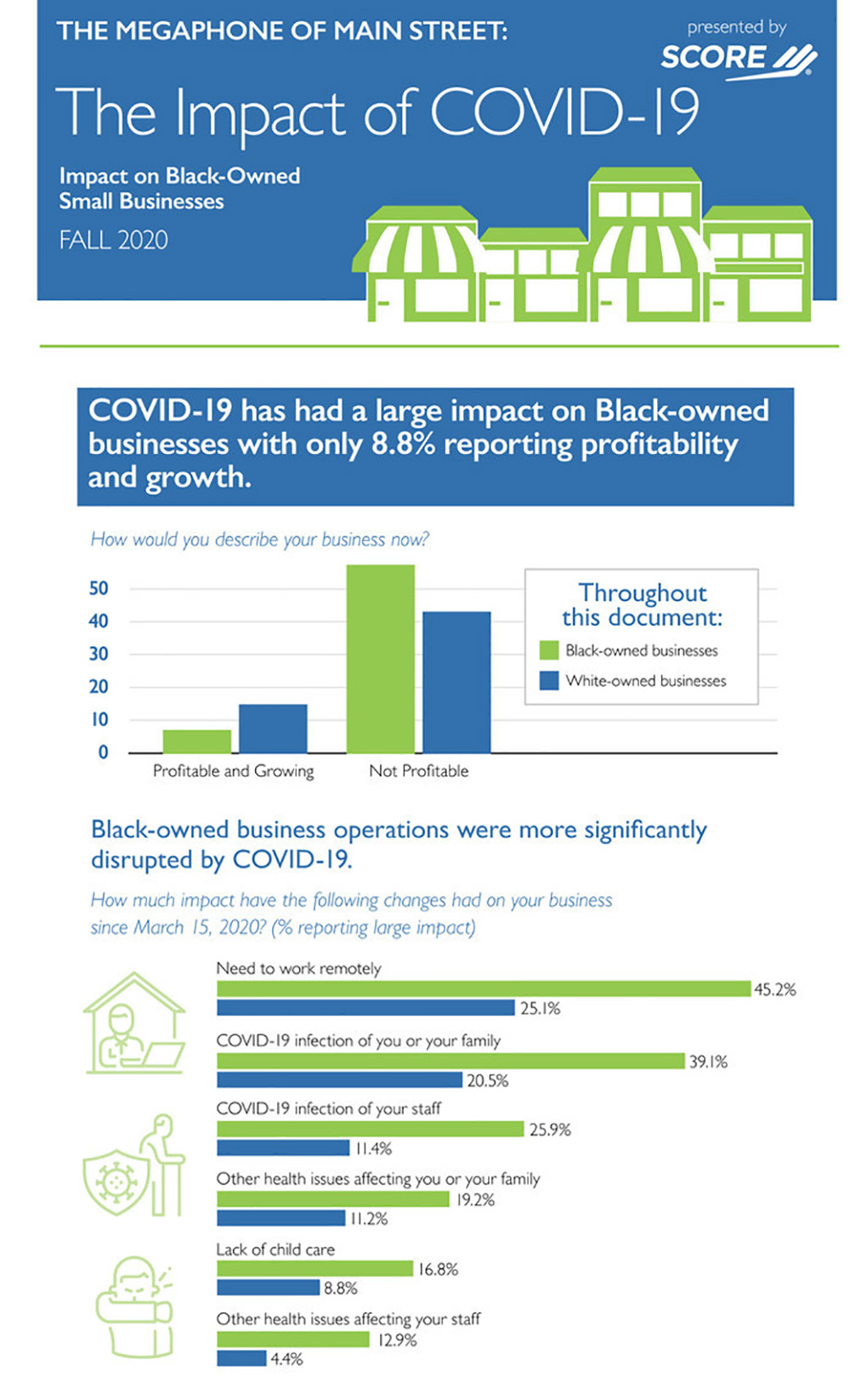

Black small business owners are 90.7% more likely than White small business owners to have a direct relationship (family, staff or themselves) with someone infected by COVID-19, and are 80% more likely to report that remote work has significantly impacted business, according to new survey data published by SCORE, the nation’s largest network of volunteer, expert business mentors. Despite seeking financial assistance at much higher rates, Black business owners were significantly less likely to receive both government and private funding.

Prior to COVID-19, Black business growth was on the rise. Between 2012 and 2018, Black business owners saw their total annual revenue grow by 23.0% – twice as fast as overall employer-businesses in the U.S., and Black business owners added employees at double the rate of all other U.S. businesses, growing staff by 24.0% compared to 10.8% of all small businesses during the same time period. However, COVID-19 has significantly impacted Black business success, with only 8.8% reporting profitability and growth today.

