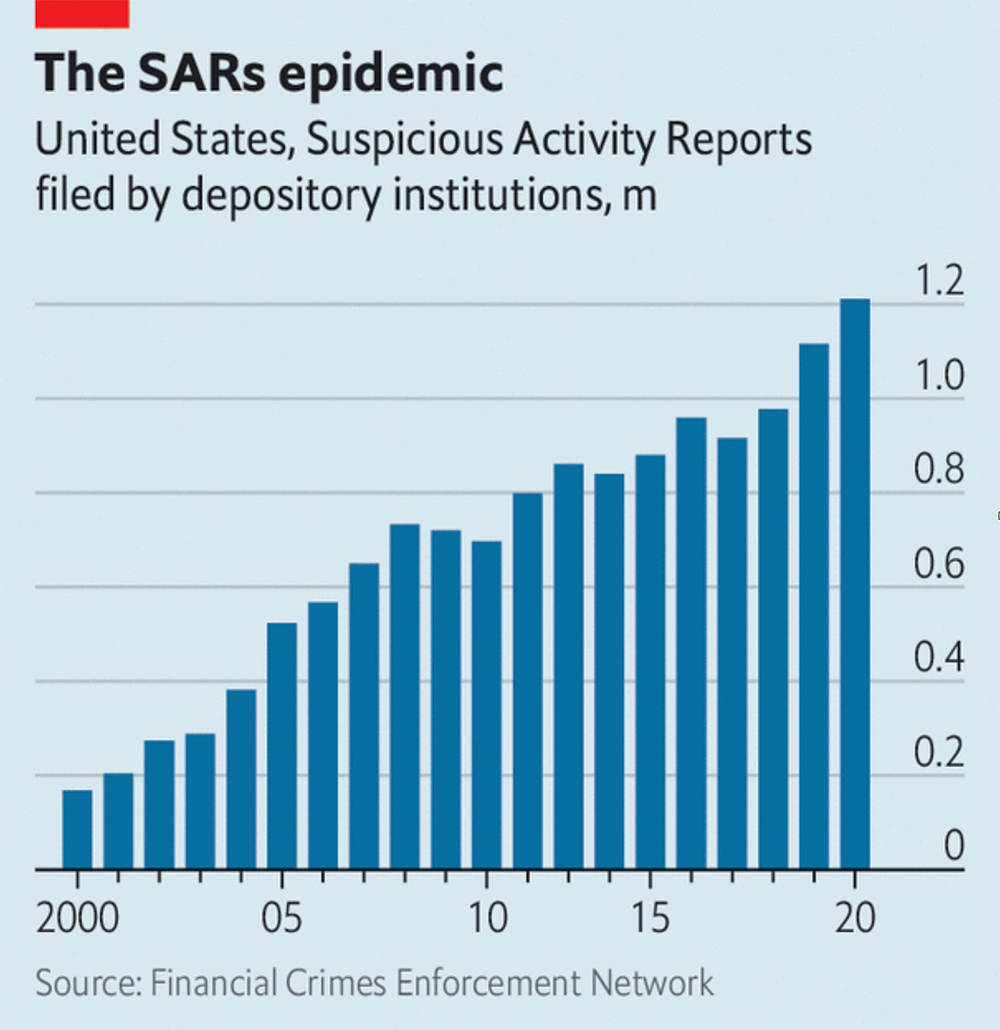

Companies are under a considerable amount of regulatory pressure to fight financial crime. Penalties for anti-money laundering (AML) and Know Your Customer (KYC) continue to rise for non-compliance, with regions like APAC (Asia Pacific) being hit the hardest due to inconsistent approaches to implementing measures.

Economic crime hit a record high of US$42 billion in 2020, with customer fraud, cybercrime, and misappropriation of assets at the top of the list. During the Covid-19 pandemic, fraudsters have exploited the system to target individuals with fake prizes and gifts. Banks then have the usual problem of stolen cards, bot attacks, and other scams to exacerbate the problem’s scale.

The fight against financial crime is like a game of cat and mouse. As soon as firms understand and resolve one crime, criminals find new methods and strategies for their attack. Companies need to invest in ever more sophisticated technology to keep up with the challenges they face. Artificial intelligence (AI) is proving to be critical to strengthening regulatory compliance.

Why do financial firms need AI to fight financial crime?

Modern AML and KYC processes need to handle vast amounts of customer and transactional data. For humans, analyzing the data accurately is both costly and time-consuming. KYC procedures can go through various manual reviews that are prone to human error and false positives.

