Key Takeaways

- Independent appraisals increase property insurance settlements by an average of 33.87% above initial carrier offers.

- Across closed claims analyzed, policyholders recovered an additional $182,532 through the appraisal process—an average of $16,594 per claim.

- Insurance-hired appraisal firms consistently undervalued claims across all carriers examined, with undervaluation rates ranging from 9% to 74%.

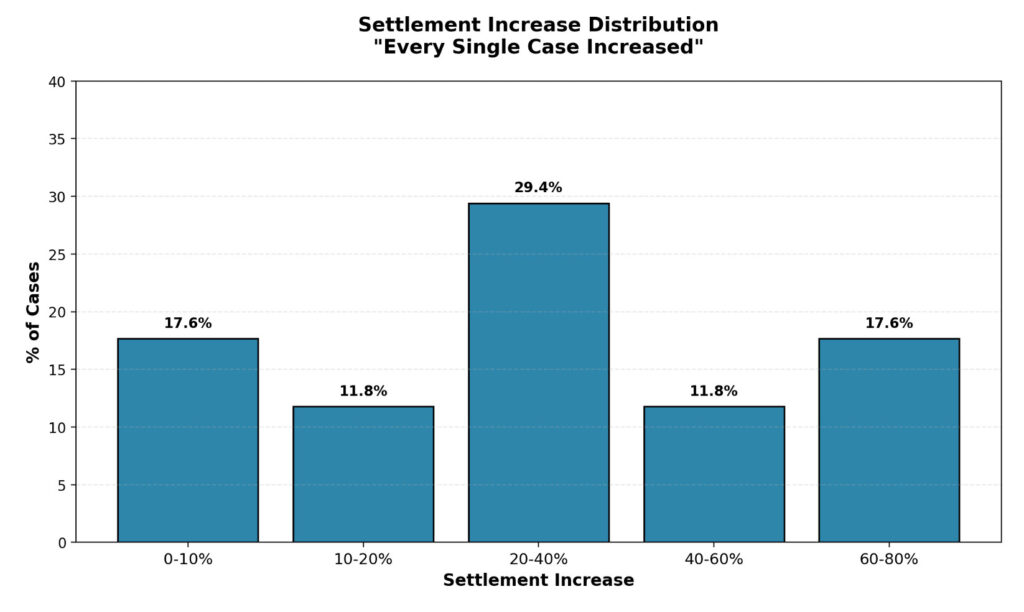

- 100% of cases that invoked the appraisal clause resulted in settlements exceeding the initial insurance company offer.

- The median settlement increase was 38%, indicating the pattern holds beyond outliers.

Motivation

When insurance companies and policyholders disagree about the value of property damage, most policies contain an “appraisal clause” that provides binding dispute resolution without litigation. Despite being a contractual right, a small minority of policyholders invoke this provision when disputing claim valuations.

Insurance carriers hire appraisal firms to assess damage and determine settlement amounts. However, anecdotal evidence suggests these firms may systematically undervalue claims due to repeat business relationships with carriers.

We seek to quantify the financial impact of independent appraisals versus insurance-hired appraisals, and to evaluate whether patterns of undervaluation exist across carriers and appraisal firms.

Results

We find that independent appraisals consistently produce higher settlements than initial insurance company offers. Across all cases examined, the average settlement increase was 33.87%, representing $16,594 in additional recovery per claim.

Every policyholder who invoked their appraisal clause received a settlement higher than the initial insurance company offer.

$182,532 in total additional recovery across analyzed cases

The data shows significant settlement increases beginning immediately upon engaging independent appraisal, with gains observed across all claim sizes—from $4,000 initial offers to $279,000 initial offers.

