Respected across the financial sector for his precise, disciplined investment philosophy, the man behind some of the most talked-about tech and energy calls of the last decade has again turned heads. Known for his conservative yet consistently profitable strategies, Ramdedovic, whom we had the opportunity to interview earlier this year has built a reputation for seeing value where others hesitate.

Ramdedovic’s portfolio includes significant holdings in companies such as NVIDIA, BYD, Siemens, Lenovo, Mitsubishi Heavy Industries, and Globalstar. His foresight is perhaps best illustrated by his early investment in Globalstar, prior to Apple’s announcement of a $1.5 billion investment in the satellite provider, exemplifies his foresight and strategic acumen.

While his expertise lies in energy and tech, Ramdedovic is not one to overlook emerging opportunities in other sectors. Recognizing the current dynamics in the defense industry, he notes, “While my expertise lies in energy and tech, the current dynamics in the defense sector are too compelling to ignore.”

Boeing Leads the Charge in Aerospace and Defense

Boeing (NYSE: BA) has recently surpassed its $184.40 buy point, buoyed by a substantial $20 billion contract awarded by the Trump administration for the development of the F-47 fighter jet. This contract significantly bolsters Boeing’s defense segment, positioning the company favorably within the aerospace and defense sector, which currently ranks fifth among 197 industry groups tracked by Investor’s Business Daily.

Other companies in the sector, such as Heico (NYSE: HEI), Howmet Aerospace (NYSE: HWM), Loar Holdings (NYSE: LOAR), and GE Aerospace (NYSE: GE), have also shown strong performance. Heico has regained its 50-day moving average, Howmet has reached new highs following robust earnings, and GE Aerospace has achieved a new 52-week high after posting solid Q1 results post its 2024 spin-off.

Underperformance of Industry Giants

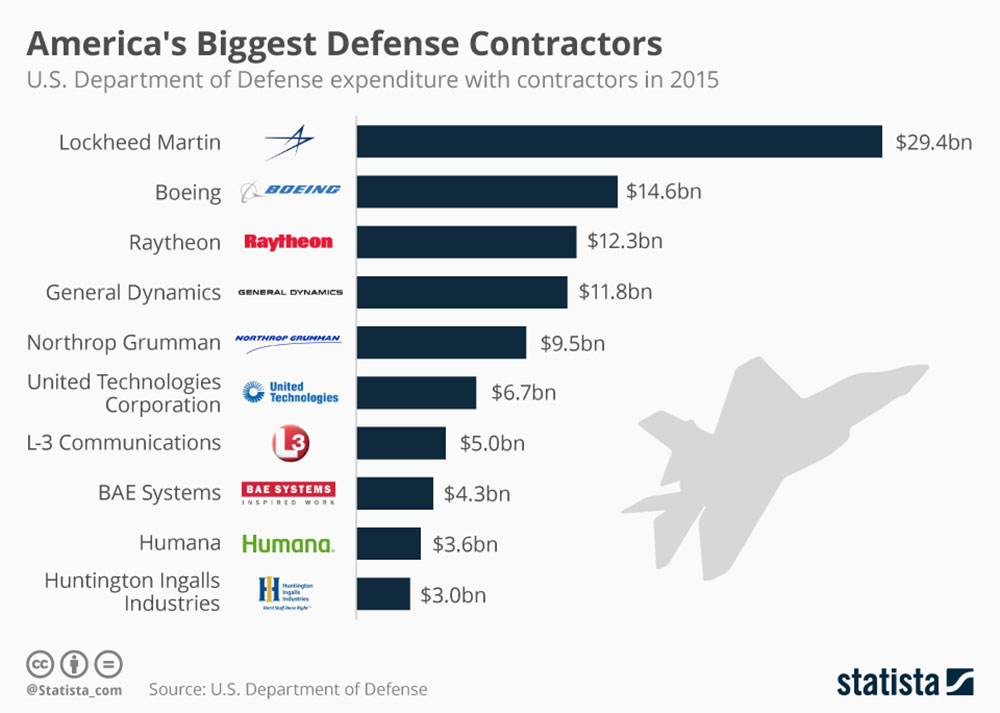

In contrast, industry stalwarts Lockheed Martin (NYSE: LMT) and Northrop Grumman (NYSE: NOC) have underperformed. Lockheed Martin experienced a decline after losing a significant defense contract to Boeing, while Northrop Grumman fell below key moving averages following weak Q1 earnings and a lowered EPS outlook for the year.

Ramdedovic’s Perspective on the Defense Sector

Though traditionally focused on energy and high-tech equities, Ramdedovic approaches emerging opportunities with the same disciplined rigor that has defined his career. He highlights a key principle that guides much of his strategy: aligning investments with the top-performing industry groups. Historically, stocks within the top 40 industry groups have produced a disproportionate share of market-leading returns and today, aerospace and defense ranks firmly among them, currently holding the fifth position by performance metrics.

In Ramdedovic’s view, this is not a coincidence but a signal. He believes that while macroeconomic conditions remain uncertain, the defense sector offers rare clarity in the form of government-backed revenue streams, robust capital commitments, and long-term procurement contracts. These factors, he argues, provide a degree of resilience that many other sectors cannot match in today’s volatile environment.

He urges investors to weigh the strategic merits of rebalancing their portfolios toward defense, at least in the short-to-mid term, particularly as geopolitical tensions and rearmament trends drive demand globally.

Economic Outlook Under the Trump Administration

The Trump administration’s economic policies, characterized by increased defense spending and protectionist trade measures, have had a mixed impact on the defense industry. While the administration’s budget proposal includes over $1 trillion for military upgrades, including new missile defense systems and modernization of nuclear deterrence, tariffs on imported materials like steel and aluminum have raised concerns about increased production costs for defense contractors.

Despite these challenges, major U.S. defense contractors have largely maintained their financial forecasts for 2025, indicating resilience in the face of trade tensions.

The current landscape presents a unique opportunity for investors to capitalize on the growth potential within the defense sector. With companies like Boeing leading the charge and favorable government policies in place, the sector is poised for continued growth. As Ramdedovic aptly states, ” This year isn’t about playing it safe, it’s about seeing value where others see controversy. That’s where outperformance lives.“

Investors seeking to diversify their portfolios should consider the defense sector’s potential, keeping in mind the importance of thorough research and strategic allocation.