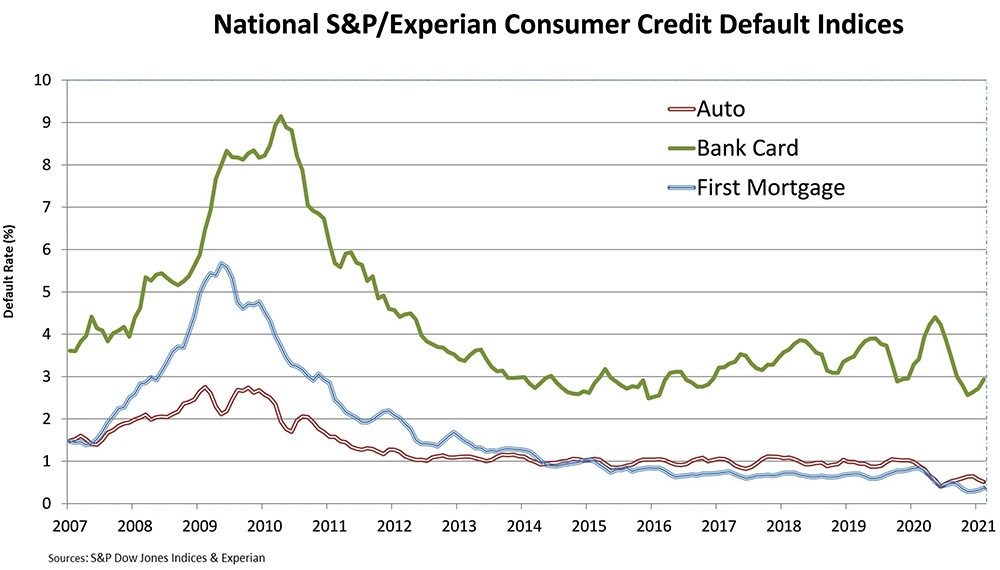

S&P Dow Jones Indices and Experian released data through February 2021 for the S&P/Experian Consumer Credit Default Indices. The indices represent a comprehensive measure of changes in consumer credit defaults and show that the composite rate was five basis points higher at 0.53%. The bank card default rate rose 21 basis points to 2.93%. The auto loan default rate was down five basis points to 0.51% and the first mortgage default rate was up five basis points to 0.37%.

All five major metropolitan statistical areas (“MSAs”) showed higher default rates compared to last month. The rate for New York increased 34 basis points to 0.83% while Miami rose 21 basis points to 1.16%. Los Angeles was 12 basis points higher at 0.44%. Chicago and Dallas were each up two basis points, to 0.55% and 0.59% respectively.

© S&P Dow Jones Indices