Many are turning to technology such as AI and applications including machine learning (ML) and natural language processing (NLP) for the answer. AI tools can perform KYC and AML tasks much faster than human compliance employees, but beyond that, they can adapt to understand new threats and methodologies. Firms can get themselves in a position to stay ahead of criminals and maintain regulatory compliance without educating humans or going through laborious processes.

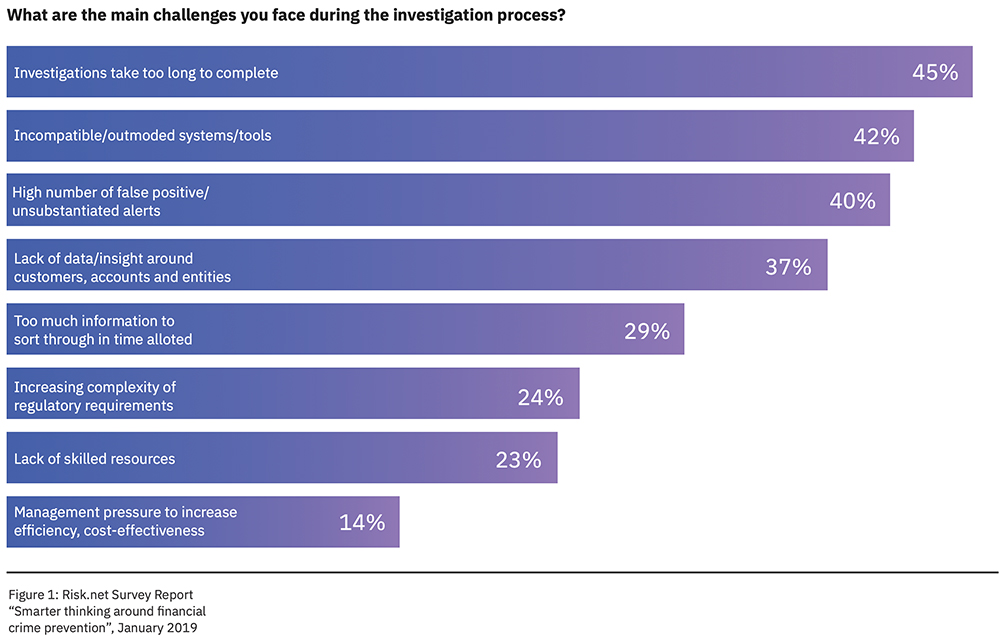

According to a Risk.net Survey Report, there are many challenges with existing investigation processes.

Source: ibm.com

How does Artificial Intelligence (AI) assist in fighting financial crime?

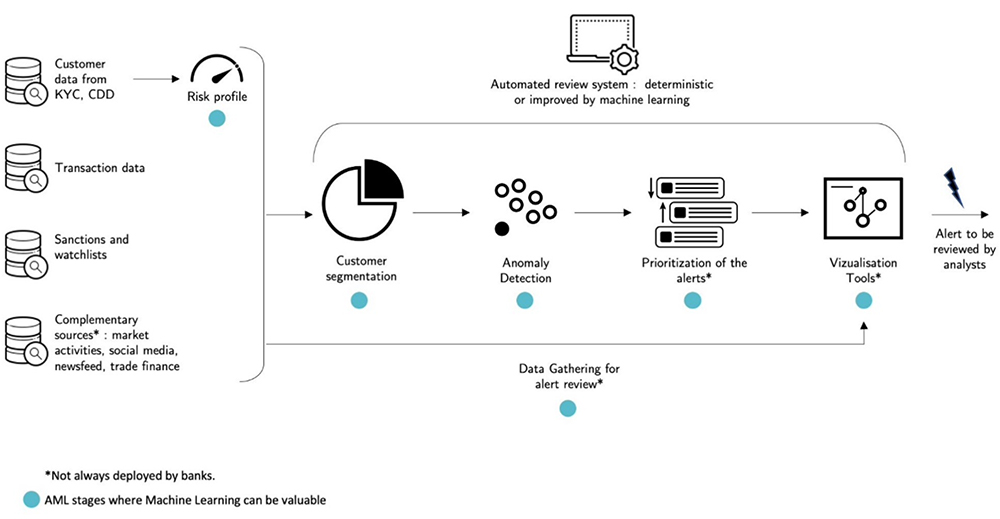

When a firm deploys AI technology and ML as part of its financial crime strategy, it typically represents various algorithms that can control the measures to detect activities such as money laundering. Algorithms can process and analyze a massive amount of data in minutes, rather than relying on humans spending hours reviewing suspicious behavior.

