefits can profoundly influence employee satisfaction and loyalty.

With the rise…

Understanding the Basics of Modern Family Law and Issues Affecting Families

Family law addresses domestic and family relationships, including adoption, marriage, financial responsibilities, custody, and separation, to resolve disputes among family members. There are different family law systems across North America, and rules vary by jurisdiction, so when people search for a good family lawyer, they should seek one in…