Claim Size Analysis:

| Initial Offer Range | Avg % Increase | Avg $ Increase |

| Under $20,000 | 38.59% | $3,827 |

| $20,000 – $50,000 | 44.46% | $8,482 |

| Over $50,000 | 25.65% | $67,005 |

Methodology

Data Collection

We analyzed closed auto and truck total loss insurance claims where policyholders invoked their policy’s appraisal clause between 2023-2025. Cases were selected based on:

- Final settlement reached through appraisal process (no litigation)

- Complete documentation of initial offer, independent appraisal, and final settlement

- Involvement of major U.S. insurance carriers

- Geographic diversity across multiple states

Data Points Tracked

For each case, we documented:

- Insurance carrier name

- Appraisal firm hired by carrier

- Initial settlement offer amount

- Independent appraisal valuation (conducted by AppraiseItNow)

- Final settlement amount reached through appraisal process

- Percentage increase from initial offer to final settlement

- Absolute dollar increase

Classification Methodology

We classify an appraisal as “undervalued” when the initial insurance company offer falls below the final settlement amount determined through the appraisal process. We calculate undervaluation as:

Undervaluation % = ((Final Settlement – Initial Offer) / Initial Offer) × 100

The Appraisal Process

The insurance appraisal clause works as follows:

- Either party (policyholder or insurer) demands appraisal in writing

- Each party selects an independent, competent appraiser

- The two appraisers attempt to agree on the amount of loss

- If the appraisers cannot agree, they jointly select an umpire

- The appraisers submit their differences to the umpire

- A written agreement by any two of the three (two appraisers or one appraiser and the umpire) determines the amount of loss

- Each party pays their own appraiser; the cost of the umpire is typically split equally

Timeline: The appraisal process typically concludes within 30-90 days.

Finding 1: Independent Appraisals Consistently Increase Settlements

Across all cases analyzed, independent appraisals resulted in higher settlements than initial insurance company offers, with zero exceptions.

Settlement Performance:

- Mean increase: 33.87% ($16,594)

- Median increase: 38.00% ($3,967)

- Maximum increase: 74.33% ($130,988)

- Minimum increase: 4.35% ($3,022)

- Total additional recovery: $182,532

The median exceeding the mean indicates the pattern is not driven by outliers—the majority of cases experienced substantial gains.

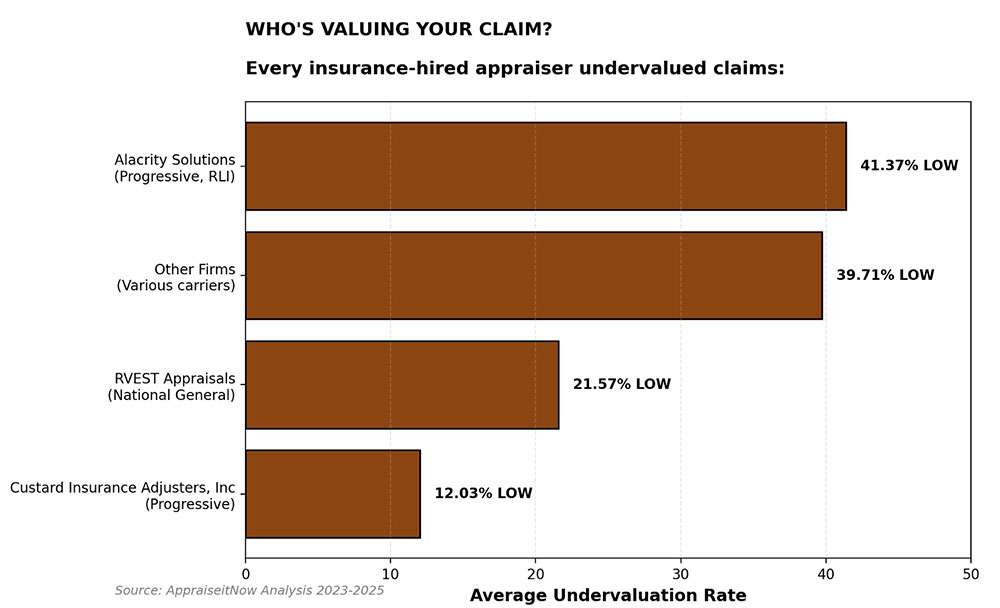

Finding 2: Insurance-Hired Appraisers Systematically Undervalue Claims

We identified multiple appraisal firms hired by insurance carriers in our dataset. In 100% of cases, the insurance-hired appraiser’s valuation fell below the final settlement amount.

Every single insurance-hired appraisal firm undervalued claims—with undervaluation rates ranging from 9% to 74%. This pattern held across all carriers, claim sizes, and property types examined.