“SCORE understands that Black and minority small business owners face unique challenges, and SCORE is committed to helping every entrepreneur succeed,” said SCORE CEO Bridget Weston. “For this fifth edition of The Megaphone of Main Street data report, we chose to focus on COVID-19’s impact on minority small businesses, in order to better understand how specific groups have been disproportionately impacted by the pandemic, and how SCORE can best serve all entrepreneurs. In order to better serve small business owners, SCORE recently launched the Small Business Resilience Hub, and the Hispanic Business Owners Hub, and we look forward to the launch of the Black Business Owners Hub later this fall.”

Key findings of COVID-19’s impact on Black-owned small businesses include:

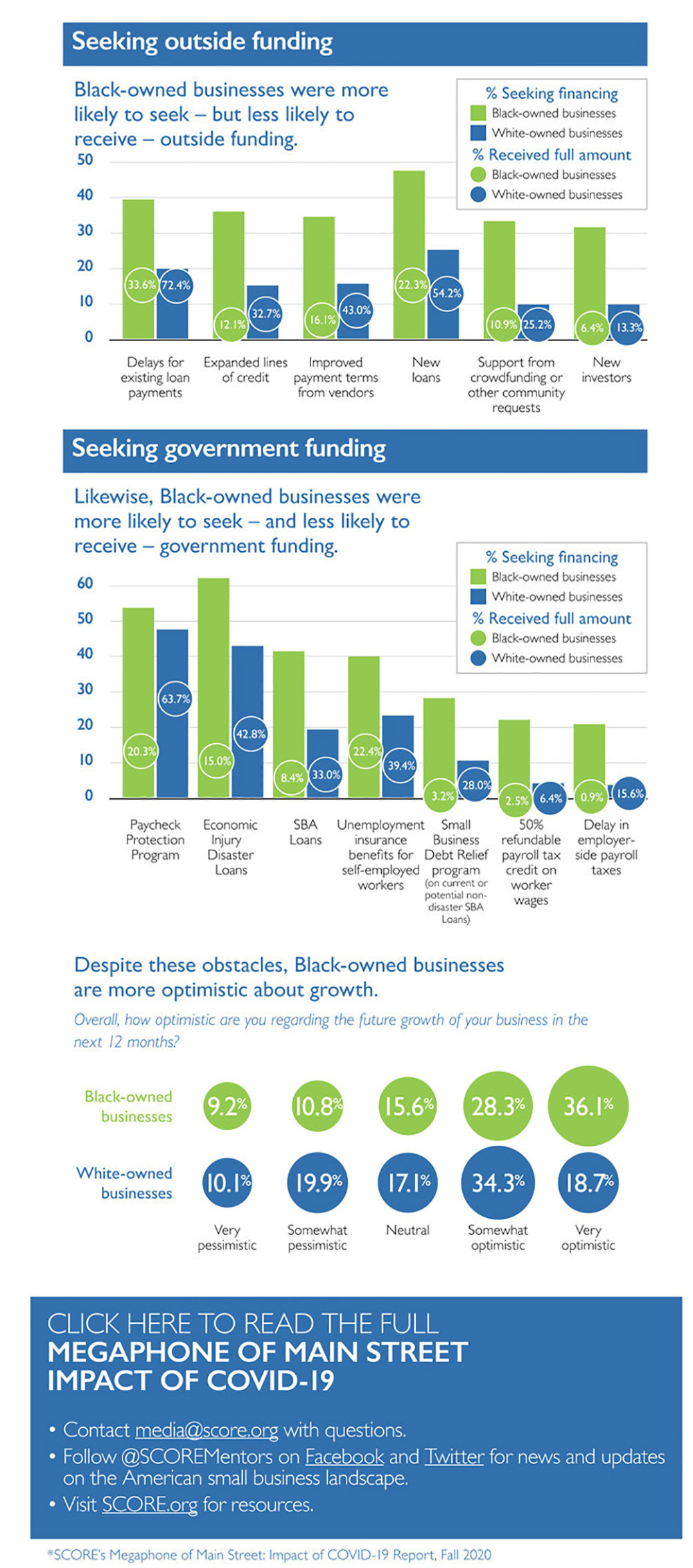

- Black and Hispanic business owners were more likely to apply for federal loans, but far less likely to receive funds.

- For example, White business owners were three times more likely to get Payroll Protection Program (PPP) loans; three times more likely to get Economic Injury Disaster Loans (EIDL); and four times more likely to get other Small Business Administration (SBA) loans than Black business owners.

- Black business owners are less likely to have a formal banking relationship, and more likely to report that the government loan process is confusing (31.9%).