How to achieve higher returns on your rental properties

Investing in rental properties is widely recognized as one of the most effective ways to build long-term passive income streams. However, the path to success in the real estate market isn’t always paved with guarantees. While the prospect of rental income may seem promising, the reality is that not all rental properties are created equal. Without the right strategies in place, even the most promising of properties may fail to yield the desired returns.

In today’s dynamic real estate landscape, where market conditions fluctuate and tenant preferences evolve, property owners face an abundance of challenges in maximizing their return on investment (ROI). Gone are the days when simply owning a rental property was enough to secure substantial revenue streams. Today, success in the rental property market requires a proactive and strategic approach—one that is grounded in a deep understanding of market dynamics, tenant needs, and industry best practices.

For property owners considering buying an investment property or investors aiming to unlock the full potential of their investments, seasoned insights into the nuances of property management and investment strategies are invaluable in today’s market. At Canopy mgmt, we understand the challenges and complexities that property owners face in a competitive rental market. With our expertise and industry knowledge, we’re committed to helping landlords and investors navigate these challenges and achieve their financial goals.

So, if you’re ready to take your rental property investment to the next level, join us as we look at the key strategies and considerations that can make all the difference in maximizing your investment. Together, let’s explore how to ensure your property not only generates steady income, but also appreciates in value over time.

What is rental property ROI?

Before getting into the specific strategies, let’s summarize exactly what a return on your investment truly means. Understanding rental property ROI is extremely important for landlords and real estate investors, as it measures the profitability of an investment relative to its purchase cost. To calculate ROI, use the formula:

ROI = (Net annual rental Income / Total investment cost) × 100. Net annual rental income includes rental income minus expenses like property management fees, maintenance costs, taxes, insurance, and mortgage payments.

Now, let’s explore the strategies to maximize the ROI of your rental property.

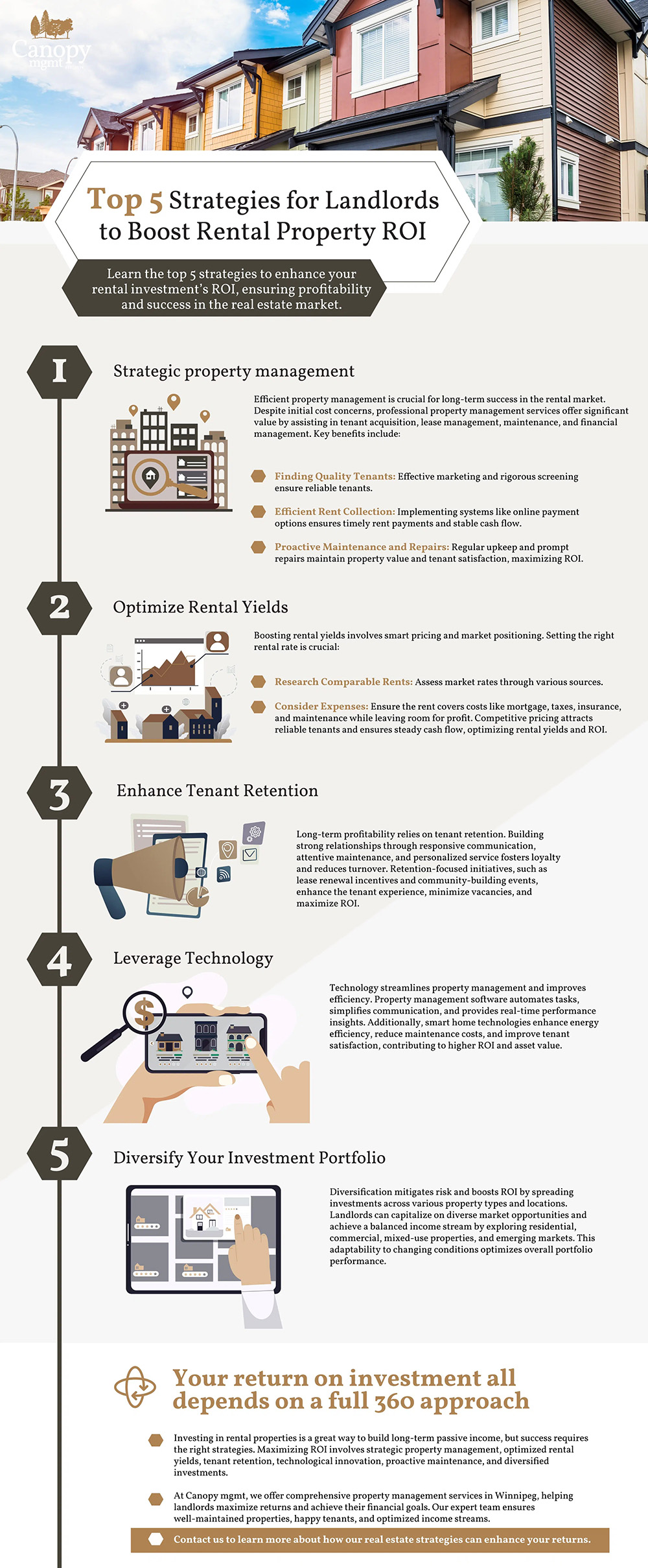

1. Strategic property management

Efficient property management is essential for long-term success in the rental property market. While some landlords may initially have reservations about the associated expenses, the value of professional property management services cannot be overstated. Expert property management companies offer assistance in various aspects of property management, from tenant acquisition and lease management to maintenance and financial management.