Appraisal Firm Performance

| Firm Name | Hired By | Avg Undervaluation |

| Alacrity Solutions | Progressive, RLI | 37.41% |

| RVEST Appraisals | National General | 26.32% |

| Custard Insurance Adjusters | Progressive | 9.38% |

| Other Firms | Various carriers | 30.10% |

This pattern holds across carriers, claim sizes, and damage types, suggesting structural incentives favor undervaluation.

Finding 3: Settlement Increases Span All Claim Sizes

The benefit of independent appraisal was evident across the full spectrum of claim sizes, from $4,000 to $279,000 initial offers.

| Claim Size | Initial Offer | Final Settlement | % Increase | $ Increase |

| Small Claims (<$20K) | ||||

| Case A | $4,000 | $5,034 | 25.84% | $1,034 |

| Case B | $4,570 | $6,347 | 38.88% | $1,777 |

| Case C | $12,500 | $17,250 | 38.00% | $4,750 |

| Case D | $12,958 | $21,000 | 62.06% | $8,042 |

| Medium Claims ($20K-$50K) | ||||

| Case E | $16,605 | $19,114 | 15.11% | $2,509 |

| Case F | $18,000 | $25,900 | 43.89% | $7,900 |

| Case G | $20,077 | $35,000 | 74.33% | $14,923 |

| Large Claims (>$50K) | ||||

| Case H | $69,500 | $72,522 | 4.35% | $3,022 |

| Case I | $279,012 | $410,000 | 46.95% | $130,988 |

Even the smallest claim in the dataset (Case A, $4,000 initial offer) gained $1,034—demonstrating that appraisal delivers value regardless of claim size.

Case Study: The $130,988 Settlement Increase

This case represents the largest absolute increase in our dataset and illustrates the potential magnitude of systematic undervaluation.

The Numbers:

- Insurance carrier: Selective

- Initial offer: $279,012

- Independent appraisal: $569,281

- Final settlement: $410,000

- Increase: $130,988 (46.95%)

Selective Insurance’s appraiser valued the claim at less than half of what the independent appraisal determined. While the final settlement split the difference, the policyholder recovered an additional $130,988 by exercising their appraisal clause.

Without independent appraisal, this represents $130,988 in unrecovered damages.

Limitations

Sample Representation

This analysis examined cases where policyholders proactively invoked appraisal clauses. The dataset does not include:

- Cases where policyholders accepted initial offers without dispute

- Cases that proceeded to litigation rather than appraisal

- Cases where the appraisal clause was not available or applicable

While our sample demonstrates consistent patterns, broader research across larger datasets would provide additional validation of these findings.

Selection Bias

Our dataset consists of cases where policyholders believed initial offers were insufficient and had resources to engage independent appraisers. This may overrepresent cases with larger settlement gaps. However, the 100% success rate suggests even cases with smaller perceived gaps benefit from independent appraisal.

Geographic and Damage Type Variations

Our study did not control for:

- Regional variations in construction costs or labor rates

- Specific types of property damage (wind, water, fire, etc.)

- Property types (residential, commercial, etc.)

Future research should examine whether settlement patterns vary by these factors.

Time Period

All cases in this dataset occurred between 2023-2025. Insurance industry practices, carrier policies, and appraisal firm methodologies may change over time.

Conclusion

Independent appraisals consistently result in higher settlements than initial insurance company offers. With an average increase of 33.87% and a 100% success rate across cases analyzed, invoking the appraisal clause represents one of the most effective tools available to policyholders disputing claim valuations. This 100% success rate should be interpreted cautiously, as it reflects a self-selected sample of policyholders who felt strongly enough about inadequate offers to pursue formal appraisal

Insurance-hired appraisal firms systematically undervalue claims—a pattern observed across multiple carriers, firm relationships, and claim sizes. Policyholders who accept initial offers without seeking independent assessment may be leaving significant sums unclaimed.

The appraisal clause exists precisely for this purpose: to provide an independent, binding resolution when policyholders and insurers disagree about loss amounts. Our data suggests policyholders should exercise this right far more frequently than they currently do.

AppraiseItNow provides certified, USPAP-compliant appraisals that insurance companies must accept. Our independent appraisers have helped policyholders recover thousands per claim. Request Your Free Quote →

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Consult your insurance policy and consider speaking with an attorney or public adjuster about your specific situation.