Five US government agencies, including the Federal Reserve and Financial Crimes Enforcement Network, the UK Financial Conduct Authority, and the Australian Transaction Reports and Analysis Centre, have all offered support in utilizing AI and machine learning to fight financial crime.

Identifying high-risk customers

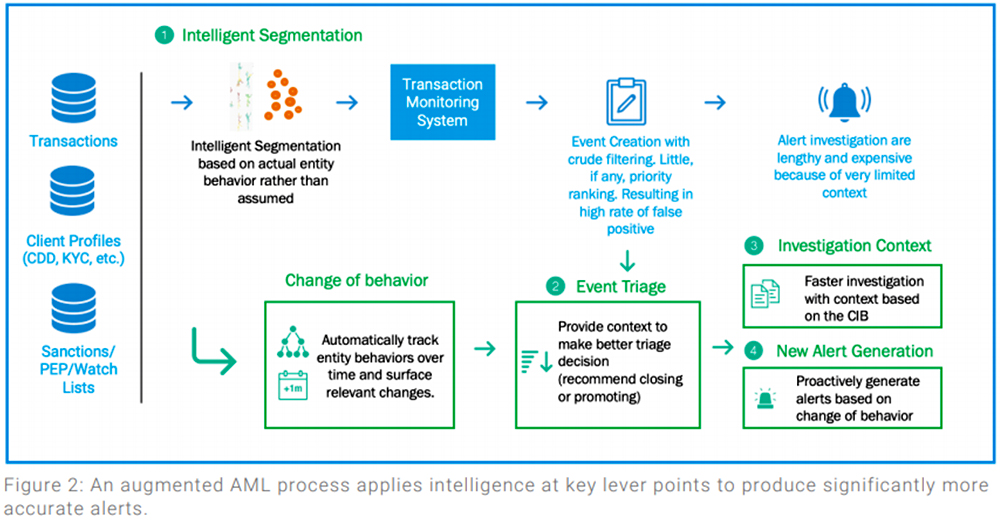

Hexatone Finance is a leading tech company that specializes in exposing financial crime. Hexatone offers anti-money laundering solutions for banks, Hedge Funds, and various Financial Institutes. A core benefit of AI in fighting financial crime is working out who the high-risk customers are. Hexatone’s new product is a new market leader in financial markets for creating Machine learning algorithms that analyze data patterns in vast volumes from KYC, due diligence, transactions, sanctions, watchlists, and other sources, including social media and newsfeeds.

The AI framework can automatically detect the data points with a high likelihood of fraud, benchmark any patterns in behavior, generate insights, conduct an initial triage, and provide contextual alerts.

Source: ip-paris.fr

Hexatone’s framework pulls together all of these sources among hundreds of others and presents them to a human investigator rather than leaving them to review the case manually. Human analysts can then focus on the parts that require their attention instead of analyzing data. The likelihood is that AI can span sources that humans would never otherwise discover and provide a more accurate result.

Source: hexatone.com

Using Hexatone’s models, banks can quickly analyze data relating to customer transactions and help in their fight against financial crime.

False Positives

According to a Dow Jones survey, half of the suspicious alerts during a KYC screening are false positives. A false positive is where the process wrongly flags individuals or companies as suspicious, wasting significant time analyzing data that firms don’t need to.

AI models can understand the data over more attributes and points than a human counterpart, reducing the volume of false positives. AI is more intelligent than a traditional rules-based system as it can incrementally learn what compliance and non-compliance look like. Identifying false positives means humans can spend time-fighting actual crime.

Intelligent Customer Insights

Modern AI technologies can identify links between entities to perform regular reviews and use NLP to gain context from structured and unstructured data sources. Like the triage process we discussed with Ayasdi, the AI automates these reviews, allowing the human analysts to focus on the most pertinent information.

Proactive, not reactive

In manual reviews, it can take departments time to analyze and understand the suspicious activity. By the time they get to the bottom of a case, it could be several months after the activity has occurred, which is far too late.

Omri Raiter, CTO of Hexatone Finance

The key to fighting financial crime is to predict when activities will happen rather than waiting until after the event. An advanced capability like Hexatone’s AI Framework that scans newsfeeds, social media, open posts, and public group conversations could find keywords that and conducive to future criminal behavior. Any changes in patterns can flag the relevant alerts to teams well before any damage is done.

Summary

In the digital era, financial crime is a real threat to the industry, and firms need to invest in AI technology to fight against it. Many banks and other institutions have improved their ability to identify customers and monitor transactions through new technology that relies on AI techniques. With regulators supporting the move to use AI to augment the fight against financial crime, it’s the perfect time for industry incumbents to plan better their programs to protect themselves and their stakeholders.