How a professional property management company can help:

- Finding quality tenants: Professional property management companies have the expertise and resources to effectively market rental properties, attracting a wide pool of potential tenants through diverse marketing channels and strategies. Their rigorous tenant screening processes ensure that only reliable and responsible tenants are selected, minimizing the risk of problematic tenancies.

- Efficient rent collection: Property managers implement efficient rent collection systems, including online payment options, to ensure timely receipt of rental payments. This promotes a stable cash flow and eliminates the hassle of chasing down late payments, allowing landlords to focus on other aspects of property management.

- Proactive maintenance and repairs: Property management companies take a proactive approach to property maintenance, overseeing routine tasks and promptly addressing repair needs. This ensures that properties remain in excellent condition, enhancing tenant satisfaction and preserving their value over time, ultimately maximizing ROI for landlords.

2. Optimize rental yields

Boosting rental yields requires a sophisticated and smart approach to pricing and market positioning. Settling on the right monthly rental rate is one of the most important factors in property rentals, as it directly impacts your property’s profitability and tenant attraction.

Determining the right rental price

Determining the right rent price is a delicate balancing act—like with most things tenant and landlord-related. While aiming for sky-high rent to maximize income may seem appealing, it can backfire, resulting in longer vacancy periods and loss of income. On the other hand, pricing too low may also leave potential income on the table. So, you need to think about it smartly. To set the optimal rent price:

- Research comparable rents: Look at similar properties in your area to gauge the market rates. Websites, local listings, and advice from real estate professionals can provide valuable insights into the goings-on of rental rates.

- Consider your expenses: Factor in your property’s expenses, including mortgage payments, property taxes, insurance, and maintenance costs. Your rent should cover these expenses and leave room for profit.

Remember, competitive pricing helps attract reliable tenants and ensures steady cash flow. Pricing too low or too high can lead to vacancies, undesirable tenants, and income loss. By conducting comprehensive market research and carefully considering your expenses, you can set competitive rental rates that optimize rental yields, increase cash flow, and enhance your overall ROI.

3. Enhance tenant retention

Tenant retention is a cornerstone of long-term profitability in rental property investments. Building strong tenant relationships through responsive communication, attentive maintenance, and personalized service fosters loyalty and reduces turnover. Implementing retention-focused initiatives such as lease renewal incentives, community-building events (for large investment buildings), and responsive maintenance services cultivates a positive tenant experience, minimizing vacancies and maximising ROI.

4. Leverage technology

Embracing technology is essential for streamlining property management processes and enhancing efficiency—especially if you’re managing a property by yourself. Implementing property management software automates routine tasks, simplifies communication, and provides real-time insights into your property’s performance.

Additionally, leveraging smart home technologies can improve energy efficiency, reduce maintenance costs, and enhance tenant satisfaction, ultimately contributing to higher ROI and asset value.

5. Diversify your investment portfolio

Diversification is key to mitigating risk and boosting your ROI across various property types and geographic locations. By diversifying their investment portfolio, landlords can spread risk, capitalize on diverse market opportunities, and achieve a balanced income stream. Exploring residential, commercial, and mixed-use properties, as well as emerging markets, allows landlords to adapt to changing market conditions and optimize overall portfolio performance.

Your return on investment all depends on a full 360 approach

Investing in rental properties is one of the best ways to build long-term passive income. However, not all rental properties are created equal, and no properties “automatically” provide revenue without the right strategies.

Achieving maximum ROI in rental property investments requires a multifaceted approach that covers strategic property management, optimized rental yields, tenant retention initiatives, technological innovation, proactive maintenance, and diversified investment strategies. By implementing these strategies, landlords can unlock the full potential of their rental properties, achieve sustainable income streams, and position themselves for long-term success in the dynamic real estate market.

At Canopy mgmt, we are committed to providing comprehensive property management services in Winnipeg, empowering landlords to get the most out of their rental property investments and achieve their financial goals. Our team’s industry know-how and dedicated services are here to ensure that your properties are well-maintained, your tenants are happy, and your returns are maximized! By embracing these strategies and reaching out for professional support when needed, you’ll be on your way to cultivating a thriving rental property portfolio. Want to learn more about how our real estate investment strategies can supercharge your returns? Don’t hesitate to get in touch with us to